Key Events This Shortened Week: GDP And Durables On Deck As 2025 Closes

For those traders who are still "out there" instead of the slopes of Chamonix mingling with freshly embezzled US tax dollars by way of Kiev, DB's Jim Reid reminds that we’re now entering a very quiet spell for markets before Christmas, with data releases and other headline announcements almost completely drying up. Indeed, there’s only two-and-a-half days left to go for many places, as the US and several European markets are closing early on Christmas Eve, and this week usually sees some of the lowest volumes of the year.

In terms of the week ahead, it’s a pretty quiet one on the events calendar. One thing to note will be a few US data releases, including the delayed Q3 GDP print Tuesday, but that’s very backward-looking and covers the period before the shutdown. Otherwise the more recent data will be the December consumer confidence reading from the Conference Board, also on Tuesday, which will be in the spotlight given the recent downtick in sentiment. In fact, the previous reading for November was the lowest since the Liberation Day turmoil in April. But apart from that, there really isn’t much scheduled.

With little on the calendar this week, this lack of events got Reid thinking about whether anything could disturb the pre-Christmas calm, as we have seen a few occasions when this week has brought heightened volatility.

The best recent example is probably 2018, when you may remember a huge selloff saw the S&P 500 fall -7.7% in the four pre-Christmas sessions. A whole bunch of negative factors converged at once, including a hawkish Fed signalling more hikes to come, weak global data, US-China trade tensions, and the start of a US government shutdown on Dec 22. That selloff deepened further after the US Treasury Department said in a Dec 23 statement that Secretary Mnuchin had spoken with CEOs of the largest US banks, and that the President’s Working Group on financial markets would have a call. So that created huge concern that policymakers knew something that the rest of us didn’t, and the S&P hit its closing low on Christmas Eve.

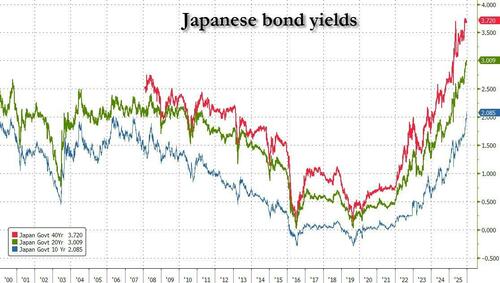

Another good example, although not quite as fearful, happened in 2022. That was the year central banks hiked aggressively to combat inflation, with global bonds and equities entering a bear market that featured huge bouts of volatility as they kept sinking lower. And the Christmas run-up was no different, with the 10yr Treasury yield surging +26bps in the week before Christmas. That followed an adjustment to the Bank of Japan’s yield curve control policy on Dec 20, which was widely seen as the beginning of the end of Japan’s ultra-loose monetary policy. They permitted the 10yr JGB yield to rise to around 0.5%, up from 0.25% previously, but the effects cascaded globally given Japan’s role as one of the last anchors for low yields. So that led to some dramatic moves right before Christmas, and it was one of the biggest weekly jumps that year for the 10yr Treasury yield.

To be fair, this time last year saw a pre-Christmas Santa rally that took the S&P 500 up +2.9% in the final 3 days before Christmas. But either way, it shows that even if it’s a quiet week on the calendar, we can’t completely dismiss the prospect of a final year-end curveball, which would be in keeping with the constant surprises of 2025 so far. After all, this year has seen a huge regime shift in German fiscal policy in March, the Liberation Day tariffs in April, a direct military conflict between Israel and Iran in June, and the longest-ever US government shutdown over October-November. And that’s before we think about some other long-running themes, including periodic bond market flareups around fiscal policy, fears of a potential AI bubble, and ongoing concern around private credit.

This morning, the main news has been further sharp losses for Japan’s government bonds, which follows the Bank of Japan’s Friday decision to hike rates by 25bps to 0.75%, the highest since 1995. The hike already meant that Japan’s 10yr yield was up +6.9bps last week to close above 2%, and this morning they’re up another +6.9bps to 2.08%, their highest since 1999.

One factor behind that has been the weakness in the Japanese yen, which fell -1.40% against the US dollar on Friday, despite the hike. And this morning, the country’s chief currency official Atsushi Mimura said to reporters that “We’re seeing one-directional, sudden moves especially after last week’s monetary policy meeting, so I’m deeply concerned”. So in turn, that weakness for the yen is seen as raising the chance of another BoJ rate hike and has prompted the latest selloff for JGBs. We’ve seen that echoed across other countries too this morning, with 10yr Australian yields up +5.1bps this morning, whilst the 10yr Treasury yield is up +2.0bps to 4.17%.

For equities however, there’s been a much stronger picture across the board overnight, with gains for Japan’s Nikkei (+1.90%), along with the KOSPI (+1.82%), the CSI 300 (+0.79%), the Shanghai Comp (+0.64%) and the Hang Seng (+0.20%). Looking forward, US equity futures are also pointing higher, with those on the S&P 500 up +0.26%. Moreover, there’s been a fresh rally for precious metals this morning, with gold prices up +1.40% to $4400/oz, which would be an all-time closing high if sustained, and is the first time they’ve reached that level on an intraday basis as well. Similarly, silver prices (+3.25%) are up to a fresh record of $69.34/oz. So that now leaves their YTD gains at +68% for gold and +140% for silver, which would be the biggest for both since 1979, back when oil prices surged after the Iranian Revolution that year led to major supply disruption.

Courtesy of DB, here is a day-by-day calendar of events:

Monday December 22

Tuesday December 23

Wednesday December 24

Thursday December 25

* * *

Turning to just the US, the key economic data releases this week are the Q3 GDP and durable goods reports on Tuesday. There are no speaking engagements by Fed officials scheduled this week.

Monday, December 22

Tuesday, December 23

Wednesday, December 24

Thursday, December 25

Friday, December 26

Source: DB, Goldman

Loading recommendations...