Meandering Through Narratives

By Peter Tchir of Academy Securities

Meandering Through the NarrativesToday, we will briefly run through the narratives that are driving markets and shaping the economy. We had the opportunity to discuss many of these during the first ½ hour of Bloomberg Surveillance on Wednesday morning.

Academy also published our monthly Around the World Podcast (also on iTunes and Spotify), focused on a range of key geopolitical issues facing us all. This dovetailed well with the “print edition” of Around the World with Academy Securities.

The i-Shaped EconomyWe had some interesting discussions around last weekend’s What Shape is the Economy? There seems to be agreement that “little i” represents the fact that a small segment of the population is doing extremely well, which isn’t reflected in either the K or k-shaped economy that so many people like to use. There is more debate on how “the stick” in the i is doing. We argued that basically it is okay, but got some pushback that those outside of the elite circle are struggling. Concern about jobs (not actual job losses, but concern about job losses) came up frequently as did indications that the consumer, at all levels, is stretched (delinquencies for lower income consumers, and “trading down” for even higher income consumers). The arguments against the vast majority doing well were reasonably compelling, but for now, I’m still in the “most people are okay to good with a few doing extremely well” camp.

Ra-Ra-RasPUTINAcademy’s Geopolitical Intelligence Group weighed in on Russia’s Air Space Incursions, in a SITREP and in the podcast mentioned earlier in this report. The President urged for NATO members to take a tough stance on such incursions during the United Nations General Assembly.

This certainly adds a new dimension to the war in Europe, but what I am most interested in, is that “suddenly” everyone is discussing the possibility of Europe taking Russia’s frozen reserves, and using the money to fund the war effort and their military spending. We advocated for this possibility two weeks ago in Ra-Ra-RasPUTIN and believe that this is the most important development in the war. More important even than Russia’s air space violations. Why? Because Russia is expecting these reserves to be returned (presumably, some may be spoken for by those countries that supply Russia with military equipment or components that Russia is using), so not getting them will hurt. At the same time, using that money to buy weapons (primarily from American suppliers) for the Ukrainians puts pressure on Putin in the battlefield.

The situation could get worse before it gets better, but even the threat of confiscating the reserves as some form of war reparations is a massive step in forcing Putin to reconsider his current stance of “business as usual” in Ukraine.

Peace Through StrengthA flurry of stories hit the tape on Thursday that the Secretary of War was calling a large number of senior flag officers (1-star and above Generals and Admirals, from the Army, Air Force, Navy, and Marine Corps) to Virginia for some meetings.

There is little (or no) information on what is going to be discussed. General Spider Marks gave his thoughts to the nation on CNN yesterday. There has been some reporting that this is preparing the military for some personnel changes, in the event of a Government Shutdown.

I am lucky enough to be in D.C. on Monday and Tuesday next week (ahead of our annual Geopolitical Summit in Annapolis) and hope to get some more color.

My thoughts are more along the lines of this is a “rebranding onsite.”

My expectation is that we will see steps taken to make deterrence more effective and to more thoroughly re-establish Peace through Strength.

My speculation on the goals of the meeting could be wrong, but all of our GIG members involved have cited re-establishing Peace through Strength as a priority for this administration. It is also a crucial step towards being able to reduce spending while maintaining global order.

The “Mythical” Neutral RateI was somewhat surprised, pleasantly, that new Fed board member used his first public speaking opportunity to argue that the so-called “neutral rate” is lower than the Fed previously thought, warranting significant rate cuts even in a stable economy.

My “enjoyment” from this topic was primarily due to watching any number of people defend Fed policy, by arguing that no one really knows what the neutral rate is, and that it changes anyways.

I suspect that this rather “wonky” discussion will help pave the way for a more “brute force” push to cut rates faster than the market is pricing in.

Look for lower yields (after the recent rise) and yield curves to continue to flatten (2s / 30s hit their lowest level since early August last week).

ProSec™Production for Security is finally catching on, at least as a political agenda and investment thesis, even if the phrase hasn’t gained popularity.

There are a number of stocks that have run up, following the leads of:

We continue to look for companies (many with small market caps) that could be integral in jump-starting the ability to produce and refine things critical to national security (chips, commodities, and even some pharmaceuticals). We also see this investment thesis going global.

It seems that more countries are looking at their vulnerabilities and at least starting to think about ways to produce some core amount of what is necessary on their own.

Having said that, a lot of questions have come up about how this is being done.

I’m not sure Graham and Dodd have a chapter for investing in this style of governance, but we need to have one in our own investing and planning playbook.

From Molecules to ElectronsMike Rodriguez, our head of Sustainable Finance, came to my rescue this week. I’ve been stuck on trying to get people to change the equation from Energy = Oil to Energy = Electricity. He pointed out how old that made me sound, and converted me to discussing the shift from molecules (fuel) to electrons (electricity).

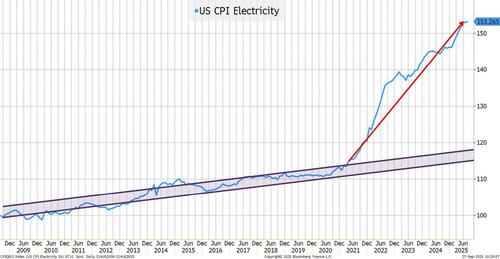

Electricity inflation may be the single most important component of inflation we have ever faced.

With some “minor” inconveniences (depending on where you live and work), you can cut back on gasoline purchases. Do more errands per trip. Carpool (they even have helpful lanes for that). Also, unless you are driving a lot, you are probably going to the gas station once a week at most. So, while it hurts to see gas surge at the pump, it isn’t the end of the world (and I’ve argued for some time, that oil prices going higher are probably more or less neutral for the economy given the number of jobs and average pay, for those in the fossil fuel sector).

Food inflation is awful and painful, but “substitution” is a real thing. You can “trade down” in terms of quality or type of food, to reduce costs. Definitely worse than gas inflation, but it is spread over so many items and happens a little each day, that it seems to get lost, at least a little, in the shuffle.

Electricity is tricky. We can all turn off lights and monitor power (maybe demand that electronic goods don’t all now come with lights that seem to stay on whether you want them on or not, but that is starting a rant we don’t have time for today). To the extent EVs are driving demand, then the same rules laid out above can apply. But refrigeration? How do you control that? Air conditioning? What temperature you live at affects your sleep, which in turn affects everything else in your life (yeah, I’ve been getting converted into a healthy sleep nut). Also, unlike the gas tank, which you watch every time you are in your car, very few of us (I hope almost no one) goes outside and watches how fast the electric meter is turning. It is always kind of a “surprise” when you see the electric bill. How much did I use? What was the cost?

I’ve probably understated the risks of other inflation and overstated the risks of electricity inflation, but I think it is going to become a major issue in upcoming elections.

It took electricity over a decade to rise just over 10% (2009 to 2020). Since then, it has risen closer to 40%! So far, there is no indication that the costs are stabilizing.

The production of electrons may be the most important part of any government’s ProSec™ strategy!

I don’t see any way around using nuclear. While many sustainable energy projects (especially wind) seem to be out of favor with the President, I don’t see how they don’t play a major role in our future. If anything, sustainable, especially solar, provide the quickest way to ramp up electron production.

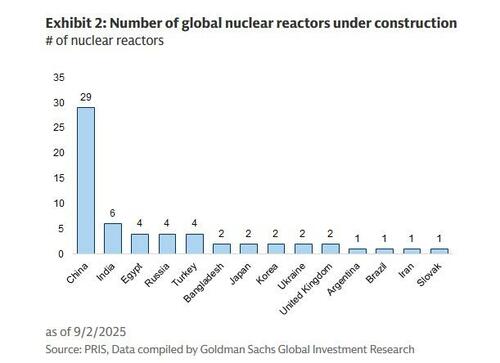

I could spend months trying to figure out a viable strategy, but sadly, I think all we have to do is look at China and charts of their solar energy production (going vertical) and their nuclear power plant building (they may be building more plants than the rest of the world combined), to know what other countries should be considering.

My portfolio is littered with companies in this sector as not only is it a major growth opportunity in its own right, but I also see plenty of opportunity for ProSec™ to be pushed into action. Again, I’ve been primarily focused on the U.S. but I see this as a truly global opportunity.

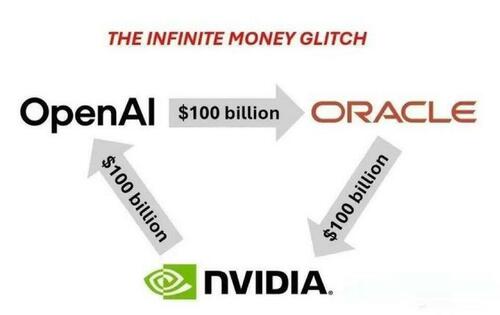

Circularity in AIThe one narrative that seems to be “circulating” in the data center/AI story is some signs of “circularity.” On one hand there is a virtuous circle. Companies are interconnected, where the growth in one, drives growth in another, which in turn, winds up helping the first company in the chain. We have seen the entire industry grow rapidly, with at least some evidence of a virtuous circle.

For the first time, I’m hearing (even from strong supporters of the space and valuations) concerns that the leaders are too intertwined and the space is susceptible to a pullback.

Against that is increasing evidence, in earnings reports and company calls, that AI and data centers are helping generate efficiencies. That is what we need to continue that component of the market rally (and economic strength). It should also help let the rally expand beyond the select few (think little i) to more companies that are reaping the benefits of their spending.

Maybe both can be true? The growth can continue but the bulk of the benefit (in terms of stock prices) might accrue to a broader swath of companies?

Bottom LineNo shortage of narratives impacting markets and the economy. Not just domestically, but also globally.

We head into this week:

It should be another interesting week, as we have month and quarter end Tuesday, as I “meander” across the country with D.C. and Annapolis this week, followed by Chicago and Milwaukee next week. I look forward to seeing many of you in person this autumn!

Loading recommendations...