Why Goldman's Trading Floor Is Buying Today's Dip With Both Hands

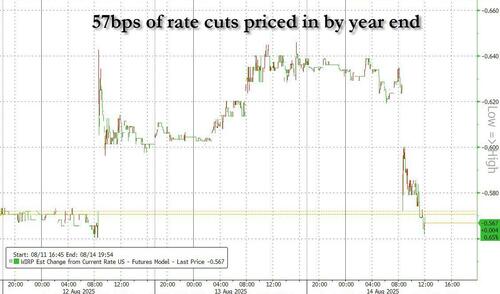

US stocks closed at yet another all time high on Wednesday (Thursday could prove challenging after the red hot PPI) with the same pro-cyclical tilt seen much of the past few weeks (Equal Weight & RTY > SPX, Cyclicals > Defensives, SIZE factor wobbles, etc.) as the market now expects a dovish Pivot from Jerome Powell at Jackson Hole next week (Aug 22) and pricing ~57bps worth of cuts into year-end (was 64bps yesterday before the PPI print).

Commenting on the recent market move, Goldman trader Michael Nocerino writes that pain is certainly felt as we drift higher with the bank's High Beta Momentum (GSPRHIMO) having has its worst day in 3 weeks on Wednesday (-354bps)...