How Leasing Has Ruined Cars - EPautos - Libertarian Car Talk

Why is there an Affordability Crisis – as regards new vehicles? There are many reasons why, including the decrease in value (buying power) of the fiat money we’re forced to use to buy things that has not been made up for by an increase in the quantity of fiat money we have to accept as payment for the work we do.

But there is another – subtler – reason. It is one a reader got me to thinking about that I think it’s worth all of us thinking about. It is how people renting vehicles – leasing them – is driving up the cost of buying vehicles.

Leasing is a way to get into more vehicle than you could otherwise afford – or want to spend on one – by not buying it. Instead, you rent a portion of its sticker price, paid over a period of say three years rather than making payments for six (or more). A vehicle that might cost you $800 per month to buy only costs $500 a month to lease and of course during the lease period, you pay for very little else because the vehicle is under warranty and because new vehicles don’t require more than basic service, such as oil changes and tire rotations, for the first several years and leases sometimes cover these costs, too.

It’s a fine deal – for those who want a more expensive, fancier vehicle than they might otherwise be able to afford – if they can afford to sign up for a new lease when the old one ends. Many are obviously able to do that and – clearly – do not mind doing that.

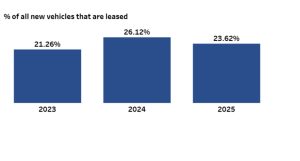

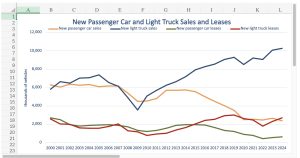

How many? About one in four, according to the available data – or about 22-24 percent of all new vehicle transactions. Interestingly, the greatest uptick in leasing involves trucks and EVs – two of the most expensive categories of vehicles.

Consider what this means. More finely, consider what it has done. The least expensive iterations of current half-ton (1500) pick-ups all have starting prices close to $40,000. For example, the least expensive version of the 2025 Ford F-150 is the $37,450 XL with 2WD. Adding the optional 4WD – something most truck buyers want because a truck without 4WD is kind of like a cat without claws – bumps the price up to $42,465.

Here is some context for these numbers:

In 1990, the base price of an F-150 was about $12,000. If you plug that into the government’s Bureau of Labor Statistics inflation calculator, you get about $29,000 in today’s money; i.e., that sum is worth – has the same buying power – as $12,000 did back in 1990. But you cannot buy a 2025 F-150 today with the equivalent-in-buying-power dollars. You must come up with about another $10k – in today’s dollars – to swing a new F-150.

Obviously, you get more for that money today – things such as standard AC and power windows and a much more comfortable, “nicer” vehicle, generally. The ’90 F-150 was a truck. Metal floors, vinyl-covered bench seats and manual transmission, etc. Wing vent windows instead of AC. But what good are “nicer” things if you cannot swing the price?

Enter the lease – and now you can! Plus more, actually. The lease lets you get into a nicer iteration of the F-150 because the lease payments are lower than the payments you’d make if you bought the base XL version. It lets you live beyond your means. It lets you appear to be more affluent than you actually are. This is the new American Dream.

It is very tempting, especially with a salesman tickling your ear all the while. Many people give in to this temptation. This, in turn, creates an incentive to have more expensive F-150s on the lot and also for Ford to build more of the expensive ones; after all, there’s more money in it for the manufacturer and the dealer. It moves inventory and it keeps those payments coming in, perpetually.

It also pushes the less expensive vehicles off the lot – and out of production. Ford no longer makes an F-150 that’s comparable to the 1990 F-150 “work truck.” Neither do any of the other manufacturers of trucks. The “base” trucks they’re selling today would have been considered very well-equipped, even top-of-the-line back in 1990. That is a good way to understand the effect leasing has had on truck prices (and generally).

Everything is very well-equipped, even “top of the line” now.

To make the point, take note of the fact that there is no such thing as an economy car on the market anymore. Economy cars – like work trucks – were just-the-basics vehicles, which made them affordable-to-buy vehicles. They have been supplanted by what are called entry level vehicles. These vehicles would have been classified as luxury vehicles by the standards of the ’90s, when AC was still optional in many cars and economy cars had 14 inch steel wheels, drum rear brakes and manual transmissions. But people without a lot of money could afford to buy them – and their availability as an alternative to more expensive cars helped keep the cost of most of those within reason, too.

Today, they are something else.

It is easy to find rows of brand-new F-150s on dealerships lots with MSRPs above $60,000; top-of-the-line versions sticker for close to $100,000. This is not to pick on Ford. You will find the same on other-make dealership lots as well. EVs “sell” chiefly because people lease them. If people had to buy them, it is doubtful many would – due to the cost of the things.

Leasing has driven this surge in costs – like a rip tide that carries everyone along for the ride – and we’re all paying for it, even if we aren’t interested in renting our next new vehicle.

And never owning one.

. . .

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $25 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

If you’d like a Baaaaa hat or other EPautos gear, see here!