Why Are Houses So Expensive? It's Deliberate Government Policy

In a press conference in the Oval Office last week, Donald Trump stated that he wants to keep home prices high. In the past, Trump has stated that he may declare a housing “state of emergency” on the issue of historically high housing prices. When asked for specifics last week, Trump stated that he’s interested in making it possible for young people to buy homes. But he also said that he doesn’t want to “knock those numbers [i.e., prices] down” because current homeowners like to keep prices high. “It’s a big part of their net worth,” Trump said, referring to older homeowners for whom their real estate is usually their largest asset. Trump continued: “I want them to continue to have a big value for their house...You create a lot of housing all of a sudden and it drives the housing prices down.”

Trump admitted that wanting to keep prices high for current owners is in conflict with policies that make housing more affordable for new owners. Yet, Trump wouldn’t say how he plans to carry out the impossible task of keeping home prices high while simultaneously making homes more affordable.

One thing we can know for sure: whatever “solution” Trump pursues on this, it will involve more government subsidies and more federal intervention in housing markets. We definitely know that the chosen course of action will not be laissez-faire or even a partial turn toward free markets. After all, to introduce actual market freedom into the equation would result in home prices plummeting.

Plummeting prices, of course, would be a good thing for millions of Americans, especially first-time home buyers and young families who desperately need more housing options. Experience shows, however, that driving down home prices to help new potential homeowners is not politically acceptable to those who already own housing assets, or otherwise benefit from high housing prices.

After all, Trump stated it plainly enough. Millions of voters now consider expensive housing to be “a big part of their net worth” and we can expect plenty of political opposition to any policy that leads to falling prices.

Moreover, Trump is saying the quiet part out loud here. Historically, it has been very poor manners in Washington to explicitly admit that keeping home prices high is a deliberate policy. But, make no mistake. It is deliberate, and it is not merely the “unintended consequence” of good intentions.

The Government Machinery of High Home Prices

For decades, it has been federal policy to increase demand for homes via a variety of mechanisms. For example, the federal government created de facto government corporations Fannie Mae and Freddie Mac to buy up mortgages in the secondary market to foster more home loan activity. Moreover, federally insured home loans through FHA, VA, and similar programs were all put in place to increase demand for homes.

Naturally, by subsidizing demand, federal intervention of this kind increases prices.

Federal bureaucrats claim this puts more people into homeownership, but whatever positive effects these policies may have had on homeownership rates many decades ago, the fact is that homeownership levels today are at the same level they were 45 years ago. Homeownership rates have not risen, yet home prices have risen repeatedly and substantially. And housing affordability is now at record lows.

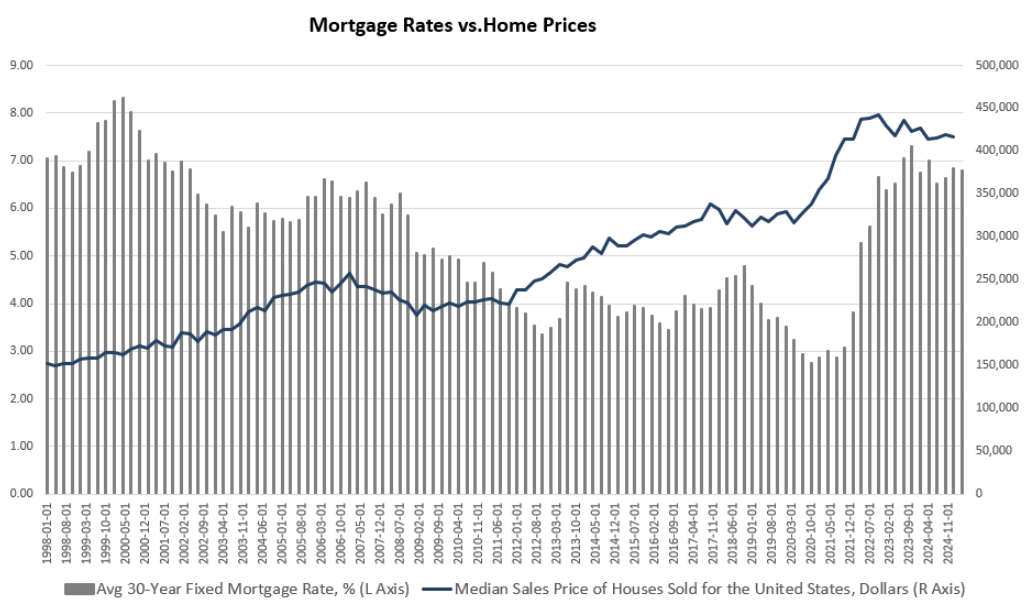

Perhaps the most insidious way federal bureaucrats subsidize home prices is through monetary policy. For decades, falling interest rates—a phenomenon fueled by the central bank’s monetary inflation and market manipulation—has pushed up home prices while doing nothing to increase homeownership.

After all, most home-purchase decisions in recent decades have been based on calculations of monthly payments. In a normally functioning market, prices will fall to meet demand and the capability of potential homebuyers. In a real market, prices will fall to the level at which monthly payments are affordable, even if interest rates are “high.” But, if the central bank repeatedly intervenes to force down interest rates, the lower interest rates will allow buyers to pay lower monthly payments even as home prices continue to rise. In other words, low interest rates can function to subsidize prices. (While the central bank certainly doesn’t “set” long-term interest rates, easy-money policies in general tend to push down the average mortgage rate in a variety of ways.)

Source: Source: US Census Bureau and Freddie Mac.

The central bank also helps push up home prices by devaluing the currency. In an economy with a stable, non-fiat currency, the money is a reliable store of value over time. Yet, when a central bank continually inflates away the value of the currency, investors flee to non-money “hard” assets, which includes real estate. In other words, investors who would have been happy to hold their wealth in currency (or money substitutes like money markets funds) flee into real estate in an attempt to preserve some value of their savings. This further pushes up prices. Moreover, an unstable currency mixed with low interest rates tends to encourage homeowners to keep a disproportionate share of their wealth in their real estate. This has given us the unhealthy practice of looking to one’s home as the primary component of personal net worth, and which is so key in driving political support for high home prices.

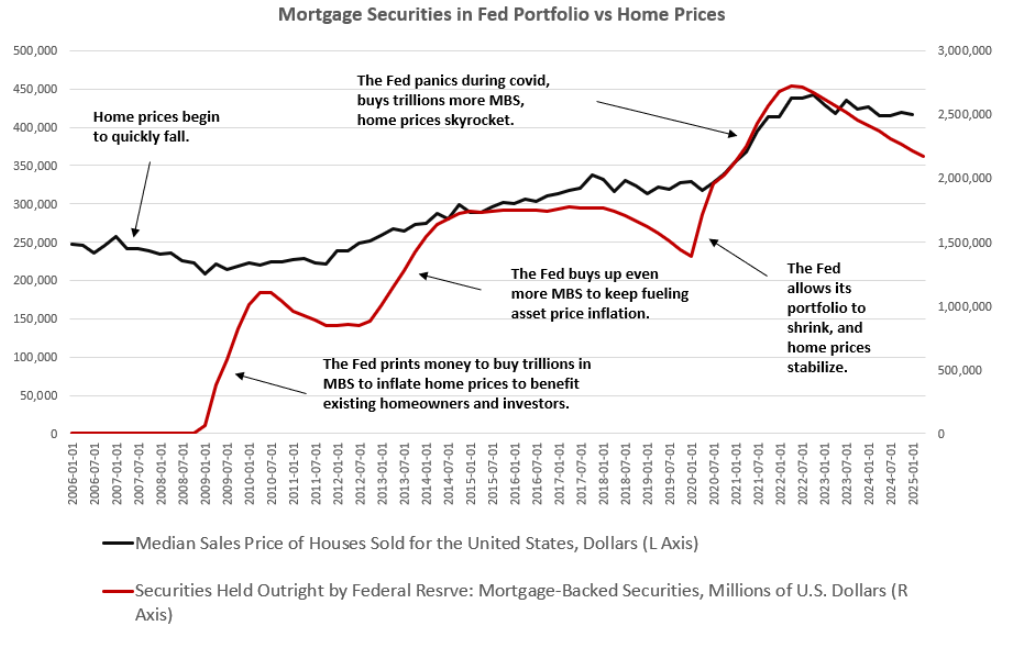

And finally, there is the most deliberate and egregious tactic of all: since 2008, the central bank has bought up trillions of dollars worth of mortgage-backed securities with the explicit purpose of ensuring that home prices did not fall substantially. This policy has been used repeatedly as a form of corporate welfare to ensure that banks and other financial institutions—which may hold enormous amounts of mortgage-backed securities—don’t have to endure financial stress due to falling home prices.

Indeed, if we look at the time frame for the central bank’s purchases of these mortgage-backed securities, we can get a sense of how this has impacted home prices:

Source: US Census Bureau and Federal Reserve Board of Governors.

The Lobbyists Who Want High Home Prices

The lowering of interest rates and the purchase of mortgage assets by the central bank have been especially important in recent years in driving up home prices. We get a sense of how important it has been when we consider how housing-industry lobbyists have pushed for the continuation of these policies. In an October 9, 2023 letter, the National Association of Realtors, the Mortgage Bankers Association, and the National Association of Home Builders lobbied the Federal Reserve Board of governors to lower interest rates and stop selling off mortgage-backed securities. The letter states:

We strongly urge the Fed to make two clear statements to the market:

The Fed does not contemplate further rate hikes; The Fed will not sell off any of its MBS holdings until and unless the housing finance market has stabilized and mortgage-to-Treasury spreads have normalized.

At the time, the Fed had been allowing short term interest rates to head upward, dampening monetary inflation. Moreover, the Fed had been allowing billions of dollars in mortgage backed securities to roll off the Fed’s balance sheet. This also had a deflationary effect and specifically reduced demand for housing assets.

Clearly, special interest groups in the housing industry, which had been enjoying fat profits and commissions from rising prices, didn’t want the central bank to do anything that might endanger the way federal policy was subsidizing home price growth. These lobbyists will always be available to remind the President of the “downside” of lowering home prices. In other words, the industry doesn’t want to see its corporate welfare go away.

Added to this are millions of over-55 voters—a demographic that votes far more than younger voters—who comprise more than 55 percent of all home buyers. It’s not hard to see why politicians aren’t exactly enthused by the idea of bringing home prices down.

(An added “bonus,” of course, is the fact that rising home prices also lead to ever higher levels of property taxes for state and local governments. So, governments are more than happy to help industry lobbyists and homeowners push for ever higher home prices.)

Now, if federal policymakers wanted to actually make housing more affordable, they could do so—by ending federal programs that drive up home prices. Congress could end the central bank’s ability to buy up mortgage securities—or even force the Fed to sell them off. This would cause home prices to immediately fall, possibly to historic lows. The Congress could, of course, end all the Fed’s inflationary powers, such as those used to manipulate interest rates. Interest rates would then rise to market rates. And, of course, Congress could also abolish many of the corporate-welfare housing programs such as Fannie and Freddie.

Housing lobbyists would no doubt then claim that home sales would plummet and “nobody” would be buying. This is not true. There will be plenty of buyers as soon as home sellers come to grips with reality and start slashing prices.

Indeed, a “great reset” in home prices would be wonderful for younger potential homebuyers, for the cost of living, and probably for the birth rate and marriage rate as well. It would return housing markets to a more realistic pricing model not based on endless federal manipulation and subsidy. Naturally, many who benefit from the current system want to make sure things never change.