China Pledges To Curb EV Price Wars Amid Deflation Worries

China has vowed to rein in “irrational competition” in its electric vehicle (EV) sector as deflationary price wars threaten economic stability and industrial progress, according to a new report from Bloomberg.

The pledge came from a State Council meeting led by Premier Li Qiang, where officials emphasized guiding automakers toward innovation and higher quality rather than relentless price cuts.

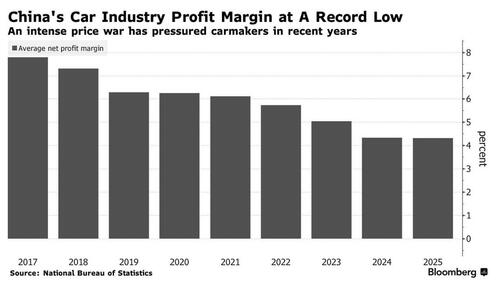

The move follows earlier warnings from top leadership to address aggressive discounting, which has dragged down prices across the supply chain. “If EV prices can stabilize, then prices in upstream industries like steel could also stabilize and ultimately that could help ease some of the downward pressure on overall prices,” said Tianlei Huang of the Peterson Institute for International Economics.

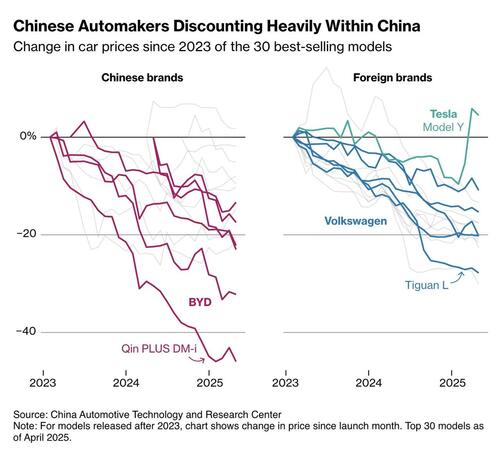

EV prices have been falling rapidly since 2023, with fierce domestic competition leading to steep discounts. Though China remains on track for 5% GDP growth this year, persistent deflation—especially in sectors like autos—poses a growing threat. Transportation and communications products make up more than 10% of the consumer price index, and automobile prices have declined for three consecutive years.

Authorities now plan to tighten oversight of pricing and costs, inspect product quality, and ensure carmakers pay suppliers on time. They also aim to establish a long-term mechanism to regulate competition, though specifics remain unclear.

EV giants like BYD and Geely—whose stocks rose following the announcement—have already faced pressure to settle supplier debts and limit destructive price cuts. Last month, the government summoned major manufacturers to discuss pricing concerns. BYD and Geely later agreed to shorten supplier payment terms to 60 days.

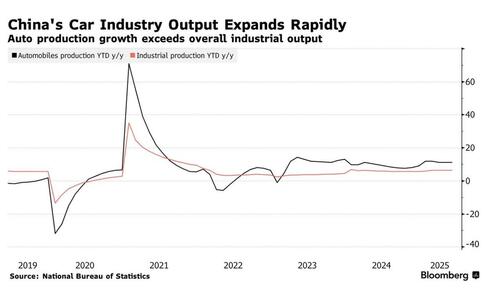

Bloomberg reports that despite being a global leader—BYD outsold Tesla in Europe in April—China’s EV boom is facing structural strain. Overcapacity is rampant, with the industry operating at under 50% utilization. “I expect they will look at traditional fuel car-making too,” said Duncan Wrigley of Pantheon Macroeconomics, citing resistance from local state-owned enterprises to mergers that could reduce excess capacity.

Finding effective tools to manage competition without undermining confidence in a flagship green industry remains difficult. “I don’t think there’s a way to regulate the car prices like they do for the property market or for the commodity markets,” said Xiao Feng of CLSA. “So at the end of the day, this is going to be window guidance.”

Even without direct price cuts, automakers can still lure buyers with free upgrades or financing deals. “Competitive pressure is not going away,” said Joanna Chen, an analyst at Bloomberg Intelligence.

Meanwhile, local protectionism adds another layer of complexity. Regional governments often resist letting unprofitable firms fail, fearing tax losses and job cuts. Huang noted, “Instead of encouraging competition among localities... the central government would need to stress coordination and make this a bigger part in evaluating local cadres’ performance.”

...and despite a recent dip in the number of EV makers, it would appear to us the shakeout in the sector is likely far from over.

Loading...