Hartnett: The Best Way To Tell If We Are In Another Stock Bubble

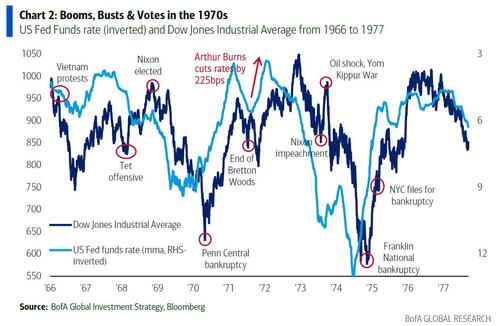

In our previous post, Michael Hartnett spent some time briefly analyzing the ongoing clash between Trump and Powell, which prompted him to compare the current market situation to the early 1970s period, just before inflation exploded.

And since so much depends on whether Trump fires Powell (and the policy decisions of the next Fed Chair), the Bofa strategist turns his attention once again to the ongoing D.C. drama between the White House and the Marriner Eccles building, and writes that while Fed chair-President clashes, and Historic examples of central bank governor dismissals by heads of state, are sparse, they are always driven by one of three things: i) policy conflict over rates (Hungary, Türkiye), ii) currencies (Russia, Argentina), or iii) allegation of corruption (Nigeria). And one thing they all have in common is that every case of central bank dismissal coincided with sharp FX declines.