Goldman Sees Brighter US Housing Outlook Taking Shape For 2026

Conversations around the housing market this week revolved around Housing Finance Agency (FHFA) Director Bill Pulte floating the idea of 50-year mortgages, pitched by the Trump administration as a clever way to make homes more "affordable" by lowering monthly payments, expanding access, and attracting more buyers. But stretching mortgages out for roughly 65% of the average U.S. life expectancy is not affordable in the long run.

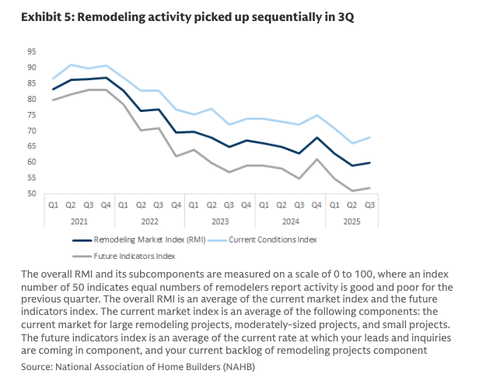

Our conversations with readers this week focused on the deepening downturn in the home improvement industry. This slide could deepen into a sharper contraction and may signal continued cooling in the housing market:

For more color on the housing market, we turn to Goldman Sachs Managing Director Kate McShane, who told clients Thursday the housing backdrop is set to improve in 2026, with mortgage rates drifting toward 6.15% and pent-up demand helping home-price appreciation recover.

Here is McShane's view on the housing market, based on her upgrade of flooring company Floor & Décor from "Sell" to "Neutral" as she sees a better 2026 environment: slightly improving housing turnover, stabilizing comps, margin recovery, and potential market-share gains as competitive pressures ease:

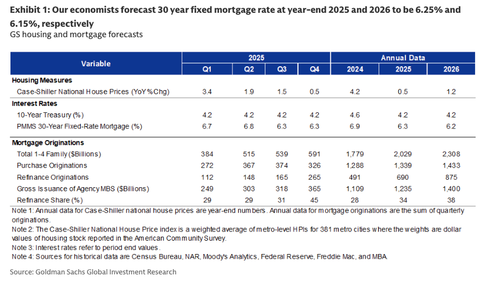

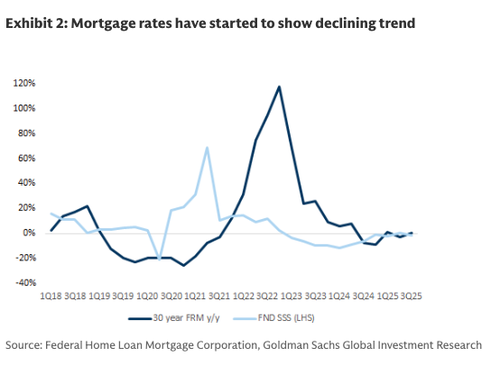

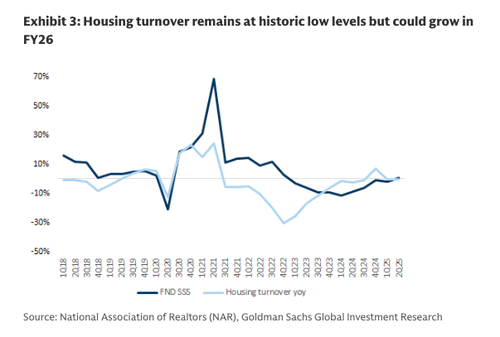

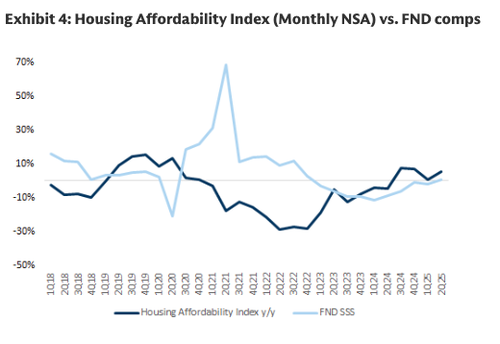

The housing market is anticipated to experience a more favorable environment in FY26 and our economists forecast mortgage rates at year-end 2025 and 2026 to be 6.25% and 6.15%, respectively. Our economists noted if mortgage rates remain around 6.15% (in line with their expectation), the pace of home price appreciation is likely to start to recover in 2026 due to pent-up housing demand. Our economists expect housing turnover to be flat to marginally higher in FY25 and projects a +5-7% increase in 2026 compared to 2025. Floor & Décor's comparable store sales (comps) are highly correlated to housing turnover, as replacing floors is one of the first improvements many new or existing home purchasers undertake. The company's focus on a growing Pro customer base and high-margin design services also provides growth opportunities as the market recovers.

Our economists have noted that HELOC deal issuance has increased since 2023, with YTD 2025 (until 10/8/25) volume reaching post-GFC highs. The seemingly renewed interest in HELOC securitization is likely a function of both increased HELOC usage by homeowners and greater demand from investors in the securitization market. Our economists now suggest potential for significant further growth in HELOC in the coming years and expect home equity debt outstanding growth rate to tick-up slightly to around $15-17 bn/quarter in 2026 (vs. $14bn/quarter over the past 5 quarters), driven by lower financing rates and increased demand for tapping into equity. In spite of this higher activity level however, the company continues to see homeowners favor smaller-scope projects amid affordability constraints. However, we believe FND is positioned to capture potential HELOC-driven upside as macro transmission improves.

GS economists forecast 30 year fixed mortgage rate at year-end 2025 and 2026 to be 6.25% and 6.15%, respectively

Mortgage rates have started to show a declining trend

Housing turnover remains at historic low levels but could grow in FY26

Housing Affordability Index (Monthly NSA) vs. FND com

Remodeling activity picked up sequentially in 3Q

McShane's view gives readers her framework for what to expect in the spring selling season, which begins in 3 to 4 months.

ZeroHedge Pro subscribers can access the full note and the complete chart pack in the usual place.

Loading recommendations...