What Will Friday's Market Meltdown Mean For Monday

Submitted by QTR's Fringe Finance

If you’ve been a long-time follower of mine, you know that I’ve consistently made two points over the last 10 years. First, technical analysis doesn’t mean shit—it’s a backward-looking tool that has limited use in predicting the future. Second, I’ve often said that some days you wake up and everything is just different than it was the day before.

Today made both points. Along these lines, I didn’t see too many technical analysts, CNBC guests, or sell-side dildos predicting what would happen today—when the market erased essentially an entire month of gains in eight trading hours. It was the old adage of “stocks taking the stairs up and the elevator down” in practice.

My subscribers know that I’ve been writing about how precarious this market is—more aggressively over the last few months—noting massive looming problems in subprime auto, private credit, commercial real estate, and overvalued tech stocks: "End Of Empire Feel": QTR On Bitcoin News

That’s to say nothing of what could be a $2 trillion bubble in crypto. I’ve laid these thoughts out in a series of podcasts and articles, some of which I’ll list here for your convenience:

Today, that massive bubble found a pin when President Donald Trump responded to China’s move to essentially weaponize rare earth exports after China said this past week that it was restricting shipments of key rare earth elements used in semiconductors and defense applications.

Trump is a tit-for-tat guy, so his response was always going to be to ramp up tariffs to 100%, as he did after the market closed on Friday—causing another 1% move lower after a 2%–3% drop, depending on which index you look at. The real question remains whether this is China’s all-in moment to serve the United States a shit burger and really go to war with the dollar, or just a move to gain leverage ahead of the Trump–President Xi meeting happening in days.

My sense is the latter. But one thing nobody was talking about today—and that I want everyone to be aware of—is that I’ve long suspected China would eventually reveal larger-than-disclosed gold holdings and essentially “flip a switch,” deciding one day to wage full-on war against the U.S. dollar. I’m not saying that’s exactly what’s happening now, but if they were to do it, this is how it would start. The weaponization of rare earth minerals—vital not only to our quality of life in the U.S. but also to our national defense—is a major power play by President Xi. As my friend Andy Schectman and I have long speculated, a declaration of war against the dollar would happen over a weekend—likely on a Sunday—and result in catastrophe on Monday: U.S. Dollar & Sovereign Debt Endgame

I’m not saying that’s the case; I’m just saying nobody is talking about it, and people at least need to be aware of it. Putting aside what all of this means long-term, let’s focus on heading into next week.

* * * Reminder: meat orders must be placed by midnight PST

Ultimate Texas Beef and Pasta Box

(10 lb) Elkins' Ground Beef & Seasoning Bundle

Carnivore Trio: Beef, Chicken & Pork

* * *

As I’ve been writing for months, leverage in the system—including record margin debt and irresponsible leverage in options and crypto—means there will be a pain point where “buying the dip” no longer works and we cascade lower. Because of how investors have been conditioned the last 2 decades, that will break people’s brains: This Next Market Crash Will Break Our Fragile Brains

The dip tried to get bought during the middle of the day today, but the market fell to lows before the close. Whatever accommodations were made by longs caught offside got worse after hours, when the market plunged another 1% on the news of Trump instituting 100% tariffs against China. This is exactly the type of surprise situation that could result in significant margin calls and unwinding of leverage heading into Monday—unless Trump somehow backtracks or winds up coincidentally “having a great call” with President Xi over the weekend.

We are in precarious territory with little margin for error given how leveraged this market is. For an idea, take a look at crypto—it trades all weekend, and I’ve long said it’s the “tip of the spear” of speculation. It’ll likely be the first place people look for liquidity and exits. After Trump’s announcement late Friday, crypto plunged significantly, with Bitcoin nearing $110,000, falling more than 5% after hours as investors caught offside—or those who listened to Tom Lee make his 7,000th CNBC appearance today and bought the dip on his instructions—scrambled to realize that dip-buying, at least for the day, wasn’t going to work.

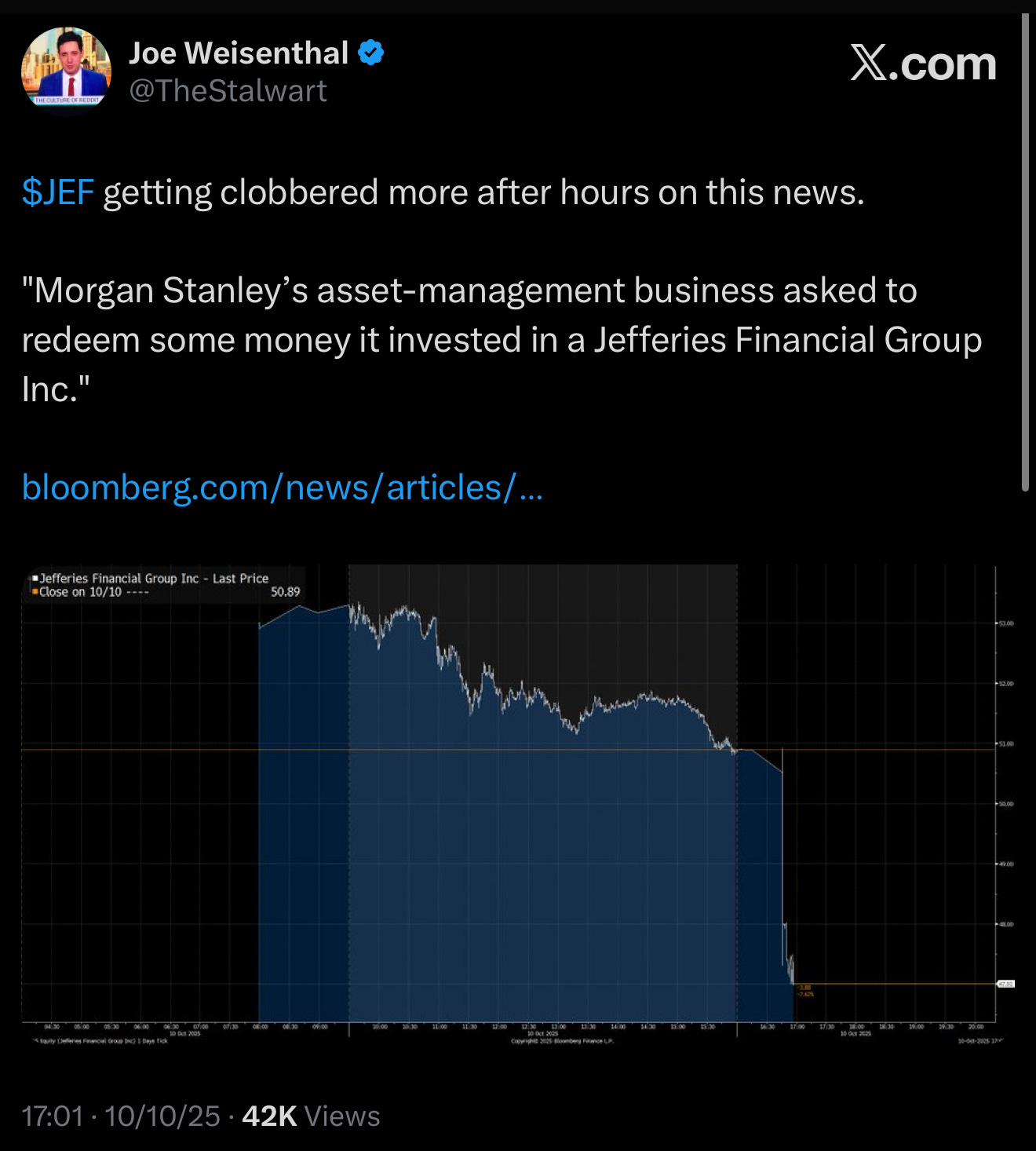

Then came the catastrophic headline that reminded me of Silicon Valley Bank: it was announced that Jefferies (JEF) was facing redemptions as banks look to shore things up after the First Brands bankruptcy (now with added off-balance-sheet debt goodness!)

This is exactly the type of news that can cause a run on a bank, and the timing couldn’t have been worse. It feels like Jefferies could be one of the first institutions under significant pressure as a result. Further, as I’ve been saying for the better part of the last year, regional banks were absolutely slaughtered today.

These are the banks with exposure to commercial real estate and subprime auto loans. I wouldn’t want to be in or near any of these banks anytime soon, as I think they’ll be the dominoes that wind up falling if this chaos continues into next week.

My “avoid list” stays the same: stay far away from subprime auto, overpriced tech equities, regional banks, anything with commercial real estate exposure, and private credit. I’ve noted this repeatedly over the last month. I think names like Apollo Global Management (APO), Blackstone (BX), Carvana (CVNA), Upstart (UPST), SoFi (SOFI), and the SPDR S&P Regional Banking ETF (KRE) could all get hit the hardest if this chaos holds through Monday morning. I would not want to be in or around any of these names.

So, what am I looking at to buy if things get mauled? See my full list and market outlook over on my blog here.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. If you see numbers and calculations of any sort, assume they are wrong and double check them. I failed Algebra in 8th grade and topped off my high school math accolades by getting a D- in remedial Calculus my senior year, before becoming an English major in college so I could bullshit my way through things easier.

The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Loading recommendations...