When Debt Meets Diamond Hands

Submitted by QTR's Fringe Finance

These lessons go for pretty much any asset class, but where I’ve noticed the largest concentration of inane theories, economic non-sequiturs and general outright confusion is among the most hubris-laden speculators in the market, the Bitcoin crowd. I own some Bitcoin and would love it just as much as the next guy if the price went to $1 million or $1 trillion or whatever Michael Saylor’s made up price target is today. But that doesn’t give me a hall pass to disconnect an otherwise well-functioning brain from all financial reality as we’ve ever known it.

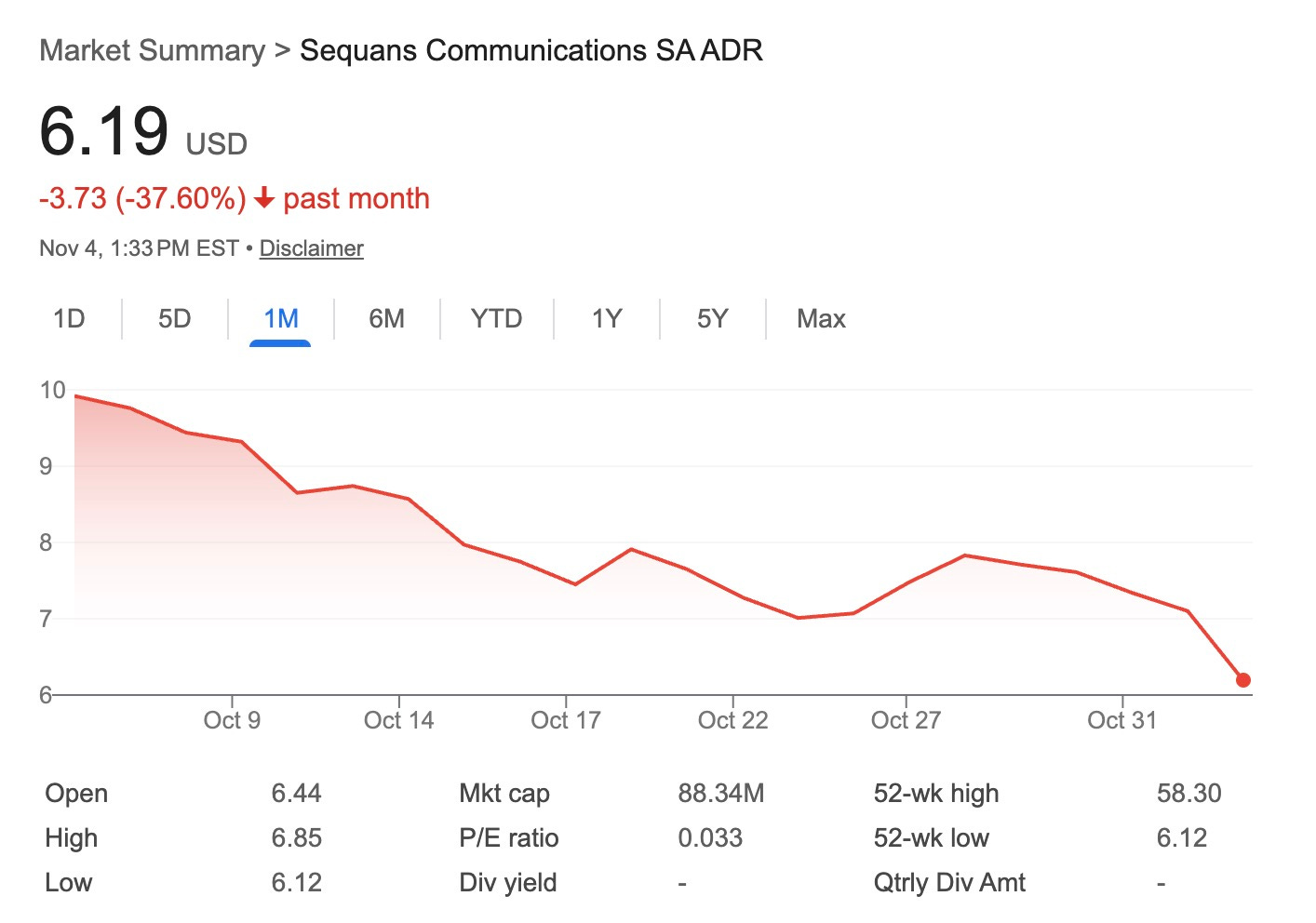

Bitcoin loyalists often repeat that holders (or HODLers) never sell, that conviction alone is enough to withstand any downturn. But as seen in the example of Sequans Communications that CoinDesk wrote about this week, even the most outspoken converts to the “BTC treasury strategy” eventually face a moment where reality overtakes belief. Sequans, which pivoted aggressively into Bitcoin earlier this year, just unloaded 970 BTC because its debt burden became too large. Go figure.

The company insisted this sale was merely tactical, yet its stock remains crushed, and its once-promoted strategy now hinges on less leverage and fewer promises.

This is not an isolated corporate event, but a preview of what happens when enthusiasm collides with the reality of financial obligations.

Bitcoin has grown into a financialized asset at every level: corporate treasuries, retail holders borrowing against their stacks, institutions using futures and leverage to enhance returns. During market strength, these decisions feel brilliant — I mean, just look at the scores of assholes who don’t know the difference between a market cap and an enterprise value bragging on social media daily about their financial acumen — and the conviction looks unshakeable. But when liquidity thins or macro stress arrives, as I predict it will in four different spots of the market, even believers discover that math is a stronger force than ideology.

There is a persistent narrative that Bitcoin supply is locked up by long-term holders who will never sell regardless of the price. But that’s not quite the truth.

🔥 50% OFF FOR LIFE: Using this coupon entitles you to 50% off an annual subscription to Fringe Finance for life: Get 50% off forever

In good times, that produces an illusion of invincibility. In downturns, it creates thin markets and a new vulnerability: when someone is forced to sell, there may not be many willing buyers on the other side.

Sequans didn’t exit the trade because it lost faith in Bitcoin. It sold because debt left it no choice. In a deeper decline, more corporations could follow the same path, not as a judgment on the asset, but as a condition for survival.

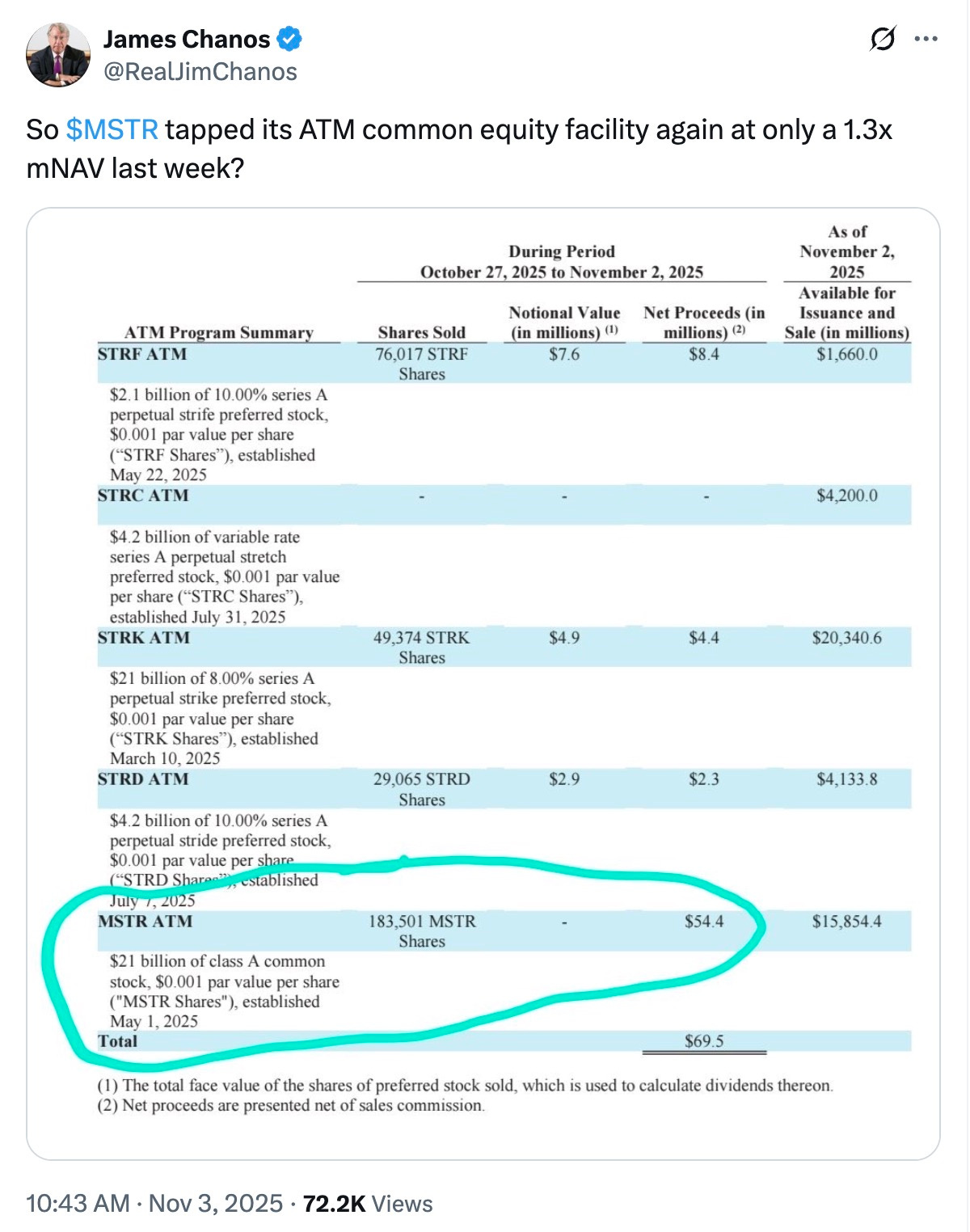

MicroStrategy, the highest-profile corporate buyer of Bitcoin, reflects the same risk dynamic from a different angle. Instead of selling, it continues to raise capital to buy more, recently issuing equity near roughly 1.3x mNAV, even as Bitcoin prices have slid from their peaks.

Short-seller Jim Chanos has been warning about this structure for years. Chanos’ core point remains timely: as long as the company borrows or dilutes shareholders to accumulate Bitcoin, it is exposed not only to BTC price risk, but to the same liquidity crunches that force other leveraged holders to capitulate when conditions turn.

The same applies to individuals who label themselves as permanent HODLers. It is easy to believe you will never sell when prices are rising or stable. Yet history shows that holders eventually capitulate when the walls close in. Margin calls, taxes, declining business revenue, personal emergencies, or simply the psychological strain of a long drawdown have all proven stronger than slogans. Those who hold through every dip are celebrated, but for every survivor, there are many others quietly forced out near the bottom.

Bitcoin’s market structure still depends on the availability of new liquidity. When that stalls, conviction does not protect portfolios. The lesson from the Sequans example is simple: holders can pretend they are immune to market cycles, but the pressure to de-risk always comes. Some capitulate early, some late, yet the cycle of forced selling repeats. The current downturn may be mild compared to what is possible when financial stress and leverage unwind together.

The belief that Bitcoin holders will never be carried out is comforting. It is also historically false. Every cycle ends with sellers who claimed they would never sell. The next one will be no different, and those most confident today may be the ones tested hardest when the market’s patience expires.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. If you see numbers and calculations of any sort, assume they are wrong and double check them. I failed Algebra in 8th grade and topped off my high school math accolades by getting a D- in remedial Calculus my senior year, before becoming an English major in college so I could bullshit my way through things easier.

The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Loading recommendations...