Three-Week Shutdown Could Push Jobless Rate To 4.7%: Report

A federal government shutdown looks increasingly inevitable as lawmakers remain deadlocked over how to fund the government for fiscal 2026 with just hours to go before the Oct. 1 deadline. None of the regular appropriations bills have cleared Congress, leaving agencies on the brink of closing their doors.

Photo: Jonathan Simcoe/Unsplash

Photo: Jonathan Simcoe/UnsplashThe economic stakes are unusually high. The White House has threatened permanent dismissals of federal employees if the shutdown occurs, a move that could upend an already fragile labor market and potentially derail a tentative recovery. Economists warn that if the economy is as close to recession as many analysts believe, sharp government cuts could push it over the edge.

GDP Effects Likely Contained—If Shutdown Ends QuicklyThe Federal Reserve’s rule of thumb is that each week of shutdown trims 0.2 percentage point from annualized GDP growth in the affected quarter. But the lost output is usually recovered once the government reopens, meaning the longer-term trajectory of the economy is little changed if the episode is contained within a single quarter.

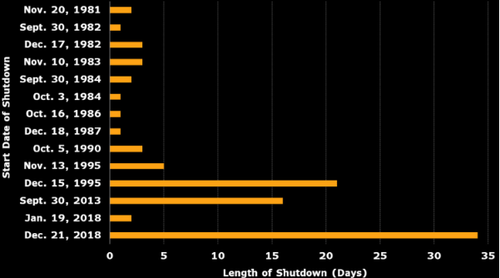

That dynamic helps explain why the 34-day shutdown of late 2018 - the longest since 1981 - had little measurable impact on growth in the fourth quarter of that year.

If the coming shutdown begins Oct. 1 and ends by mid-November, the bulk of the economic effect would likely be reversed before year-end, leaving fourth-quarter GDP intact.

Labor Market DistortionsThe effect on employment data could be more immediate and visible. The Bureau of Labor Statistics’ monthly household survey counts furloughed federal employees as unemployed if they remain idle through the Oct. 12-18 reference week. Economists estimate that as many as 640,000 workers could be sidelined, lifting the unemployment rate by 0.4 percentage point to 4.7% - a sharp uptick for a single month.

By contrast, the establishment survey, which underpins nonfarm payrolls, is unlikely to register the same disruption because furloughed employees will eventually receive back pay and remain on payrolls.

If the shutdown is resolved, the unemployment rate would likely revert to its prior level as furloughed workers are recalled. But if President Donald Trump follows through on threats to make dismissals permanent, the unemployment rate could remain elevated above 4.5% for months.

Agencies Brace for Deep CutsThe Department of Health and Human Services, for instance, is preparing to furlough 41% of its staff - about 32,460 workers - disrupting public health operations, research, and oversight. Within HHS, the Centers for Disease Control and Prevention would furlough roughly 64% of its workforce, and the National Institutes of Health about 75%. Critical programs such as Medicare, Medicaid, and essential food and drug safety functions will see partial continuity, though their capacity may be strained.

In parallel, the White House’s Office of Management and Budget has asked agencies to finalize reduction-in-force (RIF) plans - frameworks for eliminating positions permanently, not merely temporarily suspending them.Political leaders on the Democratic side have called the directive an intimidation tactic and pledged to resist.

In aviation, the fallout could be immediate. A funding lapse would suspend hiring and training of air traffic controllers - a problem especially acute given the FAA’s existing shortfall of some 3,000 controllers. The U.S. Travel Association warns of as much as $1 billion in weekly losses tied to delays, cancellations, and operational disruption.

Data Blind Spots for PolicymakersShutdowns create an additional headache for the Fed: data blackouts. If the government shuts down on Oct. 1, the release of initial jobless claims scheduled for Oct. 2 and the September payrolls report on Oct. 3 would likely be delayed. A prolonged closure could also push back key October releases, including the consumer price index (Oct. 15), retail sales (Oct. 16) and the producer price index (Oct. 16).

That would leave Fed officials with little visibility into labor-market and inflation trends heading into their Oct. 28-29 policy meeting—a particularly precarious moment if recession risks are mounting.

Since 1981, most shutdowns have lasted less than a week. Only three extended beyond two weeks: in 1995, 2013 and 2018. The 2018-19 episode stretched 34 days, disrupting everything from air travel to food inspections.

If the coming shutdown matches that duration, it would again test the resilience of federal services and potentially leave the Fed and markets in the dark about the state of the economy well into November.

The likelihood of a shutdown as of midnight Oct. 1 is high.

A three-week stoppage - the current baseline expectation - could temporarily push the unemployment rate near 4.7% before normalizing. But if mass layoffs occur or the impasse drags on, the labor market and economy could face lasting damage. For now, the greatest immediate risk may be to policymakers themselves, forced to steer the economy without their most critical gauges.

Loading recommendations...