Ranked: The Top 20 Central Banks by Total Assets

Published

4 hours agoon

January 1, 2026 Article/Editing:

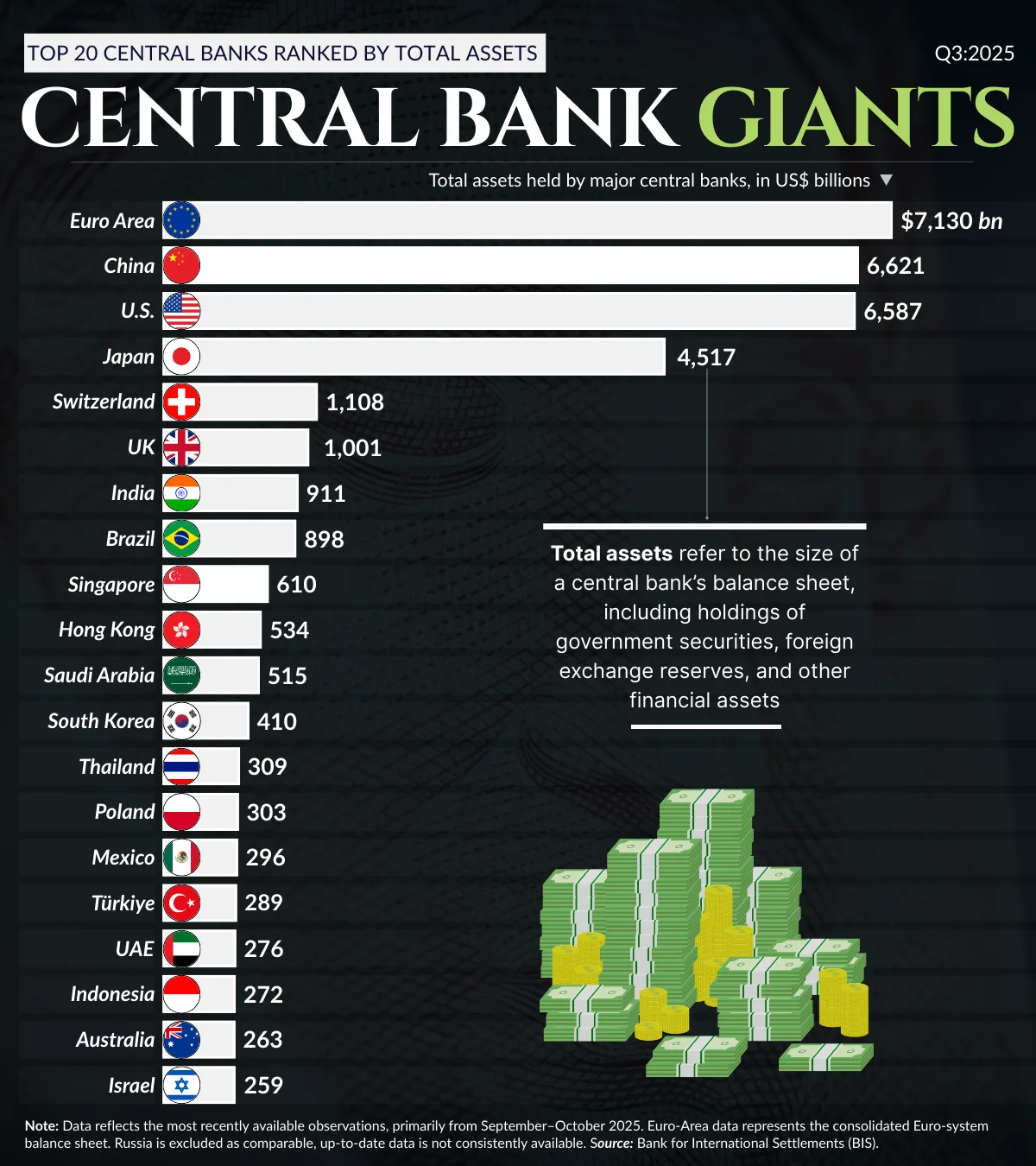

Global central banks play a critical role in shaping economic stability and monetary policy. Their balance sheets, often stacked with government securities, foreign reserves, and other financial instruments, offer a window into their financial firepower and strategic priorities.

The latest data from the Bank for International Settlements (BIS) reveals the world’s largest central banks by total assets as of Q3 2025. This ranking reflects not only the size of the underlying economies but also differences in monetary policy strategies, levels of quantitative easing, and foreign exchange interventions.

Central Bank Assets: A BreakdownHere’s a look at the top 20 central banks by assets held:

| 1 | 🇪🇺 Euro Area | 7,130 |

| 2 | 🇨🇳 China | 6,621 |

| 3 | 🇺🇸 U.S. | 6,587 |

| 4 | 🇯🇵 Japan | 4,517 |

| 5 | 🇨🇭 Switzerland | 1,108 |

| 6 | 🇬🇧 United Kingdom | 1,001 |

| 7 | 🇮🇳 India | 911 |

| 8 | 🇧🇷 Brazil | 898 |

| 9 | 🇸🇬 Singapore | 610 |

| 10 | 🇭🇰 Hong Kong | 534 |

| 11 | 🇸🇦 Saudi Arabia | 515 |

| 12 | 🇰🇷 South Korea | 410 |

| 13 | 🇹🇭 Thailand | 309 |

| 14 | 🇵🇱 Poland | 303 |

| 15 | 🇲🇽 Mexico | 296 |

| 16 | 🇹🇷 Türkiye | 289 |

| 17 | 🇦🇪 United Arab Emirates | 276 |

| 18 | 🇮🇩 Indonesia | 272 |

| 19 | 🇦🇺 Australia | 263 |

| 20 | 🇮🇱 Israel | 259 |

At the top of the list is the Euro Area with $7.13 trillion in total assets, followed closely by China ($6.62 trillion) and the United States ($6.59 trillion).

These three collectively hold over half of the world’s central bank assets. Switzerland, despite its smaller population, holds over $1.1 trillion, which is an outsized figure driven by foreign exchange interventions and reserve accumulation.

What Are Central Bank Assets, Exactly?Central bank assets represent everything from gold and foreign currency reserves to government bonds and loans to financial institutions. These reserves serve as the foundation for a central bank’s monetary operations and its ability to influence interest rates, control inflation, and stabilize currency values.

Central banks are increasingly expected to act, not only as lenders of last resort, but also as stabilizers of financial markets through asset purchases and liquidity facilities.

The Rise of Emerging MarketsWhile developed economies dominate the top of the list, emerging markets are gaining ground. India’s Reserve Bank holds $911 billion in assets, and Brazil is close behind with $898 billion. Saudi Arabia, with $515 billion, reflects its massive energy-driven surplus and the management of its sovereign wealth and currency peg.

This financial clout feeds into broader global power dynamics. For example, central bank reserves help back a country’s currency in international trade. In this light, countries with large reserves wield more influence over the global economy. As seen in our article Ranking the World’s Most Powerful Reserve Currencies, reserve-backed assets play a foundational role in global finance.

Final ThoughtsWhile total asset size doesn’t measure GDP or productivity, it reveals how much firepower a central bank has to stabilize markets or influence exchange rates.

Countries with larger asset bases have more levers to manage financial shocks. As we head into a new phase of monetary tightening and shifting global capital flows, understanding these asset levels offers insight into which economies are best positioned to weather future volatility.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.