Yields Jump After Ugly 10Y Auction Tails, Foreign Demand Tumbles

After yesterday's ugly 3Y auction, moments ago the Treasury sold $39 billion in 10Y paper (technically a 9 Year, 10 Month reopening of cusip NT4), and the reception was again rather disappointing.

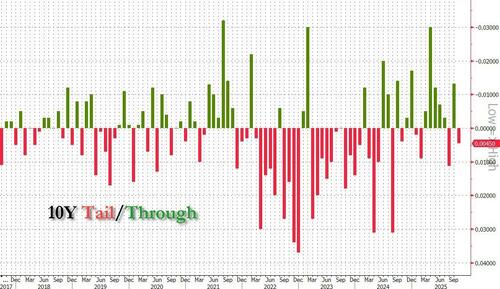

The note priced at a high yield of 4.117%, up from 4.033% in Sept, but except for that one month, it was the lowest since Oct 2024. The auction also tailed the 4.114% When Issued by 0.3bps, following last month's stop and was the 2nd tail in the last 8 auctions.

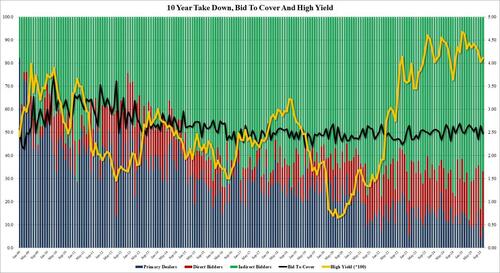

The bid to cover dropped from 2.65% to 2.478%, which while not the worst in the past year wasn't too far off, and was well below the 2.57 six-auction average.

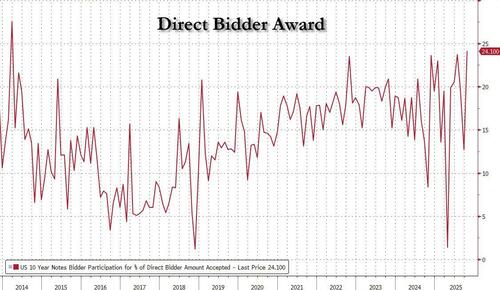

The internals were also ugly, with Indirects (aka foreign bidders) plunging from 83.1% to 66.8%, which also was below the six-auction average of 73.7%. And with Directs taking down 24.1%, or the highest in 11 years...

... Dealers were left with a modest 9.1%, below the recent average of 10.0%, but above last month's record low of 4.2%.

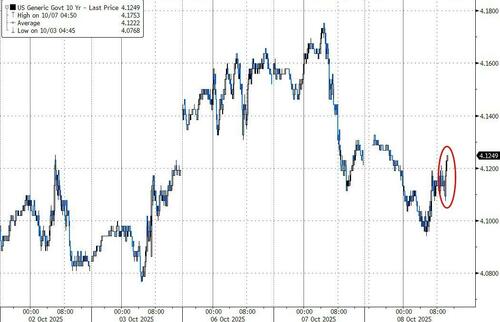

Overall, this was a subpar and disappointing 10Y auction, but it could have been worse, which is why while yields moved by 1-2bps higher across the curve, pushing the 10Y to 4.125%, they are well off yesterday's session highs.

Loading recommendations...