Why Americans Pay So Much for Health Care

Americans spend a lot on health care, more than any peer nation, and the cost is rising faster than nearly every measure of the U.S. economy.

The National Health Expenditure—the total amount paid for health care through public and private means—has risen faster in recent decades than inflation, household income, the gross domestic product (GDP), the population, and even the price of housing.

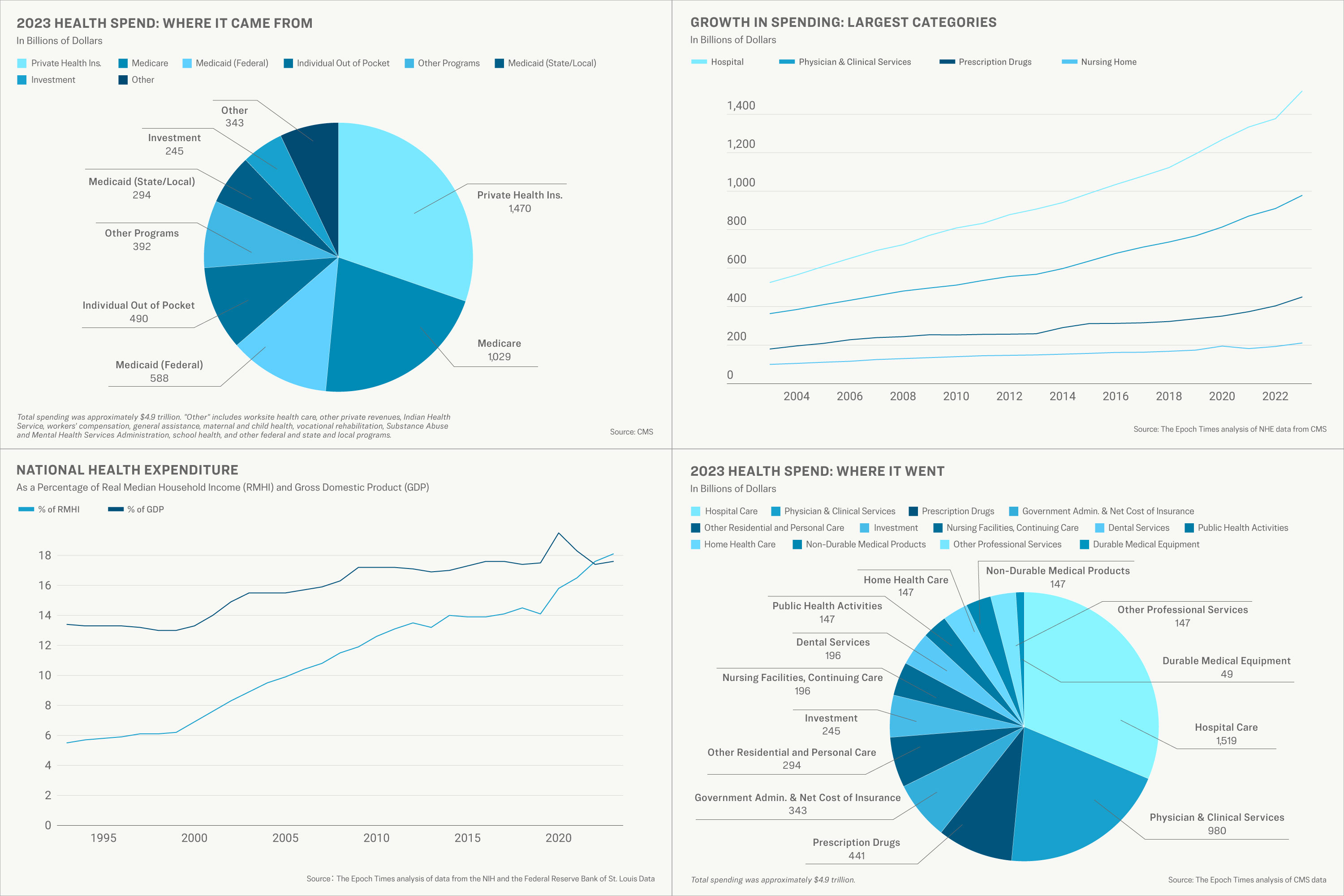

Americans collectively spent $4.9 trillion on health care in 2023, six times more than on national defense. No other country spends this much. As a percentage of GDP, the United States spends one-third more than Germany and France and more than double that of China.

Americans are not healthier than people in comparable nations, according to leading health care indices, and they do not live as long.

“We’re wealthy but sick,” Jackson Hammond, a senior policy analyst at Paragon Health Institute, told The Epoch Times.

The American health system is complex, so there are multiple reasons for rising costs. Chief among them is the increasingly poor health of the population, experts say.

Here’s an overview of American health care spending, why it’s so high, and one change that, according to experts, would certainly bring costs down.

The SpendingAmericans spent an average of $1,500 apiece on out-of-pocket medical expenses in 2023. That’s $6,000 for a family of four. But that’s the tip of the iceberg. Total spending was 10 times that amount: $14,570 per person, more than $58,000 for a family of four.Some of that money came from employers who paid all or part of employee health insurance premiums and from other third-party payers. But most came from taxpayers. Federal, state, and local governments contributed more than half of the dollars spent on health care in the United States.

The federal government spent more than $1.8 trillion on health care in fiscal year 2023. The budget deficit was $1.7 trillion that year.

Most health care dollars, 51 percent, went to hospitals and outpatient providers such as doctors and laboratories. Prescription drugs accounted for about 9 percent.

Spending has increased rapidly. Out-of-pocket spending grew by 7.2 percent in fiscal year 2023. Payments for hospital services increased by more than 10 percent, and prescription drug spending increased by 12 percent.

Older, Sicker PopulationAmericans are older and sicker than they were even 30 years ago, which has driven spending increases.“A significant percentage of the American population has a chronic condition,” Orriel Richardson, executive director at Morgan Health, told The Epoch Times.

Premium Picks

Chronic conditions are very costly, Richardson said, due to the increased number of doctor visits, medications, and other treatments they require, often for a lifetime.

Many of these diseases are brought on or worsened by lifestyle factors beginning at a young age, according to Reyn Archer, a physician and former congressional chief of staff.

“We see the advance of chronic illnesses in kids as early as 10 to 12 years old,” Archer told The Epoch Times.

“In 1991, we identified one among the first children in America, in Texas, with Type 2 diabetes,” Archer said.

“Today, in some places, as many as 70 percent of the new cases of diabetes are Type 2, which is based on obesity.”

The United States leads the developed world in deaths from diabetes, as well as chronic liver, kidney, and respiratory diseases, according to Peterson-KFF’s Health System Tracker.The U.S. population is also aging. The median age in 1960 was 29, with just 9 percent of the population being 65 or older. In 2023, the median age was 39, and 18 percent of Americans were 65 or older.

Cost of New TreatmentsNew treatments increase the cost of health care because they are initially very expensive and later become widely used.Joint replacement illustrates the phenomenon, according to Archer. “Because we are so good at the mechanics of doing that work, we can make it ubiquitous,” he said.

A joint replacement once required a hospital stay. Medicare paid up to $33,000 for the procedure in 2015, depending on location and other factors. About 1 million people had a joint replaced that year.

Those procedures are now routinely done on an outpatient basis. Medicare pays less than $10,000 for a knee replacement performed at an outpatient surgery center. But an increasing number of people have joints replaced each year.

New medications are currently driving overall costs up, according to Richardson.

“The cell and gene therapy world [gives us] a greater number of personalized, high-tech science that could be really successful,” she said. “But you have to pay for it.”

That includes drugs such as Ozempic and Rybelsus, which are approved for treating Type 2 diabetes in the United States, and Wegovy, which is approved for weight loss.

A one-month supply of Wegovy was priced at $1,349 as of March 2024, according to KFF. Medicare payments for three drugs in this category rose from $57 million in 2018 to $5.7 billion in 2022, a 1,000 percent increase in five years.

More than 11 percent of U.S. adults have diabetes, and more than one-third are obese, according to the National Institutes of Health. Some 17 percent of American children are obese also.Unintended ConsequencesGiven the complexity of the U.S. health care system, small adjustments, however well intended, can bring unintended results. Experts often cite the Medical Loss Ratio (MLR) as an example.The MLR is a provision of the Affordable Care Act (ACA) intended to limit insurance company profits. It specifies the percentage of premiums an insurer can retain for administrative costs and the percentage that must be paid for medical services.

For a large group insurance plan, an insurer must pay 85 percent of the money it receives to health providers or refund it to customers.

As a result, “the only way to make more money is to raise premiums,” Hammond told The Epoch Times.

The average premium for family coverage increased by 22 percent from 2018 to 2023 and by 47 percent since 2013. The ACA was fully implemented in 2014.

Market DynamicsPrivate health insurance has become more concentrated among fewer, larger insurers and care providers. The six largest health insurers in the country accounted for nearly 30 percent of all U.S. health care spending in 2023—an increase from 10 percent in 2011, according to an analysis conducted by Axios.“This may result in higher premiums, decreased access to affordable health insurance, and fewer options for consumers,” John Dicken, director of health care at the Government Accountability Office, wrote in a Dec. 5, 2024, article.Many insurers also operate Medicare Advantage and Medicaid programs in addition to private insurance. As a result, it can be more challenging for lawmakers to see where the money goes and how to improve the system.

“If Medicare cuts something, then [insurance companies are] going to move something over into their commercial market and upcharge the commercial market to generally be made whole,” Richardson said,

Simple supply and demand issues have also increased costs recently. “We have a workforce shortage, so our providers are coming at a premium,” she said.

Prevention as CureExperts say the simplest way for Americans to spend less on health care is to get healthier.Increasing the number of front-line specialists, including doctors, nurse practitioners, and physician assistants, would also be a good start, according to Richardson.

“We need primary care clinicians to capture more people before they have these higher progressions of diseases,” Richardson said, for example, screening more people for diabetes could prevent pre-diabetic people from developing the disease, saving thousands of dollars over a lifetime.

Archer said it’s important to “look upstream and partner with communities to create new incentives in the health system.”

This approach would mean “little by little, step by step, [helping people] to recreate the way they live their lives,” he said.

“And the way they work with physicians and the way they think about food, and literally, every single aspect of their life has to be adjusted.”

Others, including Rep. Chip Roy (R-Texas), advocate for legislative changes that would give Americans more control over their own health care spending, including by expanding the use of Health Savings Accounts.Health expenditure “is one of the most complex equations you can imagine,” Archer said.