Yields Rise, Rate-Cut Odds Slide As ISM Services Survey Signal Inflation Fears

After yesterday's mixed picture on Manufacturing (PMI up, ISM down), analysts expected both Services surveys this morning to show an upward bounce.

S&P Global's Services PMI disappointed but did rise from September's 54.2 to 54.8 (but that was less than expected and less than the 55.2 preliminary print)

ISM's Services PMI beat expectations, rising from 50.0 to 52.4, well above the 50.8 expectations.

And this is happening amid a rise in 'hard' data (though admittedly based on housing and marginal labor data given the vacuum since the shutdown)

Source: Bloomberg

Across the PMI surveys, only ISM Manufacturing saw a decline MoM in October...

Source: Bloomberg

Under the hood, Prices surged to their highest in three years, new orders expanded at their fastest pace in a year and employment improved (though remained below 50)...

Source: Bloomberg

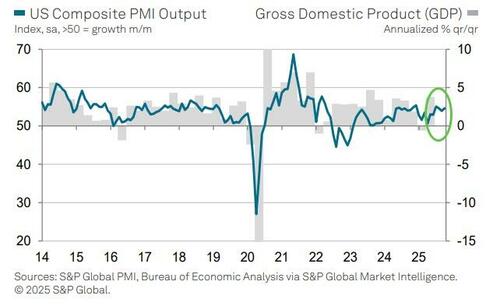

“October’s final PMI data add to signs that the US economy has entered the fourth quarter with strong momentum," according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

"Growth in the vast services economy has picked up speed to accompany an improved performance in the manufacturing sector.

In total, business activity is growing at a rate commensurate with GDP rising at an annualized pace of around 2.5% after a similarly solid expansion was signalled for the third quarter."

While growth is being driven principally by the financial services and tech sectors, Williamson says the survey is also picking up signs of improving demand from consumers.

However, the surge in prices paid is having some consequences

“However, there are signs that new business is coming at the cost of service providers having to soak up continued high input price growth to remain competitive.

Customers are often pushing back on price rises, especially in consumer-facing markets.

While good news in terms of inflation, this lack of pricing power hints at weak underlying demand and lower profits. "

Business expectations about the year ahead have also fallen sharply and are now running at one of the lowest levels seen over the past three years, as Williamson notes "signs of spending caution from customers is accompanied by heightened political and economic uncertainty."

However, Williamson points out that lower interest rates have helped offset some of the drags to business confidence, for which the October FOMC rate cut will have likely helped further.

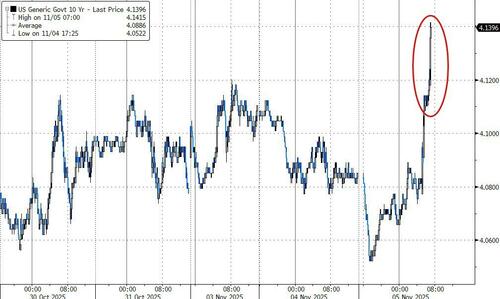

Treasury yields are on the rise (likely driven by the inflation jump) and rate-cut odds are lower...

Hopefully we will get some 'hard' data reality (Payrolls and CPI) if the government reopens before the next FOMC meeting but for now we would say, this should not be weighted enough to warrant The Fed veering from its easing path.

Loading recommendations...