How the Gold Rally Is Playing Out Around the World

Published

2 hours agoon

January 17, 2026 Graphics & Design How the Gold Rally Is Playing Out Around the World

Key Takeaways

How the Gold Rally Is Playing Out Around the World

Key Takeaways

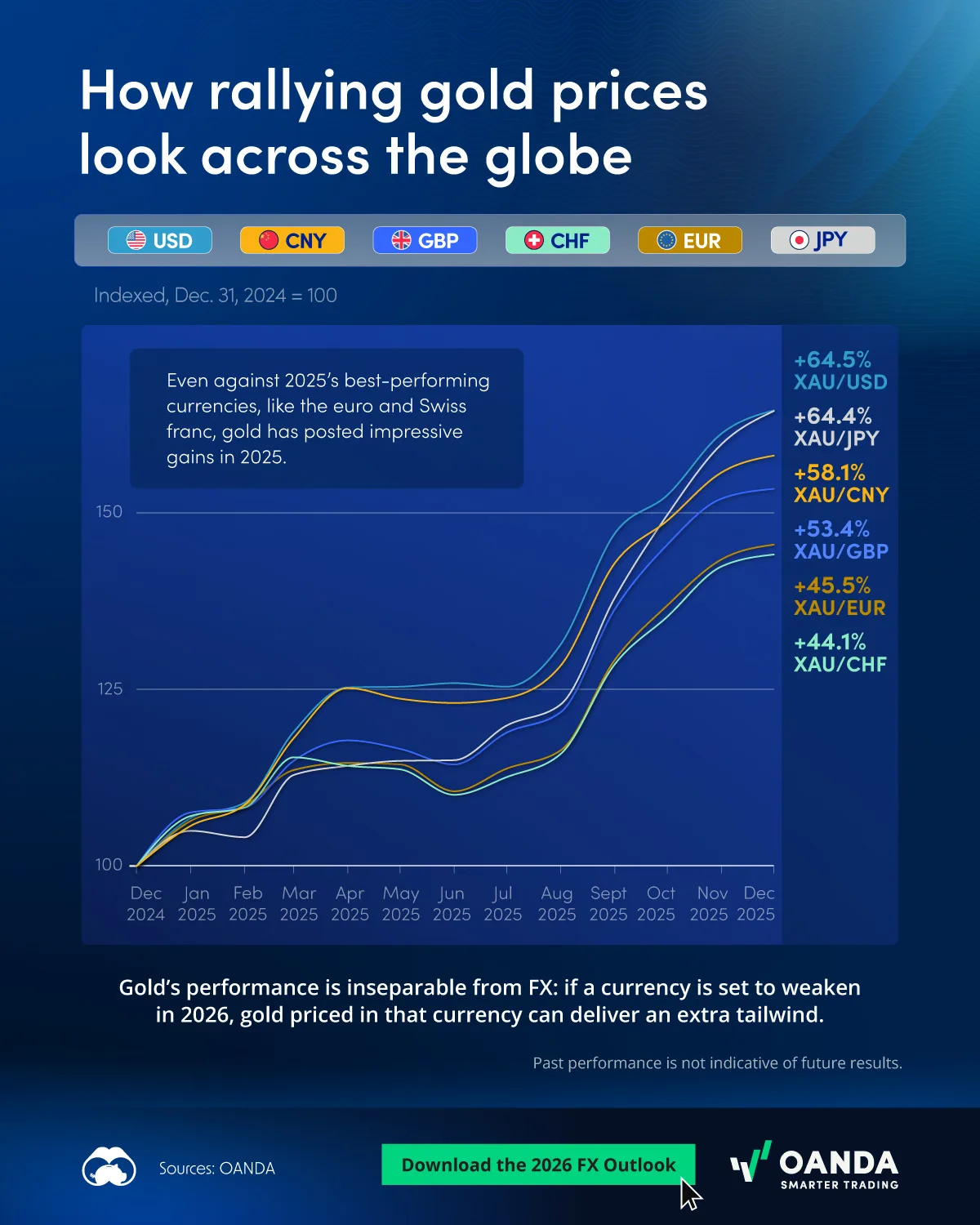

Gold’s breakout in 2025 has been striking in U.S. dollar terms, but the rally looks even more compelling when viewed across global currencies.

In partnership with OANDA, this visualization compares gold’s rally across different currencies. Which ones are rising the fastest?

The Gold Rally Through a Global Lens

The Gold Rally Through a Global Lens

This chart indexes gold prices in major currencies, revealing how broadly the metal’s surge has played out worldwide. Even in regions with relatively resilient currencies (such as the euro and Swiss franc) gold has posted solid double-digit gains, underscoring the strength of the underlying move.

| 🇺🇸 USD | 4,315.09 | 64.5 |

| 🇪🇺 EUR | 3,686.22 | 45.5 |

| 🇬🇧 GBP | 3,216.17 | 53.4 |

| 🇯🇵 JPY | 677,956.00 | 64.4 |

| 🇨🇭 CHF | 3,430.90 | 44.1 |

| 🇨🇳 CNY | 30,274.60 | 58.1 |

The rally has been even more dramatic in countries where currencies have faced greater pressure. In the U.S., for example, gold prices rose more dramatically than in other countries. This divergence highlights how local currency performance can amplify or dampen gold’s returns, even when the underlying global price is moving in tandem.

The Role of Currency and Monetary PolicyThese differences point to a key dynamic for investors: gold’s performance is tightly linked to foreign exchange. When a currency weakens, the local price of gold tends to rise more quickly, effectively delivering an FX-driven boost to returns. Conversely, in markets with stronger currencies, gold can still perform well, but gains are typically more muted.

Looking ahead, expectations for global rate cuts could play a pivotal role in shaping gold’s next phase. Easing monetary policy often weighs on currencies while improving gold’s relative appeal as a store of value. As central banks move at different speeds, shifts in currency strength may become just as important as movements in the U.S. dollar gold price itself.

What This Means Going ForwardAs 2026 starts, gold’s global performance will likely hinge on the interplay between currency moves and monetary policy, not just the metal’s price in dollar terms.

Note: Past performance is not indicative of future results.