Ranked: The World’s Best Selling Car Brands

Published

7 hours agoon

December 6, 2025 Article/Editing:![]() See more visuals like this on the Voronoi app.

See more visuals like this on the Voronoi app.

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

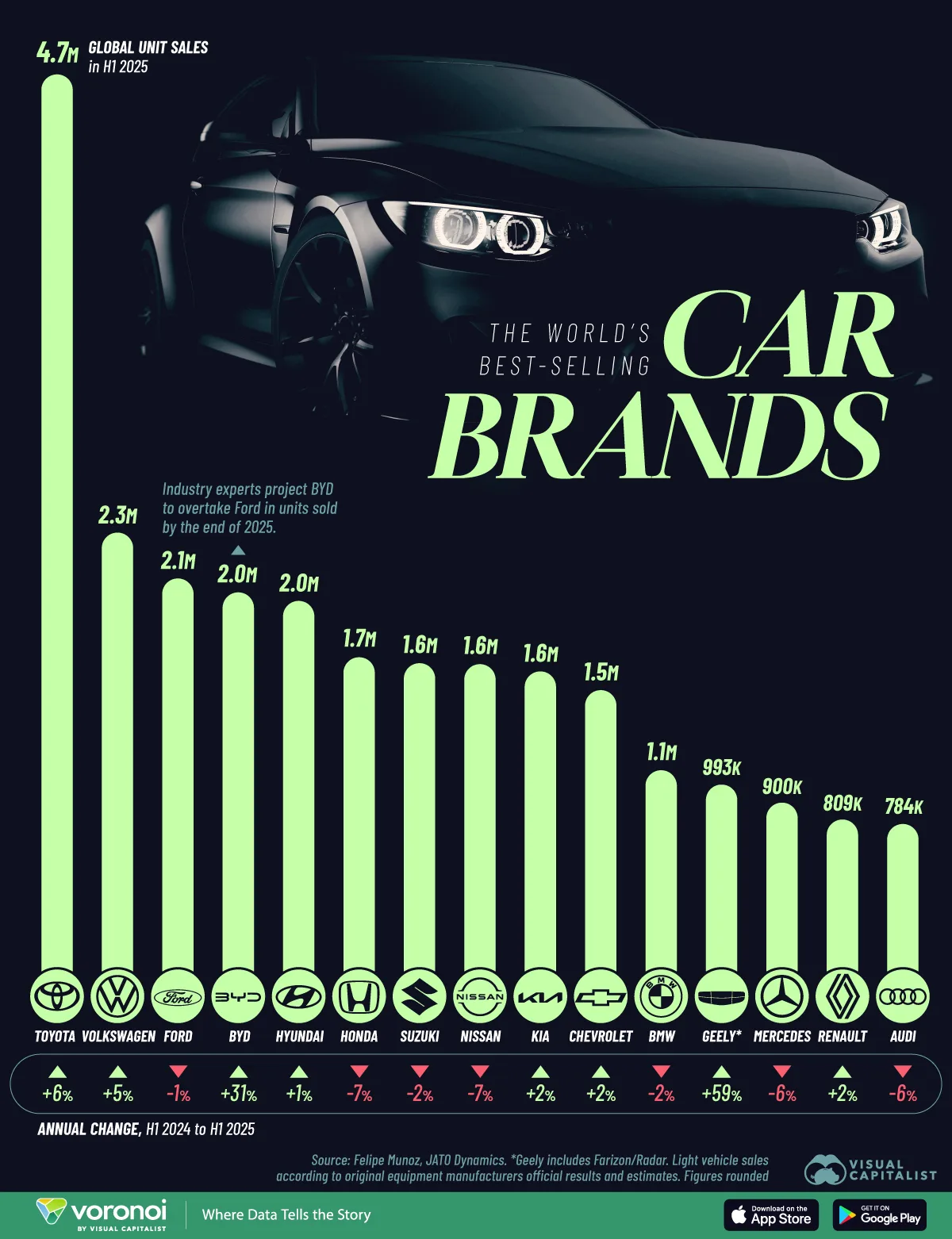

Key TakeawaysGlobal car sales continue to shift as legacy brands defend their share against fast-growing electric vehicle makers. In the first half of 2025, Toyota again led the global market by a wide margin, while several Asian automakers held strong positions across the top 15. This visualization highlights how each automaker performed, comparing unit sales with annual growth rates.

A notable trend is the rise of Chinese manufacturers, especially BYD and Geely, which are expanding both domestically and internationally. Their rapid growth contrasts with declines seen among several established brands in Europe and Japan.

Data & DiscussionThe data for this visualization comes from industry analyst Felipe Munoz, who compiles official manufacturer sales results and estimates for global light-vehicle markets. The numbers include both internal combustion and electric vehicles.

Toyota’s Dominant Global LeadToyota sold more than double the units of most competitors, reaching 4.73 million vehicles in H1 2025. This represents 6% year-over-year growth, reinforcing Toyota’s strength across markets from North America to Asia. Despite ongoing industry electrification, Toyota’s broad lineup and global production scale continue to support its leadership position.

| 1 | Toyota | 4,725,616 | 6% | 🇯🇵 Japan |

| 2 | Volkswagen | 2,320,300 | 5% | 🇩🇪 Germany |

| 3 | Ford | 2,075,500 | -1% | 🇺🇸 United States |

| 4 | BYD | 2,004,442 | 31% | 🇨🇳 China |

| 5 | Hyundai | 1,956,774 | 1% | 🇰🇷 South Korea |

| 6 | Honda | 1,661,200 | -7% | 🇯🇵 Japan |

| 7 | Suzuki | 1,631,000 | -2% | 🇯🇵 Japan |

| 8 | Nissan | 1,624,851 | -7% | 🇯🇵 Japan |

| 9 | Kia | 1,587,536 | 2% | 🇰🇷 South Korea |

| 10 | Chevrolet | 1,490,500 | 2% | 🇺🇸 United States |

| 11 | BMW | 1,070,814 | -2% | 🇩🇪 Germany |

| 12 | Geely | 992,616 | 59% | 🇨🇳 China |

| 13 | Mercedes | 899,974 | -6% | 🇩🇪 Germany |

| 14 | Renault | 808,674 | 2% | 🇫🇷 France |

| 15 | Audi | 783,531 | -6% | 🇩🇪 Germany |

BYD ranked fourth globally with just over 2 million units sold, but posted an impressive 31% annual increase, far outpacing every other major brand. At its current trajectory, industry experts expect BYD to surpass Ford by the end of 2025.

This momentum reflects China’s booming EV sector as well as BYD’s aggressive international expansion, particularly in Europe and Latin America.

Mixed Performance Across Legacy AutomakersSeveral established brands experienced declines, including Honda, Nissan, Mercedes, and Audi, each posting drops between 2% and 7%. European luxury brands also ceded share as demand softened in key markets. Meanwhile, Hyundai, Kia, and Chevrolet saw modest growth.

Learn More on the Voronoi AppIf you enjoyed today’s post, check out The Brands That Gained the Most Value in 2025 on Voronoi, the app from Visual Capitalist.