Last week, around the peak of the repo crisis we said that while the Treasury was soaking up most market liquidity via its Treasury General Account (which had ballooned to over $1TN), any sign of a govt reopening would send risk assets sharply higher (as this liquidity would then flood back into the market), and sure enough, futures are surging this morning as it now appear that the US government shutdown is finally over after Democrats folded on Sunday night and agreed to reopen the govt with no victory in hand, having kept the government shut for almost 40 days, a record, for no reason at all. As of 9:00am S&P 500 futures were up 0.9%, after the index closed just above its 50-day moving average on Friday — sharply bouncing back after a dip below the threshold; Nasdaq 100 futures jump 1.4% on optimism that the government shutdown may end soon, along with easing US-China tensions and Trump’s bid to appeal to cash-strapped Americans with a tariff “dividend.” European and Asian stocks are also sharply higher. Premarket, Mag7 and Semis are the notable outperformers with AMD, AVGO, GOOG, META, MU, NVDA all up at 2% - 3.5% pre-mkt. Cyclicals are also seeing a pre-mkt bid while parts of Defensives are in the red. Bond yields are +3-4bp with USD flat. In commodities, the story is the strength in Ags and Precious Metals with the former seeing +1% move across much of the Ag complex and gold and silver up 2% and 3.3%, respectively, outpacing Base Metals which are also bid up. With the gov’t reopening, the market appear to be shifting its view back to fundamentals which remain strong for earnings and macro, but likely not enough for the Fed to pause/skip in December, which should benefit risk-assets.

In premarket trading, all Mag 7 stocks are higher (Nvidia +3.1%, Tesla +2.1%, Alphabet +2%, Meta Platforms +1.4%, Amazon +1%, Microsoft +0.8%, Apple +0.5%).

Cryptocurrency-linked stocks are rallying amid risk-on sentiment as lawmakers move closer to a deal to end the longest shutdown in US history.Health insurers, including Centene (CNC), are falling as lawmakers move closer to ending the shutdown without securing a health care win.Gold stocks such as Newmont (NEM) are outperforming as the precious metal rises for a second day, with a weakening US economy increasing the chance of a rate cut next month and outweighing progress on ending the government shutdown in Washington.Celestica Inc. (CLS) shares are up 6% after Citi upgraded the electronic components company to buy from neutral.Grab Holdings Ltd. (GRAB) gains 6% after an Indonesian government official said the Southeast Asian nation’s sovereign wealth fund is set to be involved in a plan to combine GoTo Gojek Tokopedia’s parent with Grab.Metsera Inc. (MTSR) shares tumble 14% after Novo Nordisk A/S declined to further raise its offer for the US maker of an experimental weight-loss drug, bringing a bidding war with Pfizer Inc. to an end.Monday.com (MNDY) sinks 16% after the software company narrowed its full-year revenue forecast. It also reported its third-quarter results.Sunrun Inc. shares are up 6% in after Guggenheim upgraded the solar energy company to buy from neutral.TreeHouse Foods (THS) soars 20% after European buyout firm Investindustrial has agreed to buy the private-label food manufacturer.In corporate news, Pfizer agreed to buy Metsera for up to $10 billion, prevailing over Novo Nordisk in a bidding war. Visa and Mastercard are said to be close to a new agreement to settle a two-decade legal spat with merchants. UPS and FedEx have grounded their McDonnell Douglas MD-11 aircraft fleet on Boeing’s recommendation after a crash in Louisville.

In AI news, TSMC reported slowing growth in monthly revenue, highlighting uncertainty over the sustainability of the AI boom even as industry behemoths including Nvidia chase more chip orders. Robinhood plans to give amateur investors access to private AI companies whose valuations have increased significantly, CEO Vlad Tenev told the FT in an interview.

The risk-on mood spread across markets, lifting oil, metals and crypto. Europe’s Stoxx 600 was on track for its biggest gain since June. US Treasuries fell across the curve, pushing the 10-year yield up four basis points to 4.13%. Gold also advanced on prospects of a Federal Reserve rate cut next month. Bitcoin continued to move higher after flirting with the key $100k level early last week, while gold and oil rose.

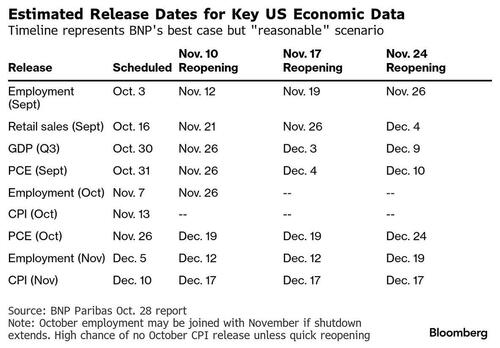

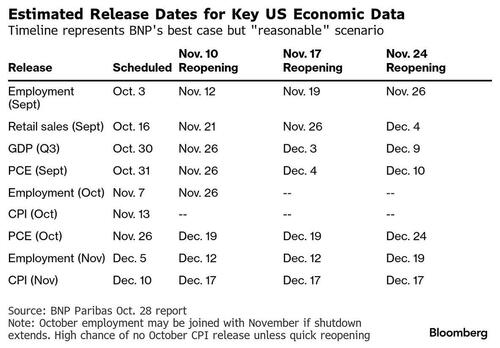

Monday’s optimistic tone offered relief after a volatile week, when worries over stretched valuations fueled a sharp selloff in the biggest winners of the artificial-intelligence boom. Ending the shutdown would give investors greater clarity on key economic data such as jobs and inflation, helping to lift the fog around the outlook for interest rates.

The Senate voted 60-40 on a procedural measure to advance a bill to end the government shutdown, with a group of moderate Democrats breaking with their party leaders to support the deal. Assuming the government reopens in the coming weeks and statistics start moving again, Fed officials still face a data fog with information compiled via retroactive surveys and other methods — if the figures are published at all.

“Markets are taking very positively to the news of the potential resolution of the US shutdown,” said Marija Veitmane, head of equity research at State Street Global Markets. “We were very constructive on the market anyway and we saw last week’s selloff as a little bit of a buying opportunity.”

That said, how soon the shutdown will end remains uncertain. The Senate has yet to schedule a final vote, while the measure must also pass the House before reaching President Donald Trump for his signature.

“It’s only the opening act in what could still be a drawn-out political drama, but investors are seizing on any sign of progress,” said Ipek Ozkardeskaya, a senior analyst at Swissquote. “They need to understand where the US economy stands, where inflation and jobs are headed and what the Fed should do next.”

As usually happens, we are now about to see a short squeeze, as discretionary and systematic investors cut exposure last week as simple momentum chasing strategies continued to stumble, according to Deutsche Bank strategists, aggregate equity positioning remains modestly overweight. A slowdown in tech and AI would be far more damaging to the US and emerging markets than to other developed regions. Since early 2024, tech and AI’s weight has risen from 39% to 50% in the US.

Elsewhere, Bessent said Trump’s suggestion, in a Sunday social media post, that Americans may receive a tariff “dividend” of at least $2,000 could come via the tax cuts passed in his signature economic policy bill earlier this year. US and China suspended port fees on each other’s ships for one year and paused probes into maritime practices.

Third-quarter earnings are just about over, and the conclusion is corporate America is performing very well as earnings rise at the fastest pace in four years. Companies in the S&P 500 Index that have reported earnings for the third quarter — about 80% of the index by market cap — have grown the bottom line by 14.6%, effectively doubling what analysts were expecting. Looking ahead, strategists are bullish on the outlook. Strategists at UBS Group AG expect the S&P 500 to climb to 7,500 next year on the back of solid earnings growth, implying an 11% gain from current levels. Their peers at Morgan Stanley, meanwhile, see clear signs of a recovery in corporate profits.

In Europe, the Stoxx 600 rises 1.4% as hopes for a deal to end the US government shutdown boost risk sentiment. Diageo shares surge after the company names former Tesco boss Dave Lewis as CEO. The technology and mining sectors lead gains — with ASML up as much as 2.9% — while personal care products shares lag. Technology stocks led gains in Europe, as they did in Asia after Nvidia CEO Huang said he had asked TSMC for more chip supplies as AI demand remained strong. Here are some of the biggest movers on Monday:

Diageo shares rise as much as 7.9%, the most since November 2020, after the UK distiller named Lewis as CEO.Kingspan advances as much as 8% after the construction materials company gave commentary on next year that Morgan Stanley described as supportive. Growth optionality presents upside to medium-term estimates, the analyst says.Siemens Energy shares rises as much as 5.5% after Jefferies upgraded its rating to buy, saying the shares continue to look undervalued despite more than doubling since the start of the year. IAG shares rise as much as 6.7%, recovering some post-earnings losses from Friday’s session. Novo Nordisk shares rise as much as 3.8% after its withdrawal from a takeover battle for obesity drug developer Metsera prompted relief among some investors that it won’t be spending $10 billion on an unproven asset.Camurus shares jump as much as 13%, the most in more than five months, after it reported positive topline results from an early-stage obesity treatment study.JTC shares fall as much as 5% after Permira agreed to buy the corporate services firm for £2.3 billion.Earlier, Asian stocks rose, supported by a rebound in technology shares following a selloff last week on concerns over lofty valuations. Hopes of a possible end to the longest US government shutdown also lifted sentiment. The MSCI Asia Pacific Index rose as much as 1%, with Tencent, TSMC and SK Hynix among the top contributors to the advance. South Korea’s Kospi gauge led gains in the region after reports on a potential dividend tax cut and likely increase in domestic equity allocation by a pension fund boosted optimism. The MSCI Asia benchmark has climbed more than 25% in 2025 — on track to outperform the S&P 500 by the widest margin in 16 years. Shares in mainland China reversed earlier losses to close 0.4% higher after the world’s two largest economies suspended port fees on each other’s ships for one year and paused probes into maritime practices. Equities also rose in Hong Kong. Here Are the Most Notable Movers

Mercari shares jumped after first-quarter earnings beat analyst expectations on greater cost efficiencies. Omron shares declined after its earnings disappointed analysts.China suspends countermeasures for one year against five US units of Hanwha Ocean from Nov. 10, according to a statement from the Ministry of Commerce.GoTo Gojek Tokopedia shares surged to the highest level in three months, after an Indonesian government official said the Southeast Asian nation’s sovereign wealth fund, Danantara, is set to be involved in a plan to combine its parent with rival Grab Holdings Ltd.Transformers & Rectifiers India shares fall as much as 20%, the most since July 2023, after second-quarter profit and revenue missed analysts’ estimate.Subaru reported net income for the second quarter that beat the average analyst estimate.Nissin Foods cut its operating income guidance for the full year; the guidance missed the average analyst estimate.Trent shares fall as much as 6.5%, most in over four months, after moderation in second-quarter sales growth triggered brokerages to cut their earnings estimates. Citi downgraded its rating on the company to a sell after results published Friday.Yangzijiang Financial Holding shares fall as much as 61% in Singapore as they start to trade excluding their entitlement to the maritime investments business being spun off into Yangzijiang Maritime Development.Intensifying competition in India’s online grocery delivery space is weighing on the shares of market leader Eternal Ltd. and its listed rival Swiggy Ltd.Mercari shares rose as much as 15%, the most since Feb. 7, after the Tokyo-based online marketplace company reported 1Q earnings that beat analyst expectations on greater cost efficiencies.In FX, the yen is the weakest of the G-10 currencies, falling 0.5% against the greenback and taking USD/JPY back above 154. The Norwegian krone is among the outperformers, rising 0.5% after CPI surprised to the upside.

In rates, Treasury fall as haven demand wanes, pushing US 10-year yield up 3 bps to 4.13%. German government bonds also edge lower.

hold modest losses in early US trading after gapping lower at the Asia open as signs lawmakers may end the government shutdown stoked risk appetite. US yields are 3bp to 4bp higher with curve spreads little changed; 10-year, higher by more than 3bp near 4.125%, is ~2bp cheaper vs bunds and gilts in the sector. $58 billion 3-year note auction at 1pm New York time has WI yield near 3.60%, about 2bp cheaper than last month’s, which stopped through by 0.8b. IG dollar issuance slate empty so far but expected to build ahead of the holiday Tuesday; around $40 billion of supply is projected this week, following a combined $136 billion over the past two weeks.

In commodities, Spot gold climbs $80 to ~$4,080/oz. WTI crude futures add 0.2% to around $60 a barrel. Bitcoin rises 1.5% to around $106,000.

The US economic calendar empty for the session. Fed speaker slate includes Daly (8:30am) and Musalem (9:45am)

Market Snapshot

S&P 500 mini +1%Nasdaq 100 mini +1.5%Russell 2000 mini +1.2%Stoxx Europe 600 +1.4%DAX +1.8%CAC 40 +1.4%10-year Treasury yield +3 basis points at 4.13%VIX -0.4 points at 18.7Bloomberg Dollar Index little changed at 1218.71euro little changed at $1.1568WTI crude +0.8% at $60.24/barrelTop Overnight News

A group of Democrats broke with their party and supported a deal to end the longest-ever US government shutdown. The Senate voted 60-40 on a procedural measure to advance the bill, though it has yet to schedule a vote for final passage. BBGDemocratic lawmakers and liberal grassroots groups erupted Sunday night as moderate Senate Democrats moved to cut a deal with Republicans that would put an end to the government shutdown. Democrats are primarily frustrated that Affordable Care Act tax credits will not be extended. AxiosMore than 10,000 flights were delayed or canceled yesterday as a snow storm in Chicago compounded the effect of a third day of government-mandated restrictions. Transportation Secretary Sean Duffy told Fox that flights may “slow to a trickle” during Thanksgiving if the shutdown persists. BBGScott Bessent suggested to ABC that Donald Trump’s proposed $2,000 tariff “dividend” may be referring to a decrease in taxes, but he hasn’t spoken about it with the president. BBGUS President Trump called for Senate Republicans to send government money given to health insurance companies and send it directly to the people.Boeing spokesperson said they recommended to the three operators of the MD-11 freighter that they suspend flight operations, while UPS (UPS) and FedEx (FDX) spokespersons said they made the decision to immediately ground their MD-11 fleets following the Louisville crash.White House Economic Adviser Hassett said US GDP could be negative in Q4 if the government shutdown drags on.US Supreme Court allowed the Trump administration to withhold billions in funding for food aid for now. It was separately reported that the Trump admin ordered US states to stop paying full food aid benefits to low-income American families and said that they are "unauthorised".China added more than a dozen fentanyl precursors to a list of controlled exports to the US, Mexico and Canada, in an apparent move to implement commitments made in a trade deal reached between Xi Jinping and Donald Trump last month. BBGChina has suspended retaliatory port fees on US-linked vessels for one year, following Washington’s pause of similar charges under its “Section 301” investigation targeting the Chinese maritime sector. SCMPThe Bank of Japan’s policy board has signaled that the next interest-rate increase may be coming soon, according to its latest summary of opinions, with members keeping a particular eye on domestic wage trends. WSJJapan’s new PM Sanae Takaichi said on Monday she would work on setting a new fiscal target extending through several years to allow more flexible spending, essentially watering down the country's commitment to fiscal consolidation. She also renewed calls for the Bank of Japan to go slow on interest rate hikes, despite signs that most central bank policymakers would prefer to see a resumption of monetary tightening sooner rather than later. RTRSThe ECB’s Luis de Guindos said the current level of euro-zone borrowing costs is appropriate but officials must remain cautious. BBGFed survey on Friday noted that policy uncertainty, including trade policy, central bank independence and availability of economic data, was the most frequently cited risk to US financial stability, while AI was added as a top stability concern, and respondents also cited geopolitical risks, inflation, monetary tightening, and higher long-term rates as top salient risks.Fed’s Williams (voter) said the gap between rich and poor risks a US downturn and suggested that poorer Americans’ mounting problems could be a factor in whether the central bank cuts rates in December, while he sees a balancing act for the December rate meeting, according to FT.NVIDIA CEO said they have very strong demand in Blackwell chips and asked TSMC (2330 TT) for more wafers to meet strong AI demand, while he stated that business is growing strongly and there will be a shortage of different things, as well as noted said Samsung, SK Hynix, and Micron have scaled up capacity.Trade/Tariffs

USTR announced the suspension of action in the Section 301 investigation of China's targeting of maritime logistics and shipbuilding sectors for dominance, with the action to be suspended for one year as of 00:01 EST on November 10th, while the USTR said the US will negotiate with China pursuant to Section 301 regarding the issues raised in the investigation.FBI Director Patel visited China last week to talk about fentanyl and law enforcement, according to sources cited by Reuters.China’s Commerce Ministry said it suspended the 2024 ban on approving exports to the US of dual-use items related to gallium, germanium, antimony, and superhard materials until 27th November 2026.China halted special port fees for US vessels for one year and removed sanctions on US-linked units of Hanwha Ocean (042660 KS) for a year.China’s Commerce Ministry said China has taken measures to exempt the export of Nexperia chips compliant with civilian use from export controls, and it welcomes the European side to continue to urge the Dutch side to correct ‘wrongful’ practices. Mofcom also said that China hopes the Netherlands will promote the early resolution of the Nexperia semiconductor issue, and that China agreed to a request from the Dutch Economics Ministry to send officials to China for talks.EU Trade Commissioner Sefcovic said they welcome confirmation given by China’s MOFCOM on further simplification of export procedures for Nexperia chips to EU and global clients.India and Australia held further talks on boosting trade and economic ties, while they reaffirmed a desire for an “early conclusion” of a Comprehensive Economic Cooperation Agreement, according to Bloomberg citing a statement by the Indian government after India’s Commerce Minister Goyal met Australian Trade Minister Farrell.China Commerce Ministry said it makes adjustments to management catalogues of drug-related precursor chemicals; will require license for export of certain chemicals to the US, China, Canada and Mexico.A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded higher amid the improving US-China trade environment and with hopes of ending the US government shutdown as several Democrats supported Republicans to pass a measure through the procedural vote in a rare Senate session on Sunday. ASX 200 gained with the upside led by the mining and tech sectors, while financials also showed resilience despite ANZ positing a decline in fiscal 2025 cash profit. Nikkei 225 rallied amid a weaker currency and as participants digested earnings, while it was also reported that Japan's GPIF posted a July-September quarterly investment return of JPY 14.45tln. Hang Seng and Shanghai Comp ultimately conformed to the upbeat mood amid the improving US-China trade environment, as both the US and China relaxed trade restrictions on each other, while there was also inflation data over the weekend which printed above forecasts, although factory gate prices remained in deflation.

Top Asian News

BoJ Summary of Opinions from the October 29th-30th meeting noted that one member said the BoJ is expected to keep raising interest rates if the economic and price forecasts materialise, while a member said it is important to check the initial momentum towards next year’s wage talks as firms firm up plans after US tariffs were set at 15%. It was stated that the key to future policy decisions is whether firms maintain positive wage-setting behaviour, while there was the opinion that uncertainty remains over the outlook, but Japan will see conditions align to adjust the policy rate depending on economic and price developments. Furthermore, a member said there is no need to rush, but interest rates must be raised without losing appropriate timing.BoJ's Nakagawa said the BoJ is expected to continue raising interest rates in accordance with improvements in the economy and prices, while she added the BoJ will make appropriate policy decisions, taking into account that uncertainty surrounding trade policies remains high.Japanese PM Takaichi said the government must restore market trust in Japan's finances, but boosting investment is also needed to strengthen economic growth, while she is not ruling out a sales tax cut as an option in the future, although the immediate priority is to compile a package of steps to cushion the blow from rising cost of living.China’s National Radio and Television Administration launched a campaign to address the spread of inappropriate animated videos.UK probes whether buses made in China can be turned off from far away after Norway found Yutong vehicles could be ‘stopped or rendered inoperable’ by the Chinese company, according to FT.Earthquake of magnitude 6.21 strikes east cost of Honshu in Japan.China issues measures on boosting private investment via Xinhua. China to also encourage private capital to invest in railway, nuclear power. Will clean up "unreasonable" access restriction for services sector. China will guide private capital to participate in low-altitude economy, commercial aerospace and other fields in an orderly manner. China to meet reasonable credit demand for private firms.European bourses (+1.3%) are stronger across the board, with sentiment boosted amidst progress related to the US Government shutdown. Price action saw indices open on a strong footing and continue to rise as the morning progressed. European sectors are almost entirely in the green, with a clear cyclical bias. Tech and Basic Resources leads whilst Optimised Personal Care lags. For Basic Resources specifically, the sector has been lifted by upside across underlying metals prices - upside facilitated by the risk sentiment and better-than-expected Chinese inflation figures over the weekend. US equity futures (ES +1%, NQ +1.4%, RTY +1.2%) are entirely in the green, with clear outperformance in the tech-heavy NQ. Overall, sentiment boosted by the shutdown-related progress; on that, eight democrats voted with Republicans to advance a deal which would reopen the government and keep it funded until the end of January. Separately, NVIDIA (+3.5%) benefits from the risk tone and after CEO Huang said that the Co. has very strong demand for Blackwell chips and asked TSMC (2330 TT) for more wafers to meet strong AI demand.

Top European News

ECB's de Guindos said the ECB firmly believes the level of rates are correct.UK faces an increase in young adults leaving the country owing to low salaries, rising tax burden and a lack of affordable housing, according to wealth managers cited by FT.UK Chancellor Reeves is reportedly set to increase the rate of dividend tax, according to The Telegraph.ECB’s Sleijpen cautioned against signing off too easily on joint European bonds and said they ultimately only lead to higher debt, according to Bloomberg.Fitch affirmed Ireland at AA; Outlook Stable and affirmed Latvia at A-; Outlook Stable.FX

The DXY trades choppily after a rangebound APAC session, showing a mixed tone against major peers as participants digest upbeat US–China trade headlines and optimism over a potential resolution to the US government shutdown. The latter followed reports that eight Democrats backed the Republican spending bill to advance past a key procedural vote. Looking ahead, the data docket is void of any pertinent releases, so focus will be on speeches from Fed's Daly and Musalem. The DXY currently holds within a tight 99.46–99.74 band, comfortably inside Friday’s broader 99.40–99.87 range.EUR/USD trades without clear direction around the 1.1550 mark amid a lack of fresh drivers from the Eurozone, while ECB’s Sleijpen warned against rushing into the issuance of joint European bonds, arguing such a move would ultimately burden the bloc with higher debt levels. Regional newsflow was light through the morning, leaving the pair largely at the mercy of broader dollar dynamics. Despite the softer USD backdrop, the euro failed to meaningfully capitalise, with upside momentum likely constrained by sizeable option expiries clustered below and around the 1.1500 handle. EUR/USD currently trades within a 1.1542–1.1583 band.USD/JPY climbed at the open as improved sentiment surrounding US–China trade ties and renewed hopes for a US government reopening drove outflows from haven currencies. The JPY stands as the clear laggard among the majors, with moves largely reflecting an unwind of prior risk premia rather than fresh domestic developments. Comments from Japanese PM Takaichi ahead of the European open failed to elicit any notable market reaction. The pair gapped higher from Friday’s 153.41 close, opening at 153.77 before reclaiming the 154 handle. USD/JPY now trades within a 153.40–154.23 range.GBP/USD eased slightly overnight from last week’s highs but remained confined to a narrow range around the 1.3150 mark amid a quiet news backdrop. The high-beta currency finds modest support from a softer dollar and improved risk sentiment, though gains are capped as traders exercise caution ahead of the November 26th Budget. The Telegraph reported overnight that UK Chancellor Reeves is preparing to raise the dividend tax rate as part of fiscal tightening efforts. GBP/USD currently trades within a 1.3136–1.3184 range.The Antipodeans are the standout gainers amid a broadly constructive risk tone and ongoing USD softness, benefiting from the easing in US–China trade tensions and firmer Chinese inflation data over the weekend. Chinese CPI and PPI figures surprised modestly to the upside, reinforcing optimism around domestic demand stabilisation. AUD outpaced its Kiwi counterpart, aided by strength in gold and copper prices, while NZD’s gains were more measured as AUD/NZD extended its advance beyond the 1.1550 mark.China will raise its retail prices of gasoline and diesel from Tuesday, based on recent changes in international oil prices, according to Xinhua.Fixed Income

USTs are underperforming today and currently reside at session lows within a 112-15 to 112-23 range. Downside comes after a week of safe haven-related inflows after a string of poor private labour market figures, downbeat UoM sentiment metrics, AI-bubble related fears and ongoing US government shutdown; the latter has recently shown signs of progress, which has boosted risk sentiment today. In terms of details, the US Government shutdown is showing some early signs of progress after eight democrats voted with Republicans to advance a deal which would reopen the government and keep it funded until the end of January. Price action today has only really been one direction, and that’s downwards; overnight saw the USTs open at 112-23 (highest today) and continue to trundle lower to make a fresh trough of 112-15 in early European hours.Bunds are weaker today, albeit to a lesser extent than global peers; currently trading off by around 10 ticks in a 128.80 to 128.96. Gapped below 129.00 at the open, and continued to drip lower overnight and into the European open. However, the German paper then caught a slight bid just after the cash open, which took Bunds back a couple of ticks above opening levels, to make a current peak of 129.02. Really not much from a European perspective today, aside from a downbeat EZ Sentix print, which printed below the most pessimist of analyst expectations.Gilts are on the back foot, in-fitting global peers but to a lesser magnitude than their US counterparts. Newsflow ultimately solely focused on the looming UK budget at the end of this month; on that, Chancellor Reeves is reportedly set to increase the rate of dividend tax, according to The Telegraph. This follows on from reports via the same press which suggested that Reeves was looking to hike income tax by 2%, whilst simultaneously cutting NI by that same magnitude. Gilts have seemingly been getting accustomed to continued reports of tax-related newsflow, after Reeves provided a slight reprieve to markets are she failed to reiterate her tax-related pledges at a presser in recent weeks.Commodities

Crude benchmarks have bid higher to start the week as it follows the positive sentiment seen stateside as the Senate passes the funding bill. WTI and Brent gradually moved c. USD 0.65/bbl higher throughout the APAC session to peak at USD 60.38/bbl and USD 64.24/bbl, respectively. As the European session got underway, benchmarks briefly extended on gains before sharply reversing lower to a trough of USD 60.01/bbl and 63.85/bbl despite a lack of drivers. On geopolitics, Russia launched over 400 drones and 45 missiles at Ukrainian energy infrastructure.Spot XAU has trended higher throughout APAC trade and into the European session despite the potential end of the US government shutdown, which should act as a headwind for haven assets. XAU drove higher straight from the open at USD 4k/oz and has broken above the highs of the 9-day range at USD 4050/oz. The yellow metal has peaked at USD 4085/oz and is currently trading at session highs.Base metals have advanced higher over hopes of the end of the US government shutdown. 3M LME Copper gapped higher to USD 10.75k/t and bid higher throughout the APAC session to a peak of USD 10.83k/t as the European session gets underway. Currently, the red metal is oscillating in a tight c. USD 30/t band.Iraq set the December Basrah medium crude Official Selling Price to Asia at minus USD 0.35/bbl vs Oman/Dubai average, while it set the OSP to Europe at minus USD 2.95/bbl vs Dated Brent and set OSP to North and South America at minus USD 1.35/bbl vs ASCI.White House said Hungary received an exemption from US sanctions for using Russian energy for a year.ExxonMobil CEO said they will “pace” spending on low-carbon projects due to disappointing customer demand and with government policies failing to provide the right incentives to create viable markets, according to FT.Industry group warned that EU climate rules risk energy security and that methane emission regulations due in 2027 will force cargoes to be diverted from Europe, according to FT.Shanghai Gold Exchange is to waive transaction fees for some gold contracts from November 11 to the end of 2026.US Event Calendar

8:30 am: Fed’s Daly Speaks on Bloomberg TV9:45 am: Fed’s Musalem on BTVGeopolitics: Middle East

Israel received the body of a deceased soldier from the Red Cross.Taliban spokesperson said the ceasefire that has been established has not been violated by them so far, and it will continue to be observed, while he added that Pakistan is not ready to take responsibility for maintaining internal security of their own country, so negotiations didn’t yield a result.Turkish President Erdogan said a high-level Turkish delegation will visit Pakistan within a week to discuss Afghanistan ceasefire talks, aiming to conclude the process.Syria carried out a nationwide pre-emptive operation targeting Islamic State cells.Geopolitics: Ukraine

Russia's Kremlin, on US President Trump's remarks about ending the war in Ukraine in the not-too-distant future, said Russia would also like to end the conflict as soon as possible. Russia remains open to resolving the conflict through diplomacy, but the situation is stuck. Foreign Minister Lavrov continues to do his job, ignoring fake news.Ukrainian President Zelensky said Russia launched 450 drones and 45 missiles to attack Ukraine’s energy sector and infrastructure.Ukrainian drone attack disrupted power and heating supply in Russia’s Voronezh.Russian Defence Ministry said Russian forces captured Rybne in Ukraine’s Zaporizhzhia region and Russian forces hit energy facilities supporting the operations of Ukraine’s defence industry, while it noted that Ukrainian attempts to unblock surrounded units in the Kupiansk and Pokrovsk areas were repelled.Russian Foreign Minister Lavrov said that he is ready to hold an in-person meeting with US Secretary of State Rubio and that regular contact with the US is important for discussing the Ukrainian issue, but noted that ending the conflict in Ukraine is impossible without eliminating its causes and taking Russian interests into account. Lavrov said work is being undertaken on Russian President Putin’s order to prepare proposals for potential Russian nuclear tests and that Russia is currently awaiting confirmation from the US that the anchorage agreements remain in force, while he stated that the US informed Russia via diplomatic channels that it is considering Putin’s proposal to adhere to the limits set out in nuclear arms control treaty after February 2026.Geopolitics: Other

North Korea’s Defence Minister said North Korea will show more offensive actions and that the US nuclear carrier escalates tension in the Korean peninsula, while he added that US Secretary of Defence Hegseth's visit to the DMZ shows a hostile nature.China’s mission to the EU said China lodged a representation with the EU on Taiwan’s Vice President entering the European Parliament.DB's Jim Reid concludes the overnight wrap

It looks like white smoke is finally emerging from Capitol Hill as late on Sunday night in the Senate there was a 60-40 procedural vote to advance a bill that would end the shutdown. Just about enough moderate Democrats have broken ranks with party leadership to progress a bill that would fund Agriculture, Veterans Affairs and the operations of Congress for the full-year, even if other agencies would only be funded through to January 30th. It seems to persuade the moderate Democrats to support the bill, a vote has been promised in December in extending the Affordable Care Act (ACA) subsidies that run out at year-end. The timetable from here is slightly less clear but we could get a full vote today or tomorrow assuming no procedural delays.

Probability markets are starting to price in the end game with a 98% expectation that the shutdown will be over by November 30th on Polymarket, a contract high. Interestingly we hit a contract low of 35% around midnight Saturday for a reopening by November 15th (this Saturday). However yesterday this spiked up and is now at 94% as I type. S&P 500 futures are currently +0.71% with the Nasdaq equivalent up +1.23%. 10yr USTs are +3.9bps at just under 4.14%. Asia equity markets are also positive with the KOSPI (+3.13%) leading the way, followed by the Nikkei (+1.28%), with both indexes benefiting primarily from a rebound in technology shares after significant losses last week. The Hang Seng is +1.22% but mainland Chinese markets are flat, perhaps after better inflation numbers over the weekend (see below) may reduce the need for larger stimulus. DAX futures are +1.44% higher as European markets closed at the US lows before the end of the shutdown speculation started to mount late on Friday.

Once the government reopens, markets will face a surge of delayed data releases. Historical precedent from the 2013 shutdown suggests that September’s employment report could be among the first to hit the wires, potentially within three business days of reopening. We expect payrolls to rebound sharply, with headline and private payrolls both forecast at +75k, leaving the unemployment rate steady at 4.3%. So we could get this Thursday or Friday.

Expanding upon this week, on the policy front, the Federal Reserve calendar is busy but unlikely to deliver major surprises. Today brings remarks from St. Louis Fed’s Musalem, who has maintained a hawkish tone. Wednesday is the most crowded day, featuring speeches from Williams, Waller, Bostic, Miran and Collins across conferences on Treasury markets, fintech and community banking. Later in the week, Musalem and Hammack will join fireside chats, while Schmid and Bostic close out Friday with discussions on energy and economic trends. Beyond Capitol Hill and the Fed, investors will monitor the Supreme Court following last week’s oral arguments in the IEEPA tariff case. Judging by the tone of questioning, the Court appears sceptical of the Administration’s position, suggesting a likely affirmation of lower court rulings. A decision could potentially come quickly, but history points to a longer timeline— with the average time line around 15 weeks - but it could stretch out to the end of the term in June.

While US politics and data dominate, global developments will also shape sentiment. In Europe, the UK releases third-quarter GDP on Thursday and labour market data on Tuesday, alongside inflation prints in Denmark and Norway (today) and Germany’s ZEW survey (tomorrow). In Asia, China has its monthly economic activity data dump on Friday. Japan will publish the Economy Watchers Survey tomorrow and producer price inflation on Wednesday.

Corporate earnings remain in focus globally. In the United States, results from Cisco, Walt Disney and Applied Materials will be closely watched. European heavyweights reporting include Siemens, Deutsche Telekom and Enel, while Asia sees Tencent, JD.com, SoftBank and Sony. With nearly 90% of S&P 500 companies having reported, the bulk of earnings season is behind us, but these names will still provide important signals on sectoral health and global demand.

Overnight, the minutes from the BOJ’s October meeting indicated that the nine-member board appears more inclined towards a near-term rate hike, aligning with the expectations of numerous market participants and consistent with Governor Kazuo Ueda’s recent indications that such a move could occur in the upcoming months.

Yesterday we discovered that Chinese inflation surprised to the upside in October rising +0.2% mom against expectations of -0.1% mom and a -0.3% mom decline in September. YoY PPI edged a tenth stronger than expected at -2.1%, up a couple of tenths from September. The anti-involution campaign that has been aimed at reducing prices wars across the economy seems to be having some impact but much of this month's increase can be attributed to seasonals, some of it around Golden Week spending. So we'll have to see if it gets repeated next month to see if a trend is in.

Last week, markets turned risk-averse as negative sentiment around technology and some disappointing private jobs data triggered a global equity sell-off. In the United States, the S&P 500 fell by -1.63% over the week, although it managed a modest +0.13% gain on Friday and rebounded from being down -1.32% as Europe went home for the week. The Nasdaq fared worse, dropping -3.04% (-0.21% Friday, but off the -2.13% lows for the day), marking its weakest performance since Liberation Day week.

Treasuries had a volatile but ultimately muted week. The 2-year yield slipped -1.2bps (+0.7bps Friday), while the 10-year rose +2.0bps to 4.10% (+1.4bps Friday). Across Europe, the STOXX 600 declined -1.24% (-0.55% Friday), even as the 10-year Bund yield climbed +3.3bps over the week.

The week could have been worse were it not for a late burst of optimism on Friday afternoon surrounding US government shutdown negotiations. That helped volatility ease, with the VIX falling -0.42pts on Friday to 19.08, though it was still up +1.64pts on the week after trading above 22 earlier in the day. Despite this reprieve, risk assets broadly struggled, led by Big Tech as lofty valuations weighed on sentiment. Palantir dropped -7.94% on Thursday and -11.24% for the week after failing to provide clear visibility for 2026. Concerns spread to the Mag-7 cohort, which fell -3.21% over the week (-0.96% Friday), with Nvidia (-7.08%, +0.04% Friday), Tesla (-5.92%, -3.68% Friday), and Meta (-4.11%, +0.45% Friday) among the laggards. Credit markets also came under pressure, with US IG spreads widening by +4bps and HY by +15bps.

Signs of disruption from the looming US government shutdown dented sentiment for most of the week, while a sparse data calendar offered little relief. On Friday, the University of Michigan’s consumer sentiment index fell -3.3pts to 50.3, its lowest level in three years, while confidence in government economic policy dropped to the lowest point in the series’ 50-year history. Other data included a weak ISM manufacturing print and higher Challenger layoffs, marking the worst October for job cuts since 2003. These negatives offset a solid ADP employment report and stronger ISM services data earlier in the week. The US-centric risk-off tone undermined the dollar, with the index down -0.20% over the week.

Europe also delivered a heavy data flow with a mixed impact. The Bank of England held rates at 4%, but the vote split was more dovish than expected at 5-4. Our UK economist maintains a call for a 25bps cut in December, followed by quarterly reductions in March and June, taking Bank Rate to 3.25%. Elsewhere, investors digested weaker-than-expected Euro Area retail sales for September, German industrial production, and UK construction PMI. These disappointments contributed to declines in major indices: STOXX 600 (-1.24%, -0.55% Friday), DAX (-1.62%, -0.69% Friday), and CAC 40 (-2.10%, -0.18% Friday). European credit spreads widened too, with IG up +7bps and HY up +9bps. Europe went home near the lows for the day for the US on Friday though.

Finally, Bitcoin’s retreat continued, falling -5.11% over the week despite a +2.73% gain on Friday. Brent crude also slipped -2.21% to $63.63/bbl, though it edged +0.39% higher on Friday as concerns about an emerging oil market surplus resurfaced.

Loading recommendations...