Futures Rise, Japanese Yields Surge, Gold And Silver Soar

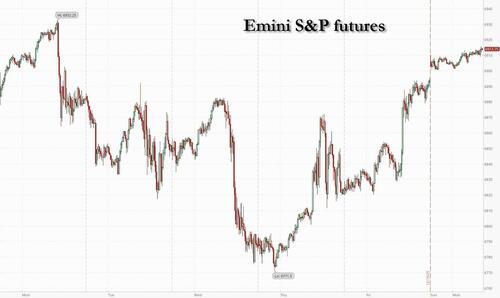

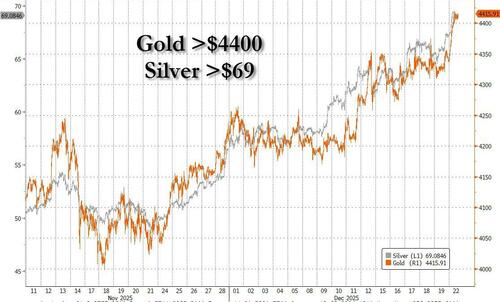

As we previewed late last week, the Santa Rally is back all right, and US equity futures are trading near session highs with the Nasdaq 100 poised to wipe out December’s losses as revived appetite for technology stocks powered gains across equity markets. As of 8:15am ET, S&P futures are 0.4% higher after the benchmark climbed 0.9% on Friday, the most in close to a month; Nasdaq futures rise 0.6% set to build on Friday’s jump as NVDA jumped 2% on a Reuters report the company sees H200 shipments to China starting by mid-February; Oracle and Micron both climbed more than 2% in premarket trading while most members of the Magnificent Seven megacaps advanced.Tech and mining shares outperformed in Europe. In Asia, benchmarks most exposed to artificial-intelligence demand, including South Korea’s Kospi, also led gains. Global bond markets remained under pressure, led by a second day of losses in Japanese debt following an interest-rate hike by the Bank of Japan. The dollar fell. Gold ($4400) silver ($69) and copper all climbed to record highs.The US economic calendar includes the Chicago Fed national activity index (8:30am). No Fed members scheduled to speak for the session

In premarket trading, Nvidia and Tesla lead gains among the Mag 7 tech stocks as sentiment toward AI-exposed companies improves following Micron Technology’s results last week. Nvidia has told Chinese clients it aims to ship its second-most powerful AI chips to China by mid-February, Reuters reports, citing people familiar with the matter. (NVDA +1.7%, TSLA +1.2%, GOOGL +0.5%, AMZN +0.4%, META +0.4%, MSFT +0.3%, AAPL is little changed).

A year-end rally in stocks is taking hold, with investors positive about further gains in 2026, although volumes are set to be thinner in this holiday-shortened trading week. Sentiment has been bullish for three weeks in a row, according to Deutsche Bank strategists. Meanwhile, in commodities, oil rose as Trump intensified a blockade on Venezuela. Gold and silver soared to all-time highs on the escalating geopolitical tensions and bets on Fed rate cuts.

“It has been very remarkable how precious metals’ prices have decorrelated from other assets in recent months,” said Roberto Scholtes, head of strategy at Singular Bank. “Earlier this year, gold prices were materially correlated to the dollar and to high-beta risk assets such as tech stocks and cryptos. But this has been waning gradually, and nowadays they’re running freely.”

The focus on price moves in commodities went beyond record-setting metals, with oil climbing amid heightened geopolitical tensions after the US stepped up a blockade on Venezuela.

Bullishness toward stocks has pushed positioning higher, while fund managers are maintaining record low levels of cash, according to the latest BofA Fund Manager Survey. They are betting on a further rally next year, despite concerns in some quarters over rich valuations, heavy artificial intelligence capex and potentially over-optimistic earnings expectations. Separately, Goldman strategists say the economic outlook is supportive for small-cap stocks, a factor that’s underpriced by the market. The Russell 2000 is likely to advance 10% in 2026, close to the 12% return expected in the S&P 500, they say.

Optimism for a year-end rally in equities are growing after dip buyers late last week supported a rebound in US stocks. While some doubts about the AI trade and elevated valuations persist, optimism over the economy and corporate earnings is helping lift sentiment.

“Markets are riding a risk-on liquidity wave into year-end as resilient US growth underpins earnings next year, while a lower Fed fund rate eases financial conditions,” said Desmond Tjiang, chief investment officer for equities and multi-asset investment at BEA Union Investment. “Fears of AI capex and returns also recede on improving compute economics.”

Unlike the US, enthusiasm for European equities is missing on Monday as the Stoxx 600 slips 0.2% with utilities as well as food and beverage shares among the biggest laggards. Meanwhile, miners outperform as traders monitor the geopolitical outlook in Venezuela. Here are some of the biggest movers on Monday:

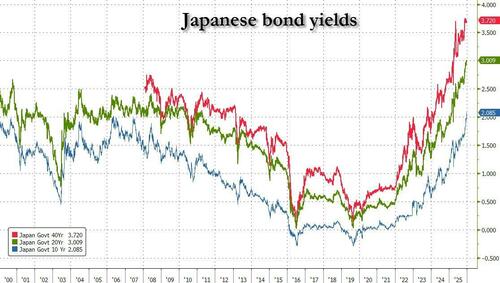

In rates, Japanese yields remain center stage, with the 10-year segment hitting its highest level since 1999. The yield is 6bps higher today, amid speculation the Bank of Japan may need to raise interest rates more aggressively. This has spilled into other global benchmarks, lifting US, UK and German yields by 1-2bps. US yields cheaper by 1bp to 2bp across the curve with 2s10s, 5s30s spreads steeper by 1.2bp and 1bp on the day. US 10-year yields trade around 4.165%, cheaper by 1.5bp vs.

In Asia, stocks extended gains, as tech firms tracked their US peers higher in a holiday-shortened week. The MSCI Asia Pacific Index climbed as much as 1.1%, with TSMC and Samsung Electronics supporting the gauge higher. Tech-heavy benchmarks in Taiwan and South Korea led gains in the region with a more than 1.5% increase each. Japan and Hong Kong shares also advanced. Here Are the Most Notable Asian Movers

This week’s Treasury auctions kick-off at 1pm New York with $69 billion 2-year notes, followed by $70 billion 5-year notes and $44 billion 7-year notes Tuesday and Wednesday. Before today’s auction, the WI 2-year currently trades around 3.482% which is ~0.7bp richer than November’s sale

In FX, the upside in Japanese yields and officials’ jawboning has supported the yen versus the dollar. Bloomberg’s Dollar Index is down 0.2%, pressured also by the outperformance in AUD, NZD and GBP.

In commodities, as noted above, gold and silver sit at record highs, up 1.6% and 2.8% respectively. WTI crude oil futures are up 1.9% as the US pursues a third tanker in Venezuela. Bitcoin continues to rise, up 1.8%.

The US economic calendar includes September Chicago Fed national activity index (8:30am). No Fed members scheduled to speak for the session

Market Snapshot

Top Overnight News

Central Banks

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks kicked off the week with gains across the board as the region coat-tailed on the strength seen stateside. Tech outperformance continued across the region. ASX 200 edged higher as miners tracked gains in gold prices, with the yellow metal buoyed by a weekend packed with geopolitics Nikkei 225 was the clear outperformer as it topped 50.5k as the index cheered the post-BoJ JPY weakness on Friday alongside the global tech rally, whilst simultaneously overlooking the continuing rise in JGB yields. KOSPI was underpinned by its tech sector and following a month-to-date rise in exports. Hang Seng and Shanghai Comp conformed to the risk tone but with upside shallower than the above peers, with the PBoC LPR left unchanged as expected, whilst reports on Friday suggested US lawmakers urged the Pentagon to add DeepSeek and Xiaomi to the list of firms allegedly aiding the Chinese military.

Top Asian News

European equities (STOXX 600 -0.2%) are trading lower/flat this morning, with price action fairly rangebound in light newsflow. European sectors are trading with a mostly negative bias. Basic Resources (+1.1%) leads on firmer metal prices, followed by Tech (+0.4%) on positive spillover from the strong Nasdaq close, and Energy (+0.3%) on higher crude amid ongoing geopolitical tensions between Russia-Ukraine and US-Venezuela. On the downside, Utilities (-0.9%), Optimised Personal Care (-0.9%) and Food Beverage and Tobacco (-0.9%) lag.

Top European News

Geopolitics: Venezuela

Geopolitics: Ukraine

Geopolitics: Middle East

US Event Calendar

DB's Jim Reid concludes the overnight wrap

For anyone still out there, we’re now entering a very quiet spell for markets before Christmas, with data releases and other headline announcements almost completely drying up. Indeed, there’s only two-and-a-half days left to go for many places, as the US and several European markets are closing early on Christmas Eve, and this week usually sees some of the lowest volumes of the year.

This morning, the main news has been further sharp losses for Japan’s government bonds, which follows the Bank of Japan’s Friday decision to hike rates by 25bps to 0.75%, the highest since 1995. The hike already meant that Japan’s 10yr yield was up +6.9bps last week to close above 2%, and this morning they’re up another +6.9bps to 2.08%, their highest since 1999. One factor behind that has been the weakness in the Japanese yen, which fell -1.40% against the US dollar on Friday, despite the hike. And this morning, the country’s chief currency official Atsushi Mimura said to reporters that “We’re seeing one-directional, sudden moves especially after last week’s monetary policy meeting, so I’m deeply concerned”. So in turn, that weakness for the yen is seen as raising the chance of another BoJ rate hike and has prompted the latest selloff for JGBs. We’ve seen that echoed across other countries too this morning, with 10yr Australian yields up +5.1bps this morning, whilst the 10yr Treasury yield is up +2.0bps to 4.17%.

For equities however, there’s been a much stronger picture across the board overnight, with gains for Japan’s Nikkei (+1.90%), along with the KOSPI (+1.82%), the CSI 300 (+0.79%), the Shanghai Comp (+0.64%) and the Hang Seng (+0.20%). Looking forward, US equity futures are also pointing higher, with those on the S&P 500 up +0.26%. Moreover, there’s been a fresh rally for precious metals this morning, with gold prices up +1.40% to $4400/oz, which would be an all-time closing high if sustained, and is the first time they’ve reached that level on an intraday basis as well. Similarly, silver prices (+3.25%) are up to a fresh record of $69.34/oz. So that now leaves their YTD gains at +68% for gold and +140% for silver, which would be the biggest for both since 1979, back when oil prices surged after the Iranian Revolution that year led to major supply disruption.

The latest rise in bond yields this morning follows several central bank decisions last week, where hawkish-leaning elements pushed yields higher around the world. So for example, the Bank of Japan did their 25bp rate hike as expected but also signalled more were still ahead and said real interest rates were “at significantly low levels”. Meanwhile in Europe, there was ongoing speculation about a potential ECB hike next year, particularly after they upgraded their forecasts for growth and core inflation. So that helped to push 10yr bund yields up +3.8bps last week to 2.89%, their highest level since the German fiscal stimulus announcements back in March.

However, the main exception to that pattern were US Treasuries, whose yields fell after the soft CPI print led investors to price in more rate cuts, with the 10yr yield down -3.7bps last week to 4.15%. That comes as speculation around the next Fed Chair has continued to swirl, and Trump said last week that it would be “someone who believes in lower interest rates”. We got some more headlines on the next Fed Chair last Friday as well, as CNBC reported that Fed Governor Waller had a “strong interview” with Trump, and that BlackRock’s Rick Rieder would be interviewed in the last week of the year. So as it stands the current odds on Polymarket are 56% for NEC Director Hassett, 22% for former Fed Governor Warsh, 12% for Governor Waller, and 6% for Rieder.

In terms of the week ahead, it’s a pretty quiet one on the events calendar. One thing to note will be a few US data releases, including the delayed Q3 GDP print today, but that’s very backward-looking and covers the period before the shutdown. Otherwise today, the more recent data will be the December consumer confidence reading from the Conference Board, which will be in the spotlight given the recent downtick in sentiment. In fact, the previous reading for November was the lowest since the Liberation Day turmoil in April. But apart from that, there really isn’t much scheduled.

With little on the calendar this week, this lack of events got us thinking about whether anything could disturb the pre-Christmas calm, as we have seen a few occasions when this week has brought heightened volatility. The best recent example is probably 2018, when you may remember a huge selloff saw the S&P 500 fall -7.7% in the four pre-Christmas sessions. A whole bunch of negative factors converged at once, including a hawkish Fed signalling more hikes to come, weak global data, US-China trade tensions, and the start of a US government shutdown on Dec 22. That selloff deepened further after the US Treasury Department said in a Dec 23 statement that Secretary Mnuchin had spoken with CEOs of the largest US banks, and that the President’s Working Group on financial markets would have a call. So that created huge concern that policymakers knew something that the rest of us didn’t, and the S&P hit its closing low on Christmas Eve.

Another good example, although not quite as fearful, happened in 2022. That was the year central banks hiked aggressively to combat inflation, with global bonds and equities entering a bear market that featured huge bouts of volatility as they kept sinking lower. And the Christmas run-up was no different, with the 10yr Treasury yield surging +26bps in the week before Christmas. That followed an adjustment to the Bank of Japan’s yield curve control policy on Dec 20, which was widely seen as the beginning of the end of Japan’s ultra-loose monetary policy. They permitted the 10yr JGB yield to rise to around 0.5%, up from 0.25% previously, but the effects cascaded globally given Japan’s role as one of the last anchors for low yields. So that led to some dramatic moves right before Christmas, and it was one of the biggest weekly jumps that year for the 10yr Treasury yield.

To be fair, this time last year saw a pre-Christmas Santa rally that took the S&P 500 up +2.9% in the final 3 days before Christmas. But either way, it shows that even if it’s a quiet week on the calendar, we can’t completely dismiss the prospect of a final year-end curveball, which would be in keeping with the constant surprises of 2025 so far. After all, this year has seen a huge regime shift in German fiscal policy in March, the Liberation Day tariffs in April, a direct military conflict between Israel and Iran in June, and the longest-ever US government shutdown over October-November. And that’s before we think about some other long-running themes, including periodic bond market flareups around fiscal policy, fears of a potential AI bubble, and ongoing concern around private credit.

Recapping last week’s moves now, global equities navigated several headwinds at the start of the week to recover into the weekend, with the S&P 500 ultimately closing up +0.10% for the week. Concerns over AI valuations had been an issue in the middle of the week, with Oracle struggling after the FT reported that Blue Owl Capital wouldn’t back a $10bn deal for Oracle’s data centre in Michigan. However, the soft US CPI report and a more positive earnings release from Micron helped things turn around into the weekend, and the Magnificent 7 ultimately posted a +1.48% gain for the week.

That US CPI report was critical because it kept open the prospect of further rate cuts from the Fed next year. Admittedly, there were questions about the data’s methodology given the government shutdown, but the print was still viewed as soft enough to make Fed rate cuts more likely. So the headline CPI rate was down to +2.7% year-on-year (vs. +3.1% expected), whilst core CPI hit its lowest since early 2021 at +2.6% (vs. +3.0% expected). Earlier in the week, we also had the delayed jobs report for November, which showed the unemployment rate ticking up to 4.6%, whilst it showed payrolls had fallen by -105k in October, before rebounding by +64k in November. So overall, that kept up the momentum behind further rate cuts, with 60bps of further cuts priced in by the December 2026 meeting at the close on Friday. In turn, US Treasuries rallied across the curve, with the 2yr yield (-3.9bps) down to 3.48%, whilst the 10yr yield (-3.7bps) fell to 4.15%. US credit spreads saw little movement however, with IG spreads widening +1bp last week, whilst HY spreads were unchanged.

In Europe, equities put in a stronger performance, with the STOXX 600 (+1.60%) closing at a new record. In part, they were supported by signs of progress on the Ukraine peace talks, and Brent crude (-1.06%) fell back to $60.47/bbl, whilst yields on Ukraine’s 10yr dollar bonds fell to their lowest since March. In the meantime, the ECB left their deposit rate at 2%, although some hawkish tones also saw yields on 10yr bunds (+3.8bps), OATs (+3.5bps) and BTPs (+3.7bps) move higher. Otherwise, the Bank of England delivered a 25bp cut, taking their policy rate down to 3.75%, albeit in a close 5-4 vote that saw the rest prefer to keep rates on hold. Meanwhile, Euro IG credit spreads were unchanged last week, whilst HY spreads were +1bp wider.

Loading recommendations...