By Peter Tchir of Academy Securities (full pdf available here)

Just last weekend, we discussed Confusion versus Uncertainty. We have a long list of potential market moving-events, many of which might be at pivotal moments.

The Big Beautiful Bill. Not letting tax cuts expire is crucial. Additional targeted tax cuts would also be helpful – especially anything that would drive growth and innovation.

The new “twist” here was the apparent falling out, played out via social media, between President Trump and Elon Musk. It seems to have quieted down, which is a good thing. While we are correct to worry about the deficit, at this point in time, moving the bill along seems more important. Will Thursday’s “social media storm” be a one-time event, or do we need to think about potential ramifications for the Trump agenda without Musk’s support? I don’t think so, but it is a concern.

Tariffs.

With July 8th approaching rather quickly, and only the U.K. deal signed, it seems unlikely that many more fully done deals will be inked before the deadline. On the other hand, the market is pricing in a “worst” case of extensions on the pause. We get some deals announced with a few countries and we get a pause extension on countries where there has been some initial negotiating. That seems reasonable for the markets to assume, given everything that has gone on.

A deal with China seems to have become the top priority.

The Geneva Deal doesn’t seem to be working as either side expected.The President is apparently getting directly involved with Xi, which is what the President wanted all along, though I’m not sure that is the best approach, given China has known this all along.We fully expected the administration to try to isolate China. We were wrong. While it is encouraging to see how the policy is being portrayed, there is a real concern, especially amongst the Geopolitical Intelligence Group, that we might not get the international cooperation against China that many think is necessary for the plan to succeed.Short-term wins versus longer-term risks. If the purpose of the deal is to buy time to prepare for more separation, then we have to structure the deal very carefully. China has the resources and global integration to also work aggressively during any “cooling off” period. Protecting IP and National Security Interests should remain an integral part of any deal. There is a real struggle on this front between short-term and longer-term needs.The processing of rare earths and critical minerals. The one “card” that China seems to have immense control over is the processed/refined rare earths and critical minerals. While Greenland and Ukraine might help get access to these raw materials (though we don’t see that as the major problem), they don’t do much for us in terms of processing/refining where China continues to dominate the market. We don’t know just how big of a card this is (quite large if they are actually willing to use it broadly for an extended period), but getting these businesses up and running domestically should be the biggest priority of the admin once Budget 2025 is passed. It still would have made sense, according to the GIG, to also include close allies in this crucial supply chain, but that ship may have sailed.

Are tariffs tools to negotiate, there to generate revenue, or designed to bring manufacturing back to the U.S.? Recently Japan cited some uncertainty, from their perspective (on the U.S. side) regarding what the goal is.

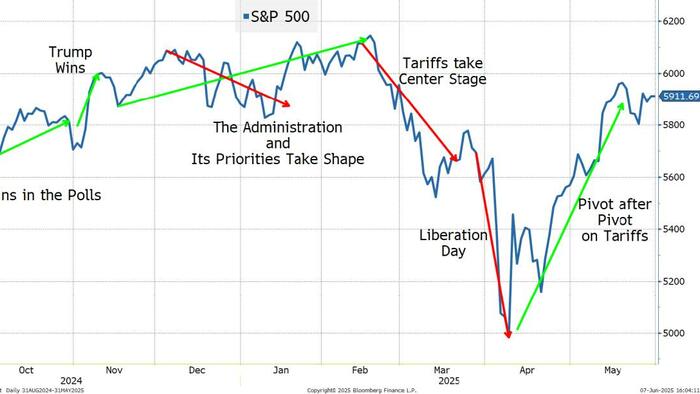

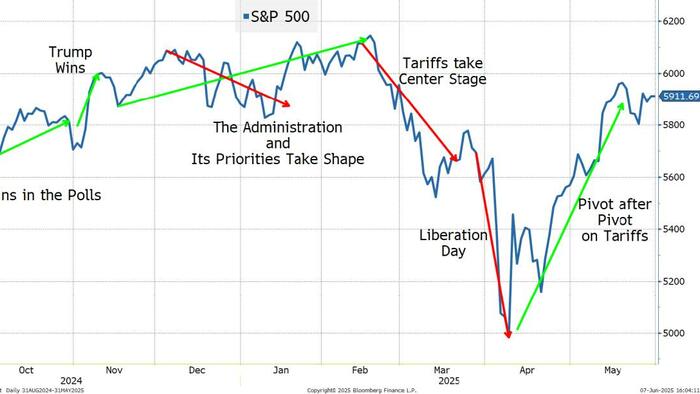

National Production for National Security. If that has the sound of something that might have been said in a Communist country, I’m okay with it. Prioritizing what is needed and pushing the agenda as aggressively as possible is key for our success and ability to compete with China down the road. Subsidies would help, but they don’t seem to be on the agenda with the urgency many of our National Security experts think is needed. On the other hand, deregulation is also a crucial step and that is something we have argued, since day 1, that Trump has specialized in. Why he didn’t start with deregulation and fighting NIMBY (Not In My Backyard) is a question I would love to have answered (the chart above would look a LOT different if the admin had come out of the gates focused on this front rather than tariffs). Treasury Secretary Bessent talks about this as being one of the “legs of the stool” and the more we turn our attention to this, the better. While it is also designed to take jobs away from elsewhere and bring them to the U.S., it seems less aggressive than using tariffs and is far more in our own control.

When, or if, will the impact of existing tariffs, policy uncertainty, or even confusion hit the economic data and the markets? We discuss this in our NFP Reaction, and remain convinced that the market, at these levels, has become too complacent with risks on the economic front. While backing off on tariffs has been great, and has greatly reduced the risk of recession, that is still a risk as the global economy takes time to adjust to the level of uncertainty (and even confusion) that has been set in motion since Inauguration Day. I completely believe the worst is behind us on the tariff headlines, but the impact has not been felt in the real world, and while 10% (or just higher) is “manageable,” there are likely going to be costs.

Peace. While we argued peace in a short timeframe was achievable (peace in a single day seemed impossible), that has stalled, at least in Russia. We published a Drone Attack SITREP on Monday. The mix of carrots and sticks was confusing to many of the GIG members, and maybe it is surprising we are here. The geopolitical situation is different than the economic situation, but if I had to be cautious about something right now – it is the growing difference between how confidently the President predicted peace, and where we are now. It is “different” than tariffs with China, right? Maybe not?Bottom Line

I still like rates. Friday’s move could have pushed the Fed’s second cut out to next year, while, for me, the jobs data solidified the chance of a July cut, with 3 to 4 for the year. 10s back to 4.5% is a buying opportunity, though a range of 4.2% to 4.6% seems about right. A bit of a wide range, but the volatility around so many of the topics listed above, especially the bill, still needs to be considered.

Credit boring. Crypto exciting.

Credit, which I think I understand, should do okay here. So far the calendar hasn’t slowed much, but credit has held in very well. Across the globe, anyone looking for corporate credit risk needs to come to the U.S. as the market is the only place big enough to offer diversification across industries, ratings, and maturities. Also, the companies issuing corporate debt are often global in nature, so the exposure isn’t confined to the U.S.

On Crypto, I don’t understand the rush for governments to get involved, but it seems that is the trajectory we are on. So long as corporations can add crypto to their balance sheets and see their stock valuations rise more than the amount of crypto they bought, I can understand why they would do that. However, I cannot understand that relationship, which is driving the process. I do understand anxiety around FX globally and deficits globally, but I’m still not sure how that translates into owing crypto – but certainly I am more tempted to jump back on the bandwagon than fight it here.

Equities. Maybe not “priced to perfection” but getting close. When we examine the list of risks, uncertainties, or even things to be confused about, the market seems positioned to the optimistic side. That could be proven correct, but the risk/reward has definitely shifted with the recent legs of this rally (China, chips, and deficit spending). The IPO market is wide open and that could be a big benefit not just to markets, but also for the economy as new and innovative companies are brought to the forefront of daily market headlines!

It has been great being on the road a lot (on the road again this week) and talking to so many of our clients, colleagues, and members of the Geopolitical Intelligence Group.

There is a decent amount of concern about small and midsize businesses, especially related to tariffs.A blind faith that the consumer keeps consuming (which has been the correct call).A more optimistic outlook for dealing with China from most people, than generally expressed by our Geopolitical Intelligence Group. We had a great outing with two GIG colleagues from the CIA last week, demonstrating how we are moving deeper into national security and policy.Today, I just wanted to conclude by thanking all of those who take time out of their hectic schedules to meet with, talk to, or even just respond to Academy Securities as it helps us grow and get better!

If we go back to today’s question “Where are We Now?” the answer is at some pivotal moments for some major drivers to kick into gear, or stumble, as they near the goal line.

Loading...