Fed Inflation Target Nears As US CPI Tumbles More Than Expected In November

'A grain of salt' is how many have described their position on this morning's government shutdown-delayed release of October and November Consumer Price Inflation data.

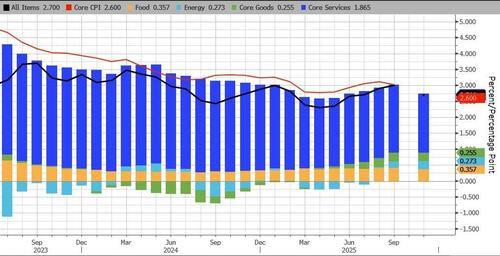

Headline CPI slowed to 2.7% YoY in November (dramatically below the 3.1% YoY expected)

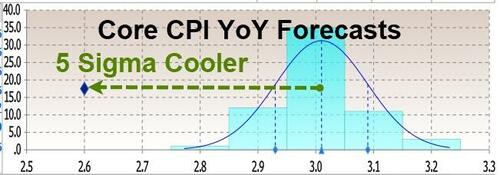

Core CPI fell to 2.6% YoY in November (well below the 3.0% YoY expected) and the lowest since March 2021...

The Core CPI print was five standard deviations below consensus...

There is very little additional data for now with Core Goods and Services down modestly while Energy prices were higher...

...but will drop notably as oil prices have plunged...

Shelter and Rent inflation also continues to slow dramatically...

As expected in Sept, both Rent and Shelter CPI are freefalling as they catch down to real-time 3rd party metrics.

This is also Miran's thesis on disinflation and CPI extending its slide in 2026. https://t.co/xcwlPzTjQO pic.twitter.com/9cQdYTHKXj

— zerohedge (@zerohedge) December 18, 2025

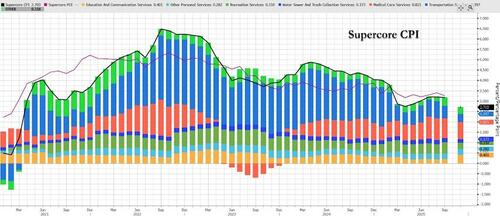

SuperCore CPI also plunged...

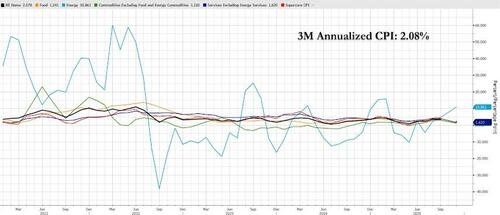

3m annualized CPI tumbled to 2.08% YoY... very close to The Fed's target...

For all those whining about the missing data or extrapolated data... the BLS shows that this report was not that different than we have become used to...

Finally, we end with three words from Goldman's Delta-One desk-head with regard this morning's data: 'beware the noise'.

Disinflation remains a key pillar of the equity bull case, and these levels still imply inflation hovering closer to 3% so not quite there yet (but heading in the right direction... a lot faster than many expected).

Loading recommendations...