Tesla Publishes Downbeat Wall Street Estimates For Vehicle Sales

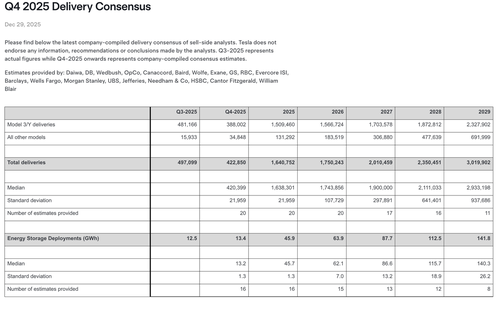

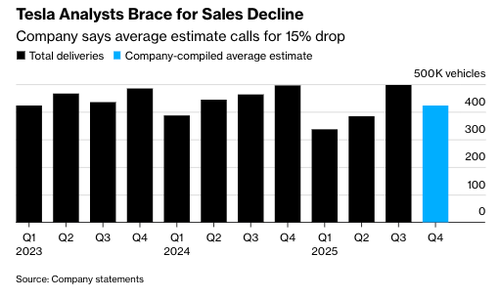

Tesla has compiled vehicle delivery forecasts from a broad group of Wall Street firms, including Daiwa, DB, Wedbush, Canaccord, Baird, Wolfe, Exane, GS, RBC, Evercore ISI, Barclays, Wells Fargo, Morgan Stanley, UBS, Jefferies, Needham, HSBC, Cantor Fitzgerald, and William Blair. The overall sell-side analyst consensus implies Q4 deliveries of roughly 422,850 vehicles, representing a 15% year-over-year decline and a 10% drop from the Bloomberg-compiled average of 445,061 vehicles.

Source: Bloomberg

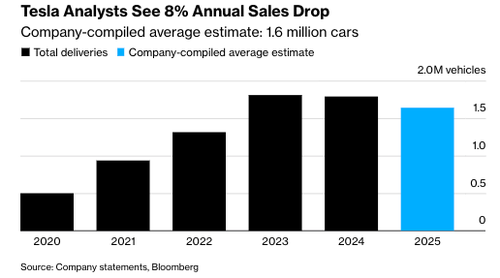

Source: BloombergThe company is on track for a second consecutive annual decline in deliveries, with analysts expecting 1.6 million vehicles in 2025, down more than 8% from last year.

This follows a slow start to the year, driven by factory retooling for the redesigned Model Y, elevated interest rates, dismal demand for EVs, and the end of federal tax credits, as well as manufactured reputational damage from the Democratic Party's propaganda apparatus. This has included billionaire-funded NGOs working with activist groups to target Tesla and Elon Musk, the spread of false or misleading claims, sustained negative media narratives, and, in some cases, militant left-wing groups carrying out arson attacks on Tesla showrooms. These actions followed Elon Musk's involvement with DOGE to uncover fraud, waste, and abuse, an effort that has since gained broader public traction amid the Minneapolis Somali-linked fraud scandal that has shocked the nation.

Here is the full printout of the Tesla-compiled consensus from sell-side analysts:

Tesla shares are up 14% year to date as of Monday's close.

Investor interest has increasingly shifted toward robotics, artificial intelligence, and power grid upgrades. The convergence of these technologies under a single corporate umbrella shows the uniqueness of the Tesla brand, as no other U.S. company currently operates at a comparable scale across those domains.

Loading recommendations...