1 in 3 Americans Are Cutting Insurance Costs Just to Afford Food - 🔔 The Liberty Daily

(Zero Hedge)—Across the country, Americans are being forced to rethink major financial decisions in the face of rising costs, high interest rates, and ongoing economic uncertainty, according to Guardian Service.

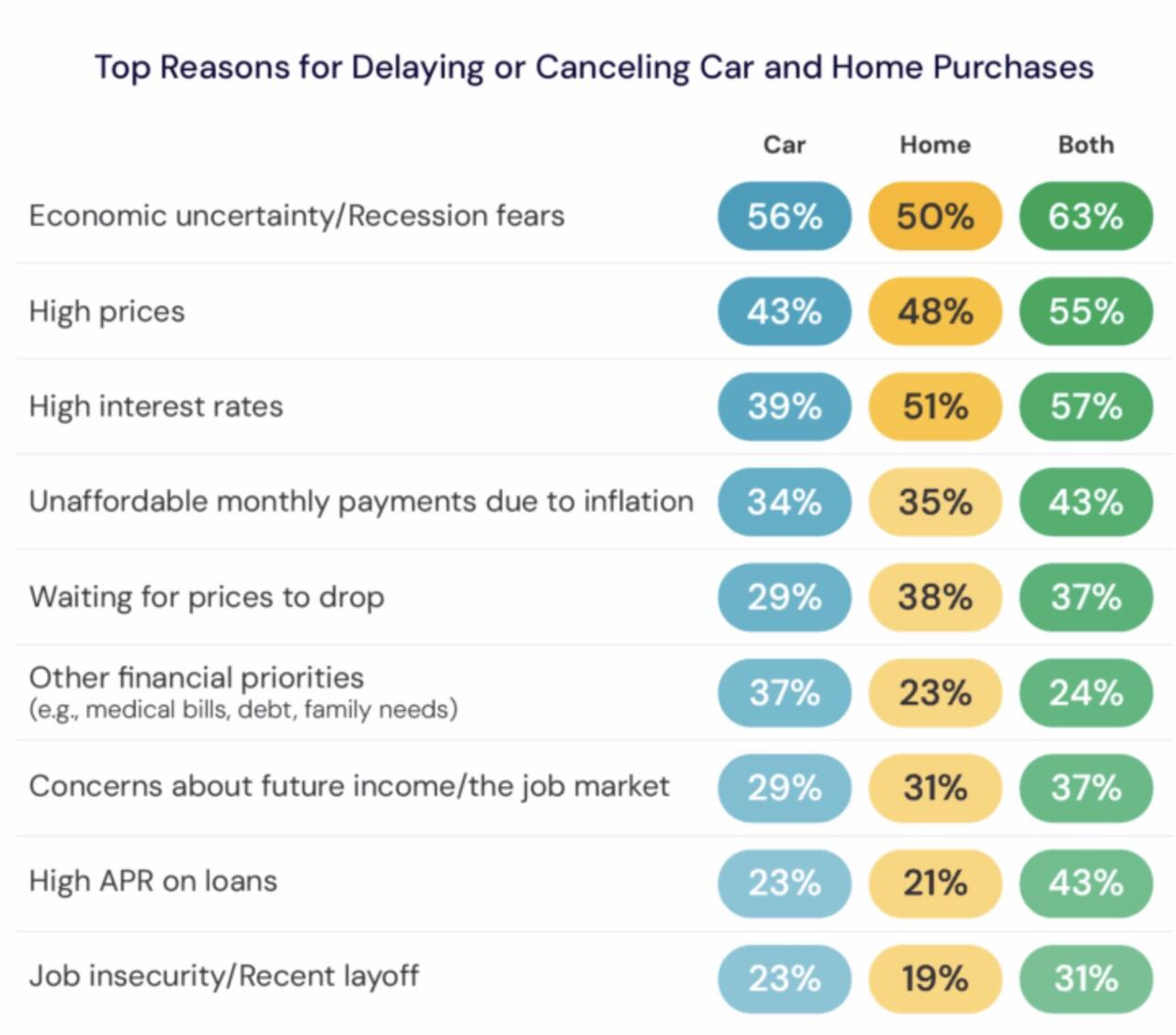

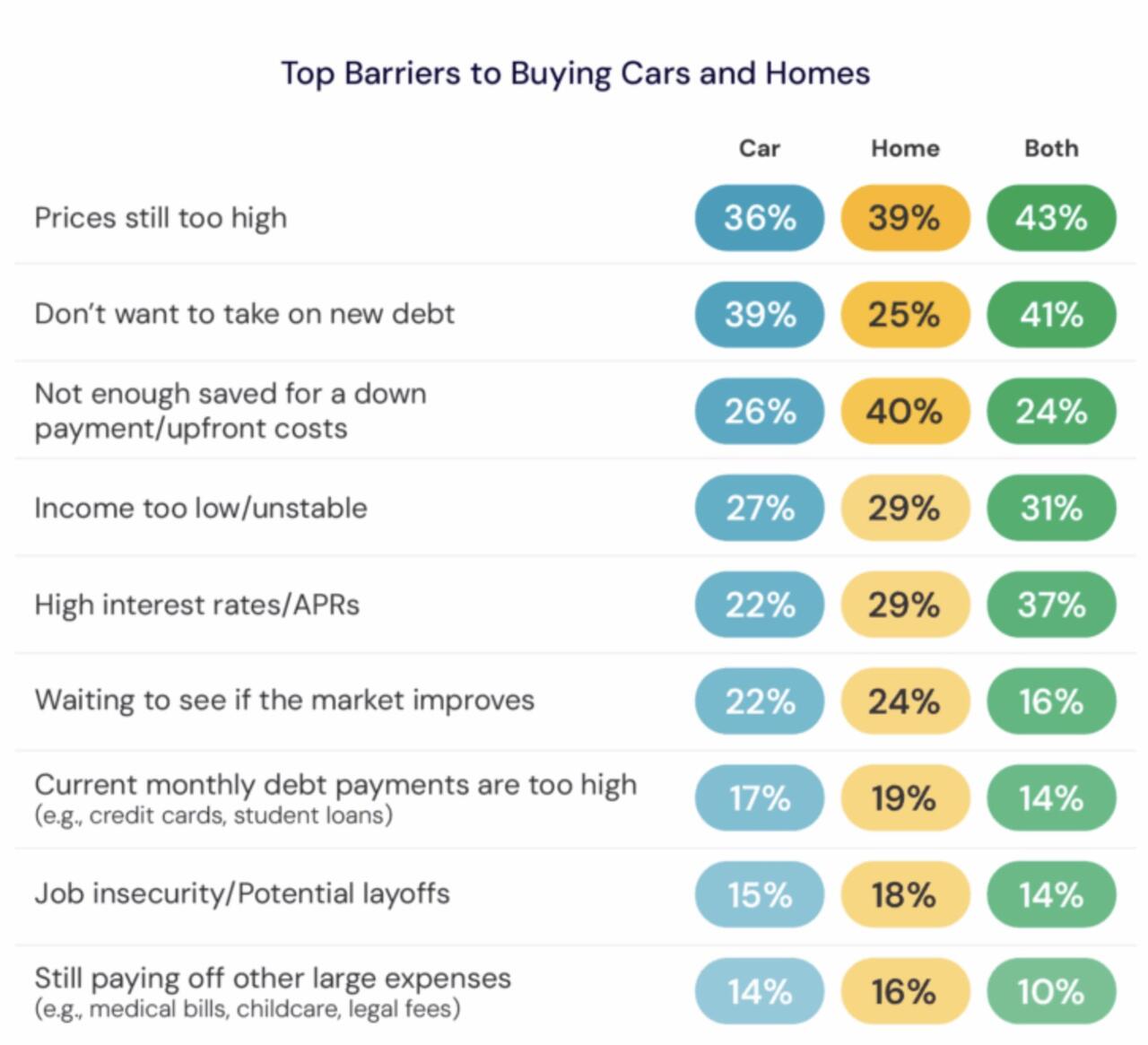

In a recent survey of 1,000 people, 35% said they’ve delayed or canceled a big purchase this year—most commonly a home (22%) or a car (8%). Millennials (40%) and Gen Z (32%) were especially likely to put plans on hold. The leading causes? Widespread anxiety about the economy (63%), high interest rates (57%), and unaffordable prices (55%).

Some are shifting expectations entirely—12% have scaled back their “dream home” goals, and nearly 1 in 4 now see renting as a better financial move than buying in 2025.

These shifting priorities extend beyond big-ticket items to everyday protections like insurance. When budgets are stretched, even essential coverage can feel expendable. Nearly 1 in 4 Americans (24%) said they’ve reduced coverage for a home or car to save money, and 29% reported downgrading or canceling at least one type of insurance over the past year.

Car insurance saw the largest cuts, with 15% scaling back and 8% switching from full coverage to liability only—moves that reduce costs but also increase financial risk.

The decisions behind these changes often stem from a desire to create short-term financial relief, even at the expense of long-term security. “A third of Americans said they would temporarily go without insurance to cover essential expenses,” and 1 in 5 would consider dropping coverage entirely if premiums continue to rise.

Guardian Service writes that at the same time, insurance is still widely valued—77% said car insurance is essential, and 57% said the same for renters or homeowners insurance. Trust, however, remains an issue, with only 37% saying they fully trust insurers to come through when something goes wrong.

The study is clear: as Americans adjust their budgets and weigh tough trade-offs, they’re showing a clear willingness to prioritize immediate needs over long-term plans.