China Has Been Exaggerating Its Economic Growth So Much That Even Xi Jinping Is Calling It "Reckless" - 🔔 The Liberty Daily

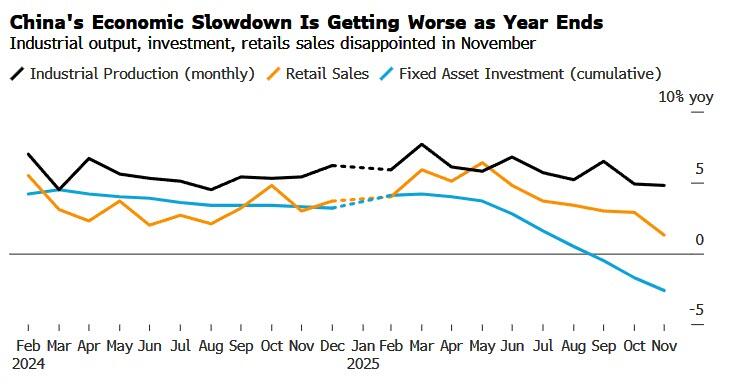

(ZeroHedge)—China’s economic momentum slowed broadly in November, with a marked weakening in consumer spending, adding pressure on Beijing to stabilize household and business demand in the world’s second-largest economy.

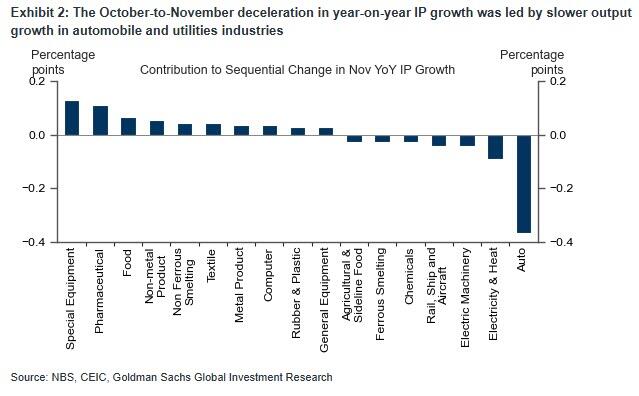

Industrial production (IP) growth edged down in year-on-year terms despite the notable improvement in export growth, with slower output growth in automobile and utilities industries more than offsetting faster output growth in the special equipment and pharmaceuticals industries.

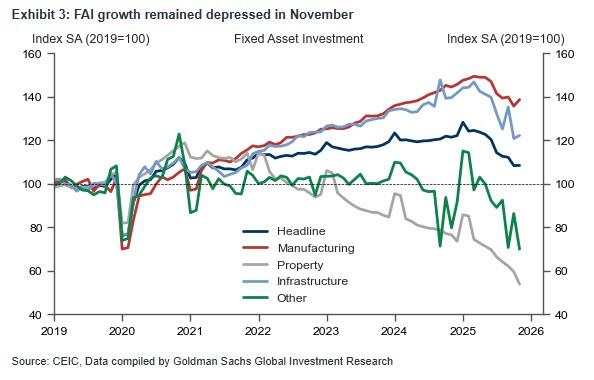

Fixed asset investment (FAI) maintained its double-digit year-on-year contraction in November on a single-month basis, though we would not over-interpret its recent slump as our study suggests that the NBS statistical correction of previously over-reported data has played at least as large a role as fundamental factors (e.g., the “anti-involution” policies and a prolonged property downturn).

Retail sales growth dropped meaningfully in November despite a low base, reflecting slowing auto sales growth and the negative distortion from an earlier-than-usual start of the “Double 11” Online Shopping Festival (which had pulled forward some demand from November to October, similar to the patterns observed in June).

Year-on-year services industry output index growth – which is on a real basis and tracks tertiary (services) GDP growth closely – moderated in November.

Property sector weakness continued in November, while unemployment rates remained largely stable.

Regarding the labor market, the nationwide unemployment rate and the 31-city metric (not seasonally adjusted) both remained flat at 5.1% in November. The latest data available suggests the unemployment rate of the 16-24 age group declined to 17.3% in October from 17.7% in September, while Goldman cautions that this indicator may have underestimated the labor market challenges that younger generation is facing amid weak domestic demand, persistent deflation and fragile private sector confidence, because of the definition change.

Incorporating October-November activity data, Goldman’s GDP tracking model based on the production approach points to a small downside risk to our Q4 real GDP growth forecast of 4.5% yoy.

And with downside economic risks building, Bloomberg reports that Chinese President Xi Jinping lashed out at inflated growth numbers and vowed to crack down on the pursuit of “reckless” projects that have no purpose except showing superficial results.

“All plans must be based on facts, aiming for solid, genuine growth without exaggeration, and promoting high-quality, sustainable development,” Xi said last week, according to a report on Sunday in the People’s Daily, the Communist Party’s official newspaper.

“Those who act recklessly and aggressively without regard for reality, impose excessive demands, or deploy resources without careful consideration, must be held strictly accountable,” he said at the Central Economic Work Conference.

Xi used stark language to call for quality in economic gains and listed examples of wrongdoing such as unnecessarily huge industrial parks, disorderly expansion of local exhibitions and forums, inflated statistics and “fake construction kickoffs.”

Access to data in China can be sensitive and controlled, making it hard for observers to assess the health of the economy, but Xi’s latest remarks seem to suggest that he wants a revamp of the existing metrics used to evaluate local officials.

Finally, we note that the initial downturn in Chinese stocks was quickly bid back into positive territory after the ‘bad data’ as it appeared ‘bad news’ would be ‘good news’ from a ‘most stimmies’ perspective, but Xi’s rant dragged stocks down to end the day in the red…

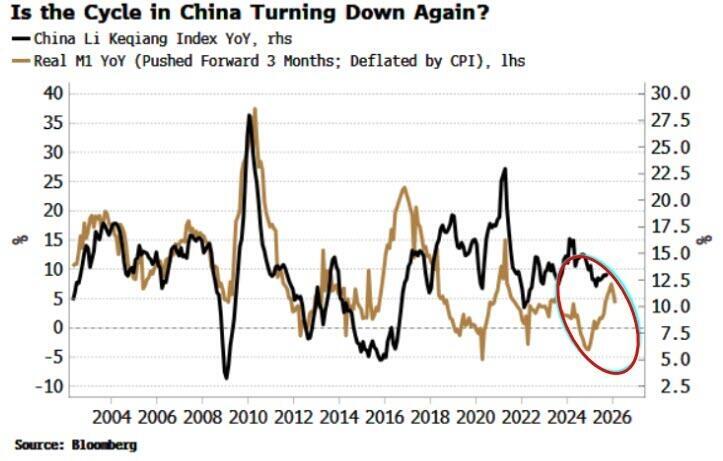

And as a reminder, we warned last week that the pace of money growth in China has slowed for a second month. If that’s sustained, global stocks could lose a hitherto supportive tailwind next year.

One snowflake doesn’t make a winter, but if M1 in China continues to pare back, that’s at least one tailwind global stocks won’t have next year.