Yield Curve Control? Why Not...

By Peter Tchir of Academy Securities

There is a lot of chatter surrounding the Federal Reserve. The FOMC, etc. What the President will or will not do. What can be “successfully” done or not. Will Powell be fired?

Today, Kevin Warsh is floating the idea of better aligning the Fed and Treasury, as has been the case in the past (so I’m told).

Warsh: "we need another Treasury-Fed accord"

The last time we had such an accord (in 1951), there was Yield Curve Control in the US. Clear what's coming.

— zerohedge (@zerohedge) July 17, 2025

Most of the analysis about what may happen tends to fall along the lines of:

Why not think more outside the box? There are a few things we know:

Why would this administration only do something halfway?

If you are going to do something radical – why not go all the way?

Who knows if anything will happen. But presumably, by May of next year at the latest (and that seems like a lifetime away) we will see changes in how the Fed behaves.

I’m not arguing against Fed independence and the dual mandate, etc., but you can see the appeal of going in a different direction.

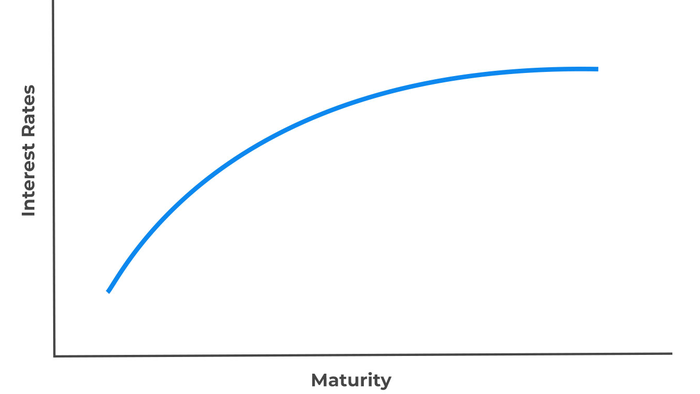

Set yields across the curve. Issue debt to take advantage of these yields. Save “trillions” in interest rate expense. There is no easier way to lower projected annual deficits than by reducing costs. That would actually help lower yields too.

If long end treasury yields cannot bear the brunt of potential reckless Fed policy (because of yield curve control) then the dollar will likely be hit hard.

Yeah, there is always “strong dollar” rhetoric, but imagine a world with higher tariffs AND a cheaper dollar? Imports look way more expensive and the U.S. exports start to look a lot cheaper.

A materially weaker dollar may be viewed as a “feature” not a “bug” if your primary goal is more manufacturing in the U.S.

1985: Plaza Accord

— zerohedge (@zerohedge) July 16, 2025

2025: Powell fired

Again, no idea how this will play out, but expecting only one “radical” move seems a little “naïve”? If you are going to reshape something (like monetary policy) why not reshape it all the way?

In any case, maybe we should be spending less time thinking about “how much steeper will the yield curve go” if something happens to the Fed, to what would you do to ensure long end yields don’t rise?

Just thinking out loud, but if we are going to get “radical” why wouldn’t we get really radical?

Loading...