Six Supertankers Perform Abrupt U-Turns In Strait Of Hormuz

Update (1119ET):

The clock is ticking as Iran vows retaliation.

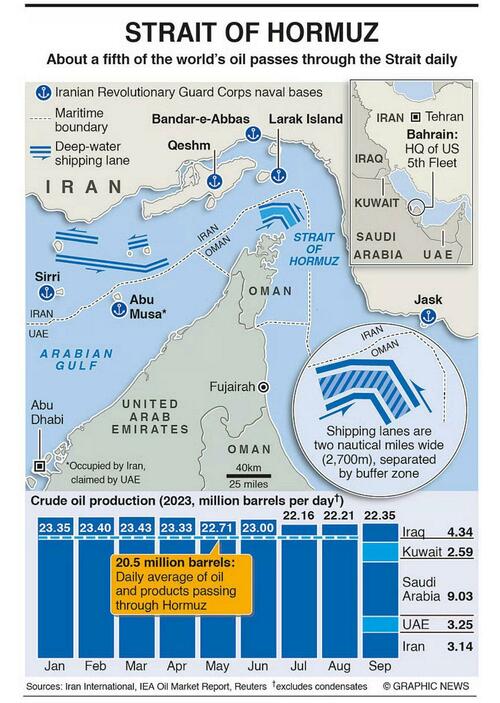

Iranian military officials and members of parliament warned that the U.S. will face severe consequences for its stealth bomber strikes on three of its nuclear facilities. While the exact nature of Iran's response remains uncertain, traders and analysts are hyper-focused on the potential for a partial—or even full—closure of the critical Strait of Hormuz, a maritime chokepoint that handles 20% of global energy flows.

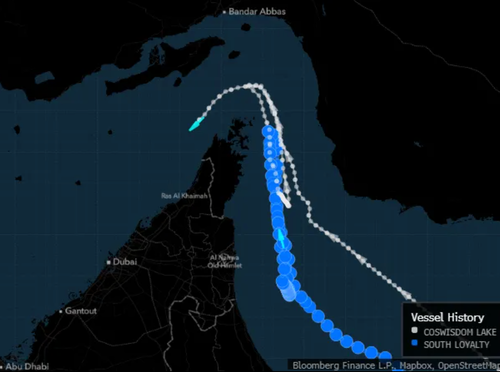

With Iranian retaliation strikes appearing imminent, supertankers navigating the narrow, critical waterway are increasingly making U-turns to avoid potential missile or drone attacks. The number of U-turns of supertankers has now ticked up to six.

Here's more from The Telegraph:

Supertankers have performed U-turns in the Strait of Hormuz amid uncertainty over how Iran will retaliate against U.S. strikes on its nuclear sites.

Six of the giant vessels, some capable of carrying 2m barrels of crude, turned back after entering the crucial trade route over the last 24 hours, according to vessel tracking data from MarineTraffic.

Three of the ships – named the Coswisdom Lake, South Loyalty and Damsgaard – eventually made second U-turns and headed through the Strait today.

It comes after Greece's shipping ministry warned on Sunday that the country's owners should think twice about using the route.

Meanwhile two large Japanese shipping companies said they will cut exposure to the strait, where a fifth of the world's oil and gas supplies pass through.

In energy markets, Goldman analysts laid out two scenarios:

If only Iran supply were to drop by 1.75mb/d, they estimate that Brent would peak of around $90, with a decline back to the $60s in 2026;

If oil flows through the Strait of Hormuz were to drop by 50% for one month and then were to remain down 10% for another 11 months, they estimate that Brent would briefly jump to a peak of around $110.

The analysts also noted:

They also expect European natural gas and LNG markets to price a somewhat higher probability of a large supply disruption. A hypothetical sustained and very large disruption of energy supply transit through the Strait of Hormuz, would likely push oil and European natural gas prices above $110/bbl and 100 EUR/MWh, respectively, given the nearly 20% disruption to global energy supplies.

Latest in energy markets over the last day:

* * *

Two supertankers—Coswisdom Lake and South Loyalty—each capable of carrying 2 million barrels of crude, abruptly altered course in the Strait of Hormuz over the weekend after U.S. stealth bomber strikes on Iran's nuclear facilities.

The Coswisdom Lake and South Loyalty both entered the waterway and abruptly changed course on Sunday, according to vessel tracking data compiled by Bloomberg. The first of the two carriers then did a second U-turn and is now going back through Hormuz. The other one remains outside of the Persian Gulf, according to its signals on Monday. -Bloomberg

On Sunday, Iranian state-owned outlet Press TV quoted Major General Kowsari, a senior member of the Iranian Parliament's National Security Commission, as stating:

"Parliament has reached the conclusion that the Strait of Hormuz should be closed, but the final decision in this regard lies with the Supreme National Security Council."

RBC Capital Markets analysts, led by Helima Croft, believe Iran doesn't need to close the critical maritime chokepoint to disrupt global oil transport. Instead, Tehran could use targeted strikes on individual tankers or key infrastructure—such as the port of Fujairah—to destabilize the vital waterway.

Croft and her team note:

Iran could have already inflicted major damage but hasn't, suggesting strategic restraint—so far.

Even limited actions could prompt shippers to avoid the region, especially in the current high-risk environment.

If Iran's leadership feels its survival is threatened, it may mobilize allied groups in Iraq and Yemen, further escalating threats to regional energy assets.

RBC warns it may take days or weeks to gauge Tehran's true response and cautions against assuming the danger has passed.

In the overnight, Brent crude futures reversed sharply—now trading around Friday's close and down 6% or so from intraday highs. UBS Research warned that the real left-tail risk remains a Strait of Hormuz closure, which would trigger a disruption larger than the 2022 Russian supply shock and could send prices soaring above $120.

Other critical research on Hormuz scenarios:

"Iran's asymmetric response is possible...limited yet impactful (partial disruption in Hormuz/Red Sea plausible, though full closure unlikely)," Goldman analyst Giulio Esposito noted on Monday.

Keep in mind that any closure—partial or full—of the Strait of Hormuz would impact Asian importers, such as China, India, Japan, South Korea, and Singapore, as well as parts of Europe, the most. The U.S. is comparatively less exposed, thanks to shale production and Strategic Petroleum Reserve. The real question is—will Asia stand by and allow Tehran to shutter the waterway?

Loading...