This Is The Worst Breadth All Time High In S&P History

With stocks finally breaking above 6,000 and accelerating to record highs two days in a row (and according to JPMorgan's trading desk, many more ATHs are to come), the bears have one by one been friendoed once again yet one recurring lament of caution remains, and it was voiced most accurately by Bank of America's Michael Hartnett in his latest Flow Show note (available to pro subs).

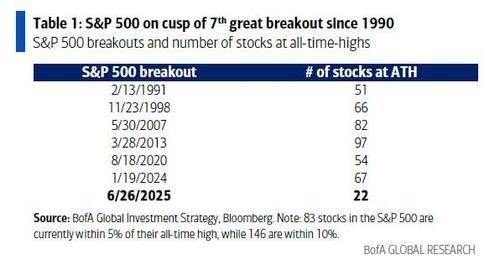

In the report, Hartnett first offers his congratulations to the S&P 500 which he says is "on the cusp of 7th great breakout since 1990" then quickly cautions that this latest breakout, as one would expect in a world dominated entirely by the Mag7, has had the smallest “breakout stock” participation, meaning that it is literally determined by a handful of stock. How many? Well, there are just 22 S&P stocks currently at all-time highs.... vs 67 in the January 24 breakout, 54 in August 2020, 97 in March 2013, 82 in May 2007, 66 in November 1998, and 51 in Feb 1991.