Charted: Countries Stockpiling the Most Gold Reserves Since 2000

Published

5 hours agoon

December 23, 2025 Article/Editing:

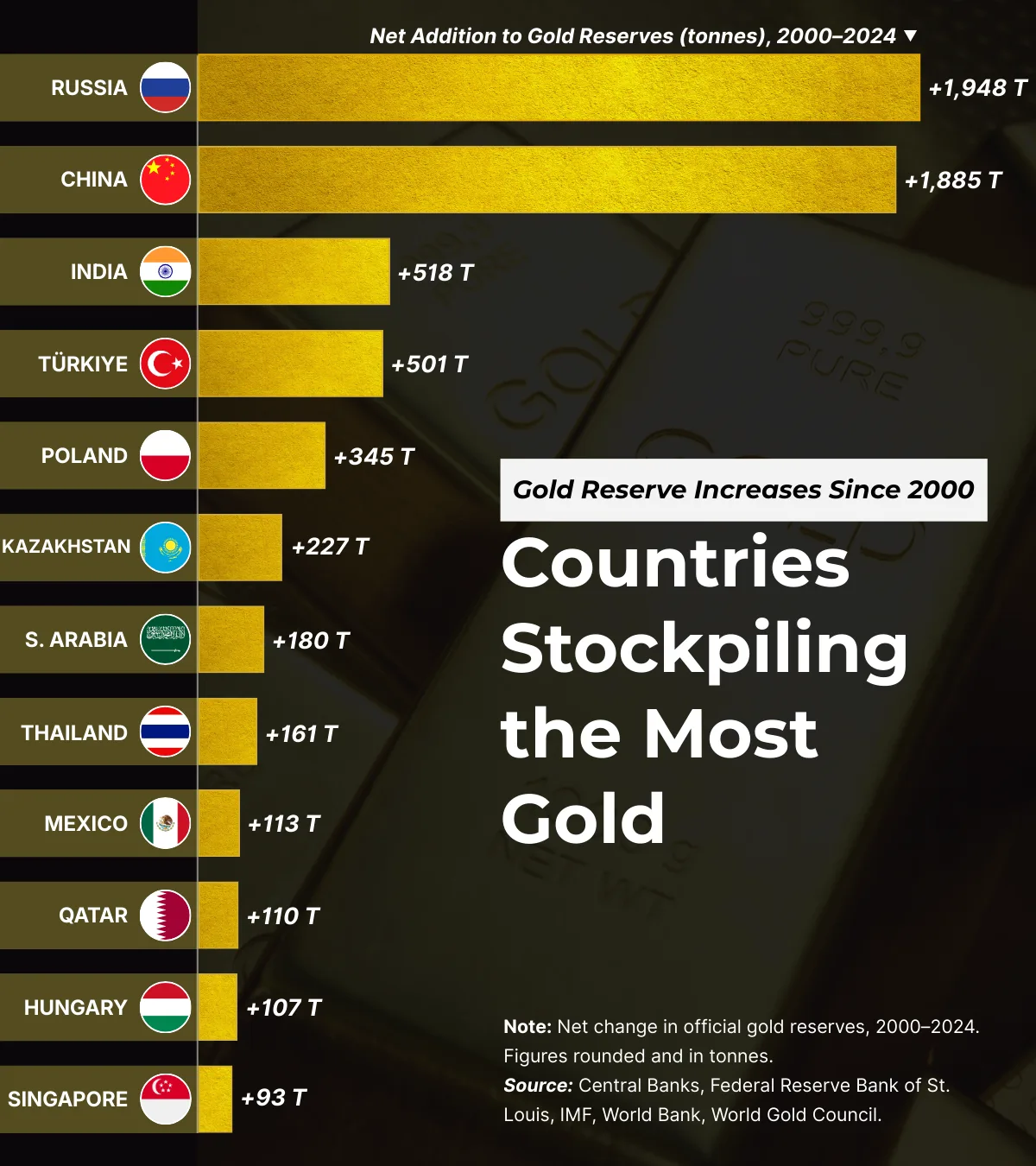

Since the turn of the century, central banks have been steadily increasing their gold reserves, a trend that has sharply accelerated in the last few years. As global trust in traditional reserve currencies like the U.S. dollar is being tested by inflation, sanctions, and shifting alliances, many nations are turning to gold as a strategic store of value.

This chart by Aneesh Anand visualizes the net additions to official gold reserves from 2000 to 2024, using data from the World Gold Council, IMF, World Bank, and other central banking sources.

Who’s Stacking?Here’s a closer look at the top countries stockpiling gold in the 21st century:

| Russia | 384.4 | 2332.7 | 1948 |

| China | 395.0 | 2279.6 | 1885 |

| India | 357.8 | 876.2 | 518 |

| Türkiye | 116.3 | 617.6 | 501 |

| Poland | 102.8 | 448.2 | 345 |

| Kazakhstan | 57.2 | 284.1 | 227 |

| Saudi Arabia | 143.0 | 323.1 | 180 |

| Thailand | 73.6 | 234.5 | 161 |

| Mexico | 7.8 | 120.3 | 113 |

| Qatar | 0.6 | 110.8 | 110 |

| Hungary | 3.1 | 110.0 | 107 |

| Singapore | 127.4 | 220.0 | 93 |

Russia leads all countries with a stunning increase of 1,948 tonnes of gold since 2000, narrowly edging out China’s 1,885 tonnes. Together, these two powers account for more than half of all gold stockpiled by central banks in the period.

Why Are Russia and China Hoarding Gold?The dramatic increase in gold holdings by Russia and China is part of a broader effort to reduce reliance on the U.S. dollar. After facing Western sanctions, Russia has accelerated its dedollarization strategy, favoring gold to protect reserves from seizure or devaluation.

China’s motives are also strategic. Amid trade tensions with the U.S. and a growing desire to internationalize the yuan, Beijing has been quietly amassing gold, often through discreet central bank purchases and reported transfers from domestic mines.

Russia and China have even engaged in historic bilateral gold trade deals that bypass the U.S. financial system.

These moves align with a broader trend, where central banks now hold more gold than U.S. Treasuries, underscoring gold’s rising appeal in a geopolitically fragmented world.

Emerging Markets Follow SuitWhile Russia and China dominate in volume, several emerging economies are also rapidly accumulating gold:

Meanwhile, Gulf states like Saudi Arabia and Qatar are increasing gold holdings as part of broader economic diversification under Vision 2030 and related national strategies.

Gold’s Enduring AllureAccording to Discovery Alert, central banks are expected to remain net buyers of gold through 2025 and beyond. As inflationary fears, geopolitical fragmentation, and currency diversification needs persist, gold remains a neutral and enduring store of value, especially for nations seeking independence from Western financial systems.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.