Solid 20Y Auction Stops Through After Jump In Foreign Demand

With stocks selling off again, and with capital - especially tech capital - scrambling for a flight to safety, it should hardly surprise anyone that today's 20Y auction was strong.

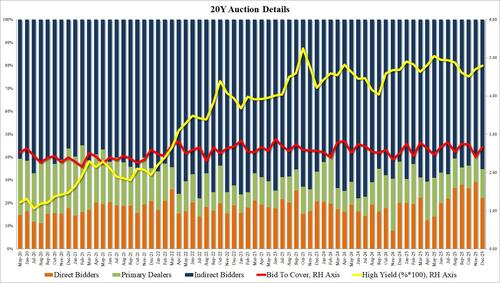

Pricing at a high yield of 4.798%, this was almost 10bps higher than the 4.71% stop in November (when the auction tailed by 0.2bps), and stopped through today's When Issued 4.799% by 0.1bps, the 6th stop through in the past 7 auctions.

The bid to cover jumped from 2.41 in November to 2.67, just above the 2.65 recent average.

The internals were also solid, as foreigners (aka Indirects) took down 65.2% of the auction, the highest since July; and with Directs awarded 22.2%, a bit below the 25.3% recent average, Dealers were left holding 12.6%, up from 11.4% in November and above the six-auction average of 11.0%.

Overall, this was a solid auction, which is what one would expected today, and while yields moved lower by about a basis point on the news, the reaction was to be expected. The big question is what happens to both issuance and yields if and when the AI trade continues to blow up and Trump decides to shift their existential risk to the balance sheet of the US taxpayer, similar to what happened in 2008 when it was banks, not AI companies, that were seen as Too Big To Fail.

Loading recommendations...