Late on Sunday we - correctly - warned that the selling was just starting, when we reported that traders on Goldman's desk had "Hit The Panic Button" warning of a "Perfect Sell Storm Of Positioning, Valuation, Breadth, Concentration And Policy." And while there were many factors involved explaining why Goldman S&T had suddenly turned very bearish, these were the three main ones:

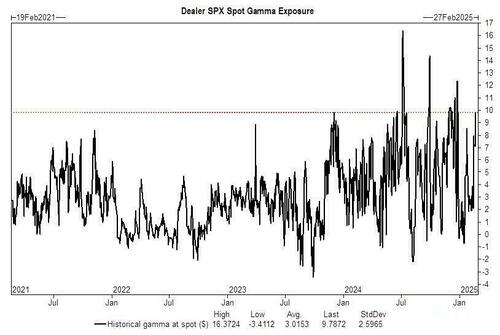

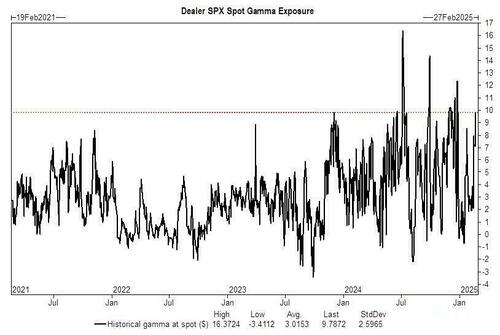

we are nearing S&P 500’s 50dma of 6010 which was the key level to hold going into the close / weekend.CTA short term momentum flips from positive to negative with S&P 500 below 6042....AKA below this level $8b of US equities for sale next week. Meanwhile, the current very high dealer gamma position - which provided a solid buffer for stocks in either direction - rolled off by ~50% after Friday’s option expiration expiry, and "the market will have the ability to move more freely next week".... by which the Goldman trader clearly means continue selling off.

Loading...