Visualized: Family Income vs. Taxes, by European Country (2024)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

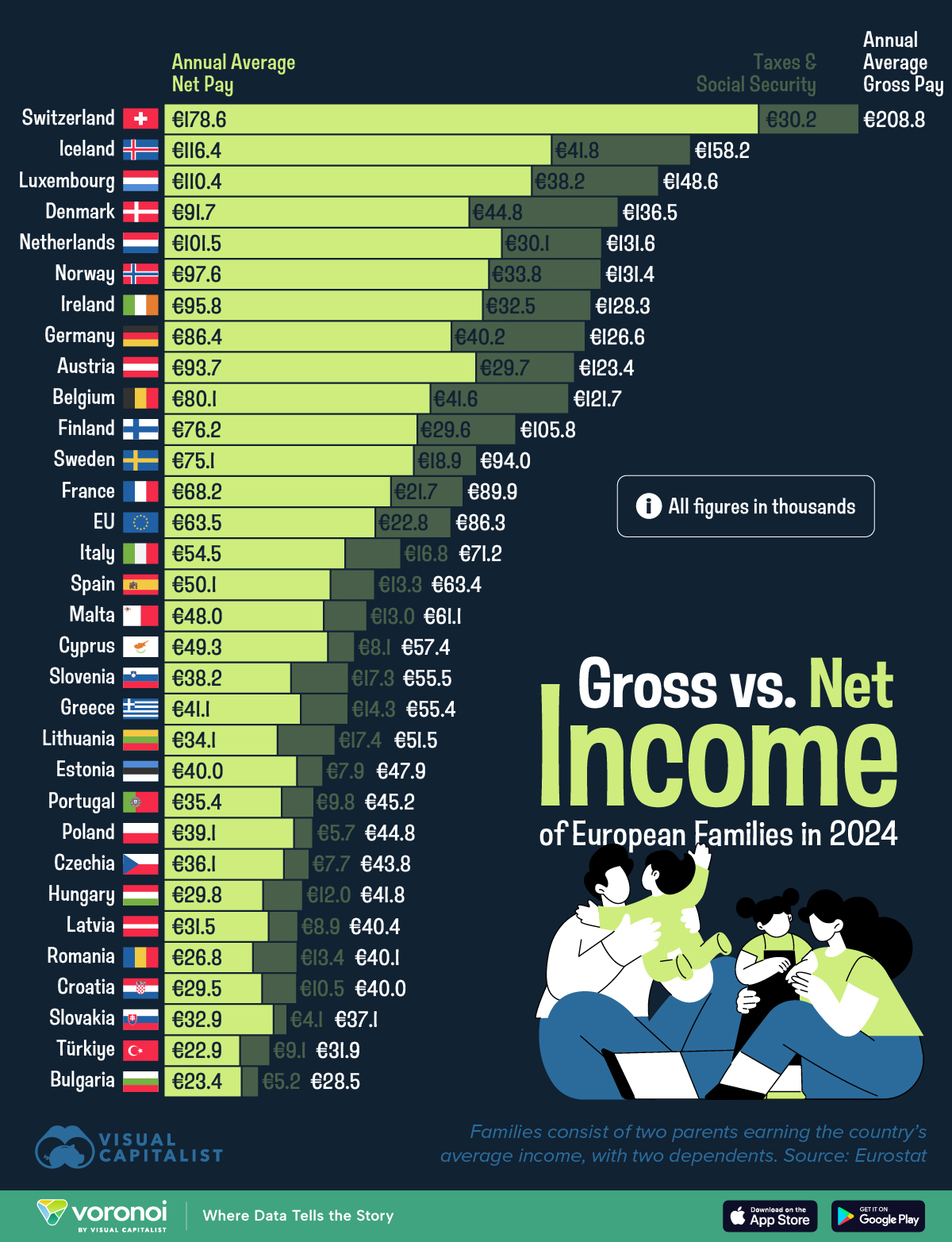

- Swiss families are winning the incomes vs. taxes game in Europe.

- Switzerland has highest gross annual income on the continent (€208,755), and keep about 86% of that pay—fourth-highest.

- The Netherlands punches above its weight: fifth in gross pay, €131,563 and top 15 take-home ratio (77%)

- Romanian families don’t make as much (€40,116) and have a heavy tax burden, taking home only about 67% of their pay.

It really isn’t about how much you make (income) any more, it’s about how much you get to keep (incomes vs. taxes).

And taxes aren’t exactly beloved, even on the continent with the highest marginal tax rates.

So who’s really getting to keep the most of what they earn? We take a look in Europe specifically.

This visualization ranks gross and net earnings for dual-income European families with two dependents, and quantifies the impact of taxes and social contributions made in 2024.

The data for this visualization comes from Eurostat, accessed via Euronews. It is not adjusted for inflation or local costs. Net income includes tax returns and family allowances.

Ranked: Countries With the Highest Income in Europe

Swiss dual-income families earned the highest gross income in Europe—over €208,000 in 2024.

Remarkably, they took home 86% of it, one of the highest net retention rates in the continent. This results in a net income of €178,553, far surpassing most other European peers.

While income taxes are relatively high, Swiss families must also make mandatory contributions to healthcare and pensions, which significantly reduces their overall taxable income.

Child support is also impressive: with monthly payments per child, daycare subsides, and tax deductions for childcare costs.

All of this substantially increases their net income (or their take-home pay).

Similarly, the Netherlands is fifth by gross income at €131,563, and they retain 77% of it after deductions.

For reference, Dutch families took home over €101,000, putting them ahead of bigger economies like Germany, France, and Italy.

Looking at Eastern Europe’s Taxes

Countries like Romania and Lithuania show stark contrasts from Western Europe.

Romanian families earned just over €40,000 but took home only €26,766, or just 67% of gross pay.

Lithuania fares similarly, with families losing about one-third of earnings to taxes.

Interestingly, both countries have a flat personal income tax rate. Why does that matter?

This IMF analysis on tax redistribution helps explain. In countries like Romania or Lithuania, tax and transfer systems aren’t doing enough to redistribute wealth and reduce poverty.

Sometimes they even make it worse because the poor pay taxes (especially flat or indirect ones) that outweigh the help they get from the state.

This shows how less progressive tax systems and weak social benefits can actually increase the financial pressure on low-income families—especially in Eastern Europe.

Learn More on the Voronoi App

What this graphic doesn’t cover is how living costs differ. Check out The Average Income for A European Family, Adjusted for Living Costs on Voronoi, the new app from Visual Capitalist.