These Are The Five States Leading America's Data Center Boom

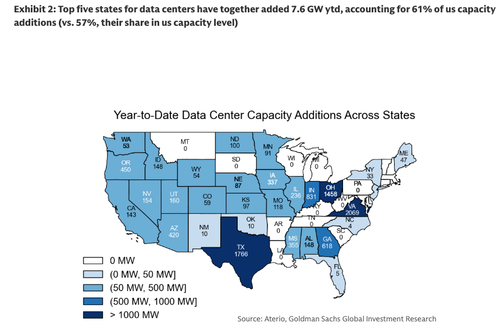

Most of the rapid growth in new data center capacity is happening in established ("incumbent") markets - places like Virginia, Texas, Oregon, Ohio, and Iowa, while new or smaller states ("emerging markets") are starting to attract data center development, though on a smaller scale so far.

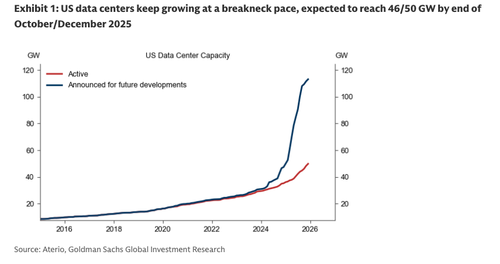

Goldman analysts, led by Hongcen Wei, cited new current project schedules from Aterio data that showed US data center capacity is projected to reach 46 GW by October 2025, marking a 37% year-over-year increase. He found that most of this increase comes from incumbent markets.

Here are the key takeaways from the report:

Top states (Virginia, Texas, Oregon, Ohio, Iowa) account for 7.6 GW of the 12.4 GW added year-to-date.

Virginia remains dominant with 33% yoy growth, while Texas and Georgia lead in acceleration, each up 57% yoy.

31 states have added capacity in 2025 (versus 22 in 2024), highlighting broader national expansion, though most new entrants remain modest in scale.

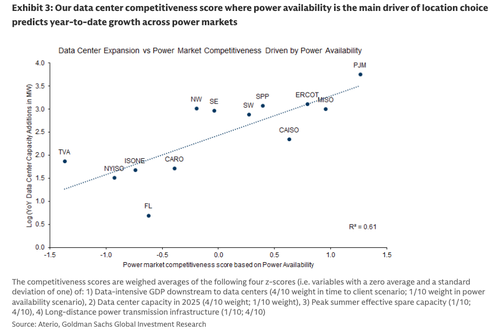

PJM (Mid-Atlantic), ERCOT (Texas), and the Southeast (mainly Georgia) together account for 64% of new US capacity.

TVA (Tennessee Valley Authority) is the least competitive region due to power constraints.

Looking ahead:

Another 4 GW of capacity is expected by year-end 2025, primarily from top markets.

Beyond that, 63 GW in new projects are announced for the next few years.

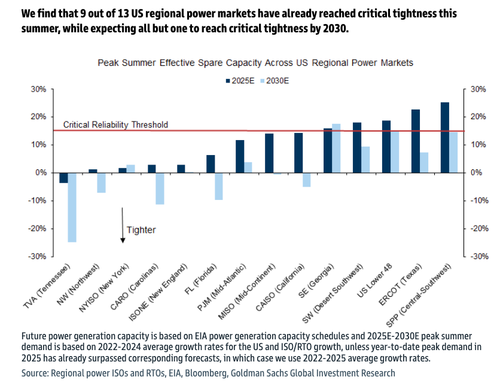

Rapid growth in data centers is expected to push major US power markets - CAISO, MISO, and PJM - toward critical tightness in coming years.

Data center buildouts are entering hypergrowth (read "circle jerk").

The top five states where data center development is surging the most - also, these states, if their grids are fragile, could send, if not already, power bills higher, which would be terrible for local officials ahead of the midterms.

What regional grids are best suited for data centers?

In August, Wei warned, "We find that 9 out of 13 US regional power markets have already reached critical tightness this summer, while expecting all but one to reach critical tightness by 2030."

And what could derail the AI bubble is what the Bank of England warned on Wednesday of "material bottlenecks to AI progress" if that's "power, data, or commodity supply chains."

Loading recommendations...