How a US Gold Revaluation Could Trigger a Global Metals Boom

Over the last year, and especially the past 72 hours, the topic of gold price resetting has shifted from a fringe theory to mainstream discussion. The turning point came when former President Trump signed an executive order initiating the creation of a U.S. Sovereign Wealth Fund.

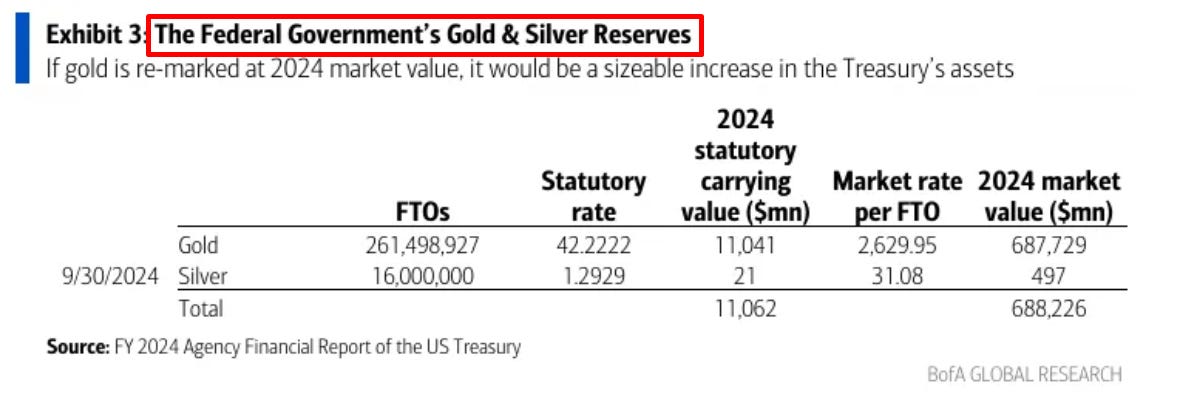

Standing beside him, Scott Bessent stated above: “We’re going to monetize the asset side of the U.S. balance sheet.” While various assets could be monetized, gold has captured the market’s attention.

Analyst Reactions and Market SentimentFollowing this announcement, market participants, particularly gold-focused analysts and traders, began speculating on gold’s role in the SWF. Financially literate communities, including GoldFix and ZeroHedge readers, Silver and Gold investors, and those familiar with the implications for bonds and spending, recognized the potential implications.

The monetization of gold—even if it does not involve direct bond purchases—could function similarly to quantitative easing (QE), with potentially inflationary consequences. In other words, raising the price of Gold and Silver held on the US Government balance sheet and then spending that money, will be bullish for inflation and bullish for Silver and Gold.

Banks and analysts reacted differently to this possibility. Some, like Bank of America and Citibank, started discussing gold in more candid terms without directly addressing the reset narrative. Bank of America’s $3,500 gold target referenced China’s insurance industry adoption as a key driver. Citibank’s report suggested a potential rise to $3,400 based on physical supply-demand models. Others, likely those with short bullion positions, either remained silent or avoided the subject altogether. […]

— Read More: www.jpost.com