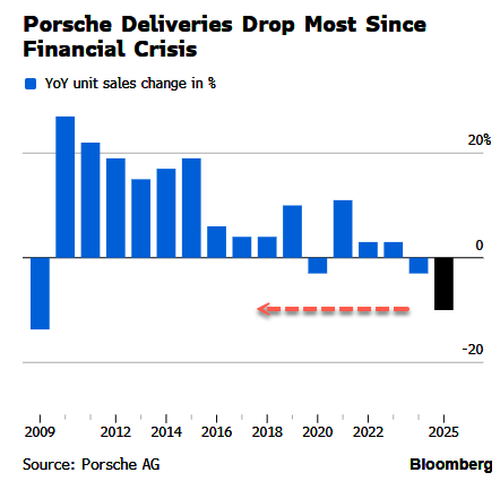

Porsche Sales Plunge Most In 16 Years

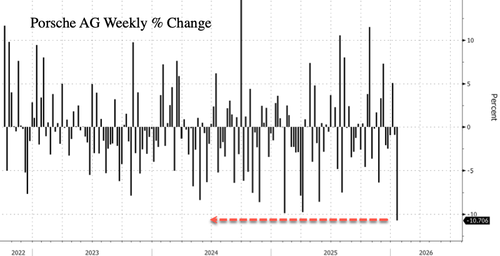

Porsche AG shares in Germany are headed for their steepest weekly decline since trading began in late 2022, after the 911 maker reported that vehicle sales in the 2025 selling year fell to their lowest level in 16 years.

The 911 maker announced earlier that it delivered 279,449 vehicles to customers worldwide in 2025, down 10% from 310,718 in 2024. This marked the largest annual drop in deliveries since the 2009 financial crisis roiled global markets and crushed consumer sentiment.

"After several record years, our deliveries in 2025 were below the previous year's level. This development is in line with our expectations and is due to supply gaps for the 718 and Macan combustion-engined models, the continuing weaker demand for exclusive products in China, and our value-oriented supply management," Matthias Becker, Member of the Executive Board for Sales and Marketing at Porsche, wrote in a statement.

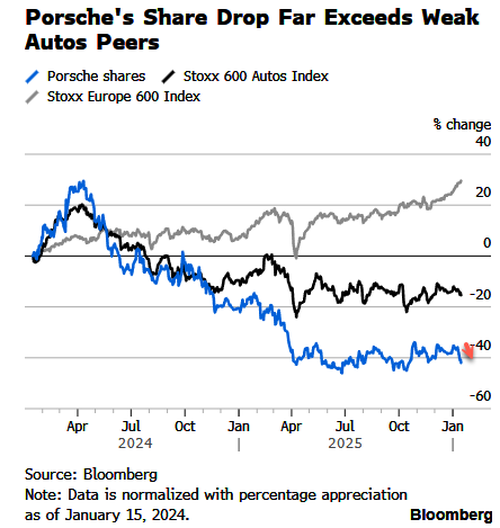

Porsche's troubles are not dissimilar to those of other European auto brands, where sliding sales, profit warnings, intensifying competition from Chinese brands, and weak electric-vehicle demand have created significant uncertainty that is likely to linger well into the second half of the year.

The stock is slightly lower in European trading. On the week, shares are down the most on record (-10%), with trading data going back to their 2022 initial public offering.

Compared with peers...

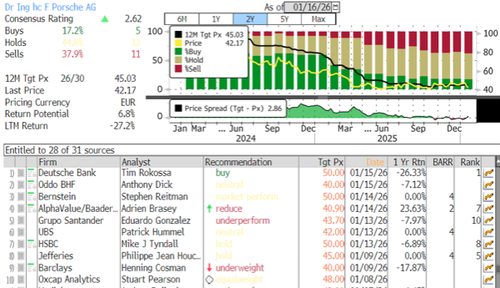

Bloomberg cited a conversation earlier this week between Oddo BHF analyst Anthony Dick and Porsche CFO Jochen Breckner at the German Investment Seminar in New York. Breckner told the analyst he was "even more conservative" than before. In reducing his estimates, Dick said Porsche is in an ongoing "major restructuring," noting that profitability has been under pressure since its IPO. He added that this year and next are likely to be transition years for the company

According to Bloomberg data, analysts remain mostly pessimistic on Porsche, with just five buy ratings, 13 neutral ratings, and 11 sell ratings.

The broader EU auto industry is struggling.

Bernstein analysts, led by Stephen Reitman, called Porsche their "wild card," noting that a shift to a full-time CEO with experience at Ferrari and McLaren Automotive provides "room for optimism" and greater urgency in improving performance.

Overall, Porsche appears to be in prolonged transition over the next one to two years, while the broader EU auto industry remains stuck in a rut, weighed down by weak demand, margin pressure, and an uncertain path forward.

Loading recommendations...