Oil: Rent Or Buy?

Deutsche Bank's head of thematic strategy, Jim Reid, writes that as a lover of long-term data, oil has always fascinated him as over the long run it’s never been able to compete with financial assets as an investment. As an example, in Reid's last annual long-term study, he showed that over the last 150 years, oil has provided a real return of ‘only’ +0.5% annually, while US stocks are at +6.58% and 10yr USTs (and equivalents) are at +1.84%. Interestingly Gold is only at +0.77% over the same period. However, copper (-0.56% p.a.) and wheat (-1.10% p.a.) are even lower.

Clearly commodities don’t provide a cash flow in the way that dividends and coupons help equities and bonds. In addition, technological improvements in extraction over time (mining or farming), and potential substitution effects in production, mean there’s usually a limit to how far prices can ever deviate from the long-run trend.

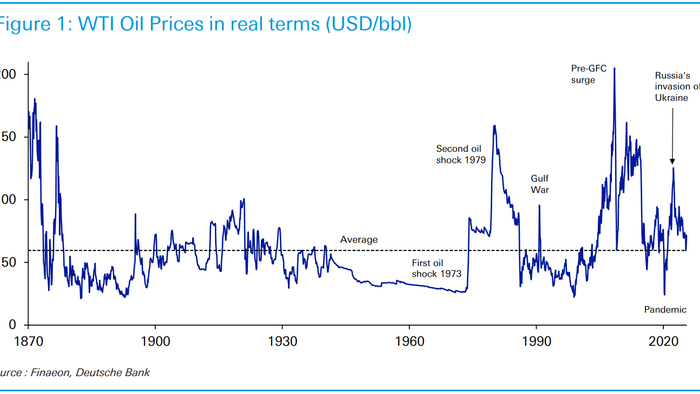

Still, that deviation can be more extreme over shorter cycles, and one can see that between 2008 and 2020 the market went to both sides of what was a very big range. It’s fair to say the recent range has been more extreme than from the late 1940s to 1973 when the price was broadly fixed in nominal terms by US government policy and a pricing cartel dominated by a group of seven oil majors nicknamed the “Seven Sisters”.