Estimates By Analysts Have Gone Parabolic

Authored by Lance Roberts via RealInvestmentAdvice.com,

Just recently, S&P Global released its 2026 earnings estimates, which, for lack of a better word, have gone parabolic. Such should not be surprising given the ongoing exuberance on Wall Street. As noted last week, correlations between all asset classes, whether international or emerging markets, gold or bitcoin, have all gone to one. Unsurprisingly, rationalizations justify illogic when too much money is chasing too few assets.

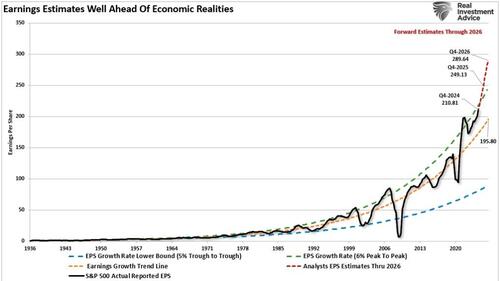

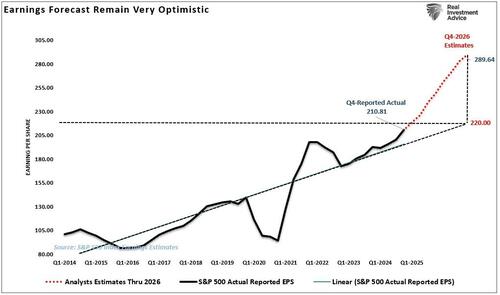

Therefore, it should not be surprising to see analysts ramping up estimates to rationalize or justify overvaluations in the market. The chart below shows earnings’ long-term growth. Notably, analysts expect a record deviation above earnings’ long-term exponential growth trend of $195/share and above the 6% peak-to-peak historical growth rate.

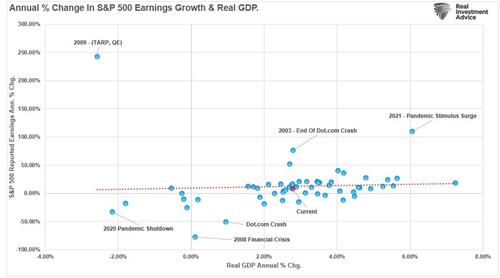

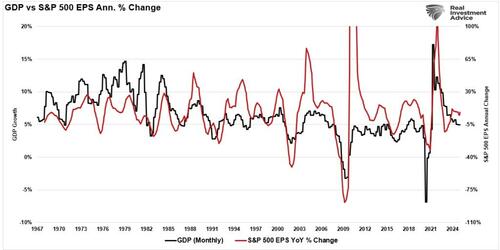

The peak-to-peak growth trend is crucial because it is the historical growth rate of nominal GDP. Given that corporate revenue, from which earnings are derived, comes from economic activity, the correlation is logical. There are times when earnings can grow much faster than the economy, such as when the economy emerges from a recession. However, over time, earnings growth returns to the long-term relationship.

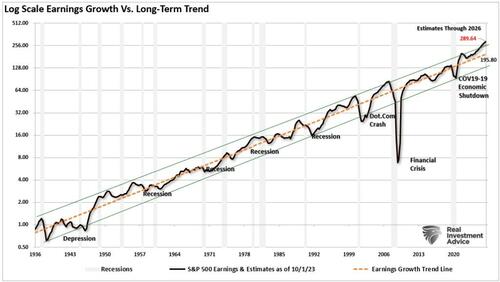

By viewing the data above on a log scale, we see the same deviation above the long-term growth trend of earnings. (A log scale mitigates the impact of large numbers.) Whenever earnings have exceeded the 6% peak-to-peak growth trend historically, such have been near peaks in economic growth rates. The 2026 earnings estimates for $289/share are far above the long-term exponential growth trend of $195/share.

While such a deviation may be sustainable short-term, historically, adverse economic impacts, be it a recession or an event-driven outcome, have reverted earnings toward their long-term trend. Again, this is because earnings can not indefinitely outgrow the economy, given the relationship of economic activity to revenue generation.

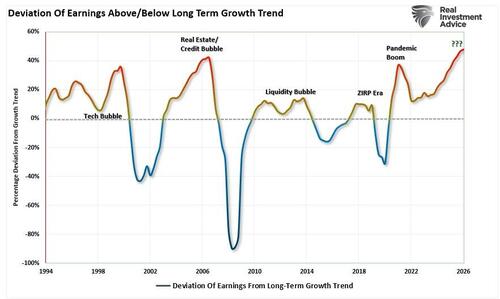

The chart below shows Wall Street estimates’ current deviation from the long-term exponential growth trend. As stated, the current deviation is the most significant on record.

Questioning the accuracy of these estimates is prudent for investors, given the relationship between changes in earnings growth and market outcomes.

Manufacturing EstimatesAs noted above, analysts are very optimistic about earnings growth into 2026. The current estimates are well above long-term trends, suggesting we will see earnings closer to $220/share vs $290.

Again, this is because earnings are a function of economic activity. Therefore, for earnings to match current estimates, expectations for economic growth must improve sharply. However, such seems unlikely given the impact of tariffs and reductions in government spending and employment. Therefore, it is far more likely that we will eventually see a sharp decrease in forward estimates.

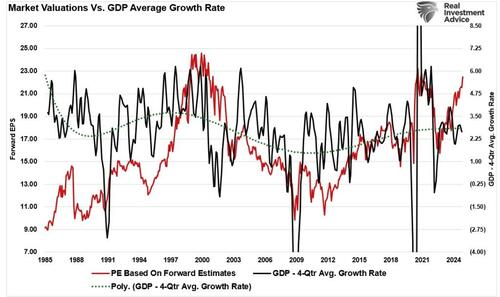

The risk to investors is overpaying for assets today, assuming that forward estimates will prove correct, thereby reducing that overvaluation. However, earnings have failed to achieve previous estimates, pushing valuations sharply higher. Given the relationship between earnings and economic growth, the overvaluation investors are paying today has created a sharp deviation that will likely not correct itself via more substantial economic growth.

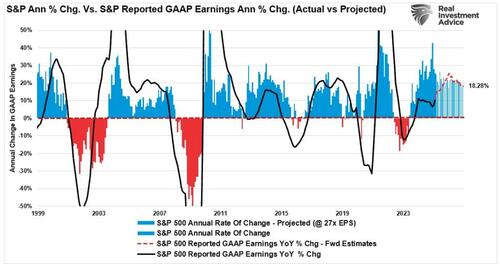

We see the same deviation between the annual rate of change of the S&P 500 versus actual reported earnings. As shown below, there was a sharp expansion in the market’s price without an equally substantial increase in underlying earnings per share. Such resulted in a dramatic rise in multiple expansions over the last two years. Analysts must increase their “manufactured” estimates to justify those elevated valuations and catch up with the market’s price. However, it is more likely that the growth rate of equity prices will slow substantially to allow earnings to catch up with valuations.

Of course, one factor that has been essential in sustaining market prices despite consistent earnings underperformance to meet analysts’ estimates is buybacks.

Buybacks When You Need Them The LeastI have previously written much on corporate buybacks and why they are not a return of capital to shareholders but rather a benefit primarily obtained by insiders.

Nonetheless, there is no denying the “heavy hand” they play in boosting asset prices and supporting reported earnings by lowering the denominator of the EPS (earnings divided by shares outstanding) calculation. As noted in our previous articles:

“The impact of buybacks extends beyond individual companies. Since 2000, net corporate buybacks have accounted for 100% of the equity market’s net asset purchases—a reflection of the diminished participation from pensions, mutual funds, and individual investors:”

Pensions & Mutual Funds: –$2.7 trillion

Households & Foreign Investors: +$2.4 trillion

Corporations (Buybacks): +$5.5 trillion

Net Flow: +$5.2 trillion

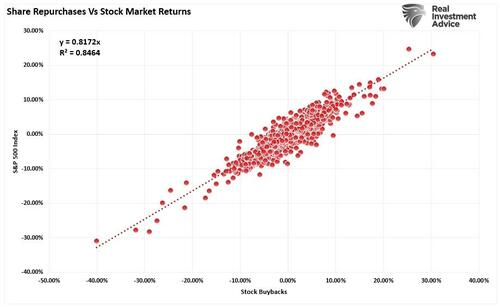

In other words, if you strip out share buybacks, asset prices would be roughly 40% lower than where they currently sit. Crucially, share buybacks and stock market returns have an extraordinarily high correlation.

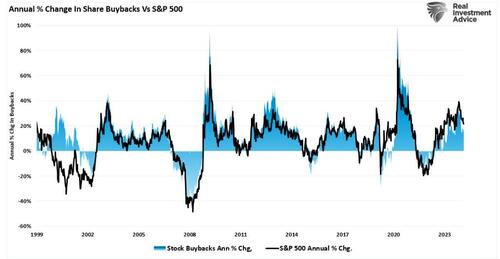

This is essential as many believe corporations repurchase shares when the market undervalues them. However, the reality is quite the opposite. Corporations tend to be net buyers when asset prices rise and vacate that practice when shares fall. In other words, when the markets rise sharply, corporations execute buybacks when they are the least accretive. Such is because they use buybacks not to benefit shareholders but to:

Prioritize short-term stock price gains over long-term investments.

Signal a lack of business reinvestment opportunities—or a deliberate choice not to pursue them.

Concentrate benefits among insiders and executives, tying compensation to stock performance.

As noted, companies repurchase shares at generally non-accretive prices, destroying capital from future productive investments.

Nonetheless, buybacks are expected to exceed $1 trillion in 2025 and likely increase by 2026. This is, of course, barring any event that dramatically slows economic growth or causes market repricing. If those buybacks are completed, they should continue providing a “bid” under stock prices, which could offset the forthcoming negative revisions to analysts’ overly optimistic earnings expectations.

ConclusionWall Street analysts’ overly optimistic assumptions are almost always likely to overshoot reality. As discussed, earnings tend to grow very close to their long-term trend, with overshoots and undershoots caused by macro-driven events like monetary and fiscal interventions or recessionary outcomes. This time is unlikely to be any different.

Given the current market exuberance, historical overvaluation concerns, and the reliance on buybacks to sustain prices, investors should consider hedging strategies to protect their portfolios.

Don’t forget fixed income to lower market-related volatility.

Don’t be afraid to increase cash levels when uncertain where to invest.

Focus on fundamentally strong companies with strong dividend histories.

Monitor corporate buybacks and economic indicators.

Since buybacks have played a crucial role in market stability, investors should monitor corporate buyback trends. Market volatility could increase if buybacks decline due to economic weakness or policy changes. Likewise, tracking macroeconomic indicators such as employment data, inflation trends, and GDP growth can provide early warning signals of a market shift.

By taking small actions within portfolios currently, investors can better navigate the risks associated with an unexpected rise in market volatility.

Or, you can shut your eyes and hope for the best.

* * *

For more in-depth analysis and actionable investment strategies, visit RealInvestmentAdvice.com. Stay ahead of the markets with expert insights tailored to help you achieve your financial goals.

Loading...