Paramount Unveils "Superior Alternative" Offer For Warner Bros As Bidding War With Netflix Accelerates

Update (0950ET):

The bidding war between Netflix and Paramount for Warner Bros.' film and television studios, including HBO and HBO Max, is intensifying heading into the US cash session on Monday morning.

Paramount has raised its bid with a $30-per-share, all-cash tender offer for all of Warner Bros. Discovery, stating in a press release that its proposal is a "superior alternative" to Netflix's deal announced last Friday.

Deal highlights:

Price: An all-cash offer at $30.00 per share, equating to an enterprise value of $108.4 billion, which represents a 139% premium to the undisturbed WBD stock price of $12.54 as of September 10, 2025. In contrast, the Netflix proposal entails a volatile and complex structure valued at $27.75 mix of cash ($23.25) and stock ($4.50), subject to collar and the future performance of Netflix, equating to an enterprise value of $82.7 billion (excluding SpinCo).

Structure: Paramount proposal is for all of WBD, without leaving WBD shareholders with a sub-scale and highly leveraged stub in Global Networks, as the Netflix agreement assumes.

"Paramount's strategically and financially compelling offer to WBD shareholders provides a superior alternative to the Netflix (NASDAQ: NFLX) transaction, which offers inferior and uncertain value and exposes WBD shareholders to a protracted multi-jurisdictional regulatory clearance process with an uncertain outcome along with a complex and volatile mix of equity and cash," Paramount wrote in a press release.

Additional facts about the deal:

Fully backstopped equity (Ellison family + RedBird) and committed debt financing (Bank of America, Citi, Apollo).

Cleaner structure: Paramount buys all of WBD rather than leaving investors holding a Global Networks spinout.

Regulatory path: Paramount argues its deal is simpler, while noting that Netflix-WBD would likely face lengthy global antitrust fights.

David Ellison (son of Oracle's Larry Ellison), Chairman and CEO of Paramount, stated: "WBD shareholders deserve an opportunity to consider our superior all-cash offer for their shares in the entire company. Our public offer, which is on the same terms we provided to the Warner Bros. Discovery Board of Directors in private, provides superior value, and a more certain and quicker path to completion. We believe the WBD Board of Directors is pursuing an inferior proposal which exposes shareholders to a mix of cash and stock, an uncertain future trading value of the Global Networks linear cable business and a challenging regulatory approval process. We are taking our offer directly to shareholders to give them the opportunity to act in their own best interests and maximize the value of their shares."

Ellison continued, "We believe our offer will create a stronger Hollywood. It is in the best interests of the creative community, consumers and the movie theater industry. We believe they will benefit from the enhanced competition, higher content spend and theatrical release output, and a greater number of movies in theaters as a result of our proposed transaction. We look forward to working to expeditiously deliver this opportunity so that all stakeholders can begin to capitalize on the benefits of the combined company."

Paramount listed why the Paramount-WBD would be strategic for Hollywood:

Creates a scaled Hollywood studio champion with larger content budgets

Stronger theatrical footprint and support for movie theaters

Bigger, more profitable direct-to-consumer platform (Paramount+ + HBO Max)

More competitive vs Netflix, Amazon, Disney

Tech boost via Oracle partnership

Major global sports rights portfolio

Stronger linear networks and ad business

Over $6 billion in cost synergies plus existing Paramount transformation savings

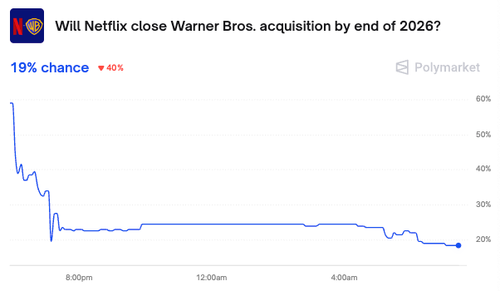

Polymarket odds for a Netflix-WBD deal fell from about 20% to 16% following Paramount's news.

pic

The Trump administration is likely aware that Netflix remains heavily influenced by the Obama era, while the Ellison family (major backers of Paramount) is in Trump's orbit. Trump has already signaled he intends to play an active role in antitrust scrutiny, warning earlier that a Netflix-WBD tie-up "could be a problem."

* * *

Beyond President Trump's walk down the red carpet at the Kennedy Center Opera House in Washington, D.C., where he greeted actors, musicians, and entertainment industry legends on Sunday evening, he also spoke with reporters about one of the biggest developments in Hollywood: Netflix's plan to acquire Warner Bros., including its film and television studios as well as HBO and HBO Max, in a $72 billion deal.

Trump told reporters on the red carpet that he had some skepticism about the prospects of the Netflix-WBD getting approval. He suggested that regulators could push back, noting Netflix already has a large market share that would "go up a lot" if it acquires WBD.

"Well, that's got to go through a process, and we'll see what happens," the president said, adding, "They have a very big market share ... when they have Warner Bros., that share goes up a lot."

Trump said he plans to discuss the mechanics of the deal with "some economists" before giving it his approval.

"I'll be involved in that decision, too," he said. Normally, presidents don't intervene directly in antitrust reviews of corporate mergers, which makes his comments stand out. It also reinforces the growing panic across Hollywood about what this deal could mean.

"But it is a big market share, there's no question about that. It could be a problem," he added.

President Trump says he would have a role in whether a proposed merger between Netflix and Warner Brothers should go forward, telling reporters the market share of a combined entity could raise concerns https://t.co/bIqw9EKC72 pic.twitter.com/F4bw7d6TUp

— Reuters (@Reuters) December 8, 2025

No other than the former WBD CEO summed things up succinctly:

If I was tasked with doing so, I could not think of a more effective way to reduce competition in Hollywood than selling WBD to Netflix.

And as we pointed out:

Besides consolidation, Benny Johnson pointed out the marriage between the two companies may only suggest a more sinister plot: Netflix's plan to "own a monopoly on children's entertainment."

Over the weekend, Barclays analysts led by Kannan Venkateshwar questioned Netflix's deal, asking why it would spend nearly $80 billion for a studio company it already disrupted, especially with only $2 to $3 billion in expected synergies and a slow integration due to existing WBD distribution and content-licensing agreements (read the report).

Also, Trump added that Netflix's CEO, Ted Sarandos, joined him at the White House last week. He said Sarandos was a "great person" who has done "one of the greatest jobs in the history of movies."

The latest Polymarket odds of whether the Netflix-WBD closes by the end of 2026 stand at 19%.

Merger approvals are typically handled by independent regulatory agencies, such as the Federal Trade Commission and the Department of Justice, rather than by the president directly. That makes Trump's stated involvement highly unusual. It's also worth noting that Paramount–Skydance, backed by the Ellison family, recently made a bid for WBD.

Loading recommendations...