Monthly Housing Costs Tumble 5%, Biggest Drop Since October 2024

Trump's push to boost housing affordability is starting to bear fruit.

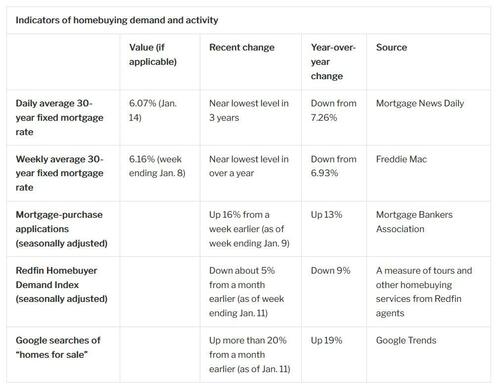

Just days after the president launched his own version of QE, after instructing GSEs to purchase $200BN in MBS, today Redfin reports that the median U.S. monthly housing payment dipped to $2,413 during the four weeks ending January 11 - down 5.5% from a year earlier which was the biggest decline since October 2024 - and near the lowest level in two years.

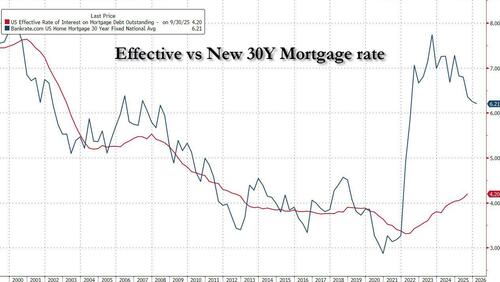

Housing payments are coming down because mortgage rates are falling. The daily average mortgage rate dropped to 5.99% last week, its lowest level in nearly three years, after President Trump ordered federal agencies to buy $200 billion in mortgage bonds (the daily average rate has since ticked up to 6.07%). To look at the impact of declining mortgage rates another way, Redfin notes that homebuyers’ purchasing power has increased by roughly $14,000 in the last month and $30,000 in the last six months.

Another anecdotal indicator of improving housing sentiment: Google searches of "homes for sale" jumped 20% from a month early, and were up 19% YoY.

More importantly, the gap between the effective outstanding mortgage, which was most recently at 4.20% and reflects all the refis and new mortgage done when rates were much, much lower, and the new Bankrate 30Y mortgage, has shrunk to the lowest level since 2021.

Monthly housing payments would be falling even more if not for still-rising sale prices. But while the median home-sale price rose 1% year over year according to the latest data, that's a solid improvement compared to the 4% to 5% increases at the start of 2025.

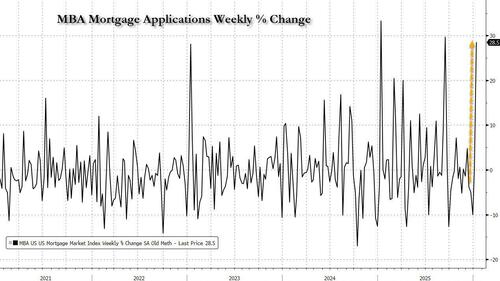

Alas, despite lower housing costs and improving affordability, fewer people are buying and selling homes. Pending home sales fell 5% year over year, and new listings declined 4.7%. The silver lining is that there may be an improvement in pending sales soon; last Friday’s significant rate decline, from roughly 6.21% to 5.99%, could result in more homes going under contract in the coming weeks. Mortgage-purchase applications soared 28.5% last week after mortgage rates slumped, the 3th biggest jump since covid...

... though mortgage applications don’t always line up with home sales.

In summary, while last week saw a big improvement in housing affordability, which is a welcome change to recent trends, there is still a long way to go.

Loading recommendations...